[Asia Economy Reporter Eunmo Koo] Apple (Apple·AAPL.US) surpassed $100 billion in quarterly revenue for the first time in its history, with all products recording double-digit growth alongside the full-scale shipment of its first 5G smartphone, the iPhone 12. Considering that Apple is leading the growth of the 5G smartphone market, growth is expected to continue this year as well.

On the 29th (local time), Apple announced that its revenue for the first quarter of fiscal year 2021 (October to December 2020) reached $111.4 billion (approximately 124.49 trillion KRW), a 21.4% increase compared to the same period last year, and operating profit rose 31.2% to $33.5 billion (approximately 37.44 trillion KRW), achieving the highest quarterly performance ever.

The hardware segment recorded revenue of $95.7 billion, growing 21% year-over-year. By product category, iPhone revenue increased 17% to $65.6 billion. The iPhone 12, with its 5G capability and design changes, is believed to have triggered replacement demand, driving revenue growth. The iMac ($8.7 billion) and iPad ($8.4 billion) also grew 21% and 41%, respectively, fueled by demand for remote work and online education due to COVID-19. Wearables also increased 30% to $13 billion during the same period.

Revenue from the services segment expanded 24% year-over-year to $15.8 billion. The App Store, Apple Music, cloud services, AppleCare, and advertising revenue all set record highs. The total number of paid subscribers across all service platforms reached 620 million, an increase of 140 million compared to the same period last year, exceeding the annual subscriber target by 3%. The newly launched Apple One bundle service contributed to the overall subscriber growth.

Analysts note that this quarter’s results highlight the expansion of sales across various product lines beyond the iPhone. Kim Rok-ho, a researcher at Hana Financial Investment, said, “Although the iPhone achieved its highest-ever revenue this quarter, its share shrank to 59%. This is a positive outcome reflecting the expanded share of wearables and services, which reduces dependence on the iPhone.”

Lee Dong-joo, a researcher at SK Securities, also noted, “While hardware revenue growth drove this performance, the annual share of iPhone revenue fell to 50%. Apple’s mid- to long-term growth strategy involves platform business through subscriber acquisition, and it is necessary to consider the potential expansion of platforms from Apple Music, TV+, and Arcade to the automotive market in the mid- to long term.”

Growth was balanced across regions as well. North American revenue increased 21.4% year-over-year to $46.4 billion, and European revenue rose 17.3% to $27.3 billion. Most notably, revenue in China grew 57.0% to $21.3 billion, strengthening Apple’s position. Lee Jong-wook, a researcher at Samsung Securities, said, “This is the result of both the competitiveness of the iPhone 12 and the decline of Huawei smartphones. With an estimated record-high market share of about 15% in China, further growth in Chinese revenue is expected to drive Apple’s overall revenue this year.”

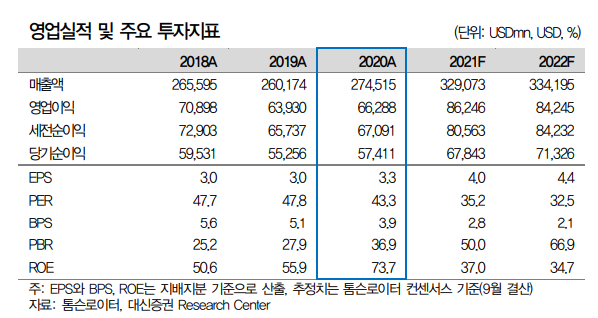

Although Apple had not provided guidance for the next quarter for four consecutive quarters since the COVID-19 outbreak, growth is expected to continue considering Apple’s leadership in the 5G smartphone market. Park Kang-ho, a researcher at Daishin Securities, said, “Apple supported the 28 GHz band for the first time, maintained high- and mid-price strategies, and simultaneously achieved sales growth and profitability improvement in the COVID-19 environment. Considering the delayed launch of the iPhone 12, iPhone revenue and profit growth in the first half are expected to be higher than last year.” He added, “The second half’s new model, tentatively named iPhone 13, is also expected to improve performance with an increased number of models applying sensor-shift and ToF cameras.”

The increase in actual users is also a positive factor for service revenue growth based on this. The actual number of iPhone users is about 1 billion, growing annually by around 5%, and as of this quarter, the total number of users across all devices reached 1.65 billion, a 10% increase year-over-year. Researcher Lee Jong-wook predicted, “As the share of iPhone decreases and the shares of MacBook and iPad increase, the organic linkage, which is the strength of the iPhone, will become a competitive advantage and a driving force for service revenue growth.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)