"Promotion of Interest Rate Benefits Alone Is Difficult to Expand"

Appealing to 2030 with Creative Content

[Asia Economy Reporter Song Seung-seop] The savings bank industry is actively shifting away from a sole focus on ‘interest rate competition’ to marketing strategies aimed at capturing the MZ generation (Millennials and Generation Z). They are not only launching YouTube and social networking service (SNS) pages but also collaborating with ‘B-grade sensibility’ webtoon artists. This marks a clear departure from the past, when the focus was mainly on promoting preferential interest rates for non-face-to-face sign-ups or raising interest rates by even 0.1 percentage points.

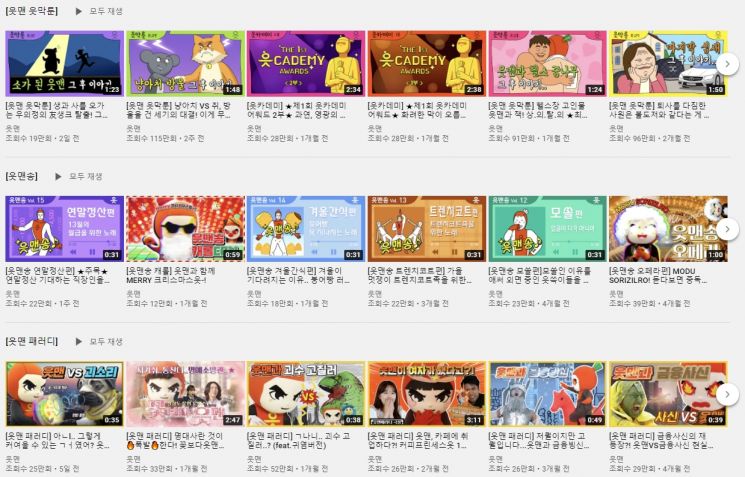

According to the savings bank industry on the 25th, OK Savings Bank’s YouTube channel, which has 340,000 subscribers, features parody videos starring OK Savings Bank’s character ‘Utman,’ as well as content such as ‘cookbang’ (cooking broadcasts) and ‘ASMR.’ Among its flagship content, ‘Utman Moving Toon,’ seven out of the last ten videos posted recently have surpassed one million views, indicating high interest. On the 19th, a cartoon book titled The Story of Utman Whose Heart Beats Carrot-Carrot, themed around Utman, was published.

Welcome Savings Bank introduced content in collaboration with ‘Jjaltoon,’ a webtoon artist famous for B-grade sensibility among people in their 20s and 30s, while Sangsangin Plus Savings Bank hired comedian Shim Hyun-seop to post ‘Sangsangin Parody’ videos on its YouTube channel.

In the Era of Ultra-Low Interest Rates, Active MZ Targeting Ahead of Open Banking Launch

The change in marketing approaches in the savings bank industry is interpreted as a consensus that it is no longer easy to attract customers solely with interest rate benefits. A savings bank official explained, “Originally, the main customer base of savings banks was the elderly, and product advertisements were based on regions, focusing on how much the interest rate or limit was.” He added, “As interest rates have fallen and the market size has grown on its own, marketing related to the company’s image is increasing rather than direct interest rate advertisements.”

In particular, the general view is that there are limits to marketing that emphasizes interest rate advantages due to prolonged ultra-low interest rates caused by low growth, structural recession, and the impact of COVID-19. It has become difficult to find fixed deposit products with interest rates in the 2% range even within the savings bank industry. According to the Financial Supervisory Service’s integrated financial product comparison disclosure data, as of this date, the average deposit interest rate of the five major savings banks (OK, Welcome, SBI, Pepper, Korea Investment) is about 1.82%. OK Savings Bank offers 1.80%, Korea Investment Savings Bank 1.70%, and the other three banks have the same rate of 1.90%.

With the launch of open banking services scheduled for March, there is also analysis that this is part of a strategy to actively capture the 20s and 30s generation, who have high loan demand and digital/mobile usage. Another savings bank official said, “As industry competition intensifies and open banking services dominated by commercial banks aim to attract young generations, it is necessary to improve positive perceptions of savings banks.” He added, “It is a strategy to instill a positive image of savings banks to increasingly savvy customers.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)