[Asia Economy Reporter Minji Lee] Interest in ETFs related to secondary batteries and automobiles is heating up in the exchange-traded fund (ETF) market as well. With President Joe Biden's administration, structural growth in the electric vehicle and battery markets is expected to begin in earnest, and the rapid growth of the electric vehicle market in China appears to be further stimulating investors' sentiment.

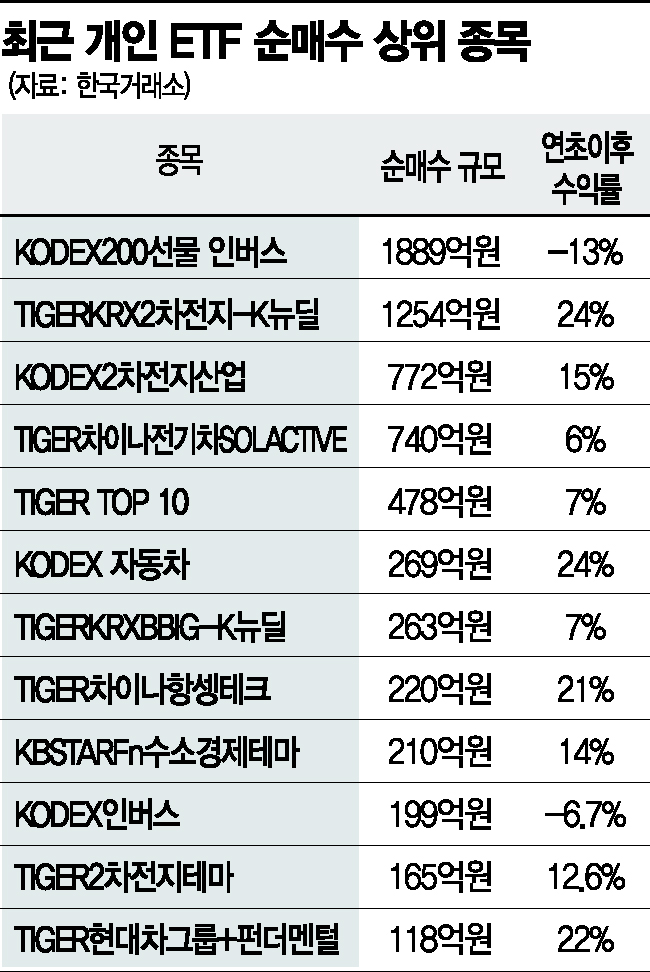

According to the Korea Exchange on the 25th, among the top 10 ETFs purchased by individual investors over the past 10 trading days, seven were related to automobiles and secondary batteries. Except for ETFs betting on a decline in the KOSPI, most were related to electric vehicles, secondary batteries, and eco-friendly themes. Expectations that the related market will blossom in earnest were reflected as news spread that major global IT companies such as Apple and Baidu are entering electric vehicle production in line with the Biden administration's inauguration. The popularity of Tesla's Model Y is also believed to have influenced this trend.

The ETF most purchased by individuals was ‘TIGER KRX Secondary Battery-K New Deal,’ with net purchases worth 125.4 billion KRW during the same period. About 80% of its constituent stocks are the leading secondary battery companies SK Innovation (28%), Samsung SDI (27%), and LG Chem (20%), and it also includes stocks such as POSCO Chemical, Iljin Materials, and Cheonbo. Since the end of last year, the rise in secondary battery stocks has become prominent again, and the ETF's year-to-date return was 24%, significantly outperforming the KOSPI return of 6%.

Domestic investors' interest is extending beyond the domestic market to overseas markets. ‘TIGER China Electric Vehicle SOLACTIVE,’ which invests in Chinese electric vehicle-related companies listed in the U.S., China, and Hong Kong, attracted funds totaling 74 billion KRW. It posted a return of around 6% since the beginning of the year, but when calculated from its listing on December 8 last year, it recorded a profit of 33%. It tracks the China electric vehicle company index published by Solactive, including companies such as Xpeng Motors, Tesla, Guoxuan High-Tech, Leading Intelligent Equipment, and Eve Energy.

Jeon Gyun, a researcher at Samsung Securities, said, "The Chinese electric vehicle market is rapidly growing thanks to economic stimulus and environmental regulations, and it is gaining global-level competitiveness through partnerships with global electric vehicle operators." He added, "Since its listing, the assets under management of TIGER China Electric Vehicle SOLACTIVE have increased, ranking third in asset growth rate among ETFs established after the fourth quarter."

Additionally, as the possibility of Hyundai Motor Group collaborating on the ‘Apple Car’ was conveyed to the market, ‘KODEX Automobile’ and ‘TIGER Hyundai Motor Group+Fundamental,’ which mostly hold Hyundai Motor Group stocks, recorded returns of 24% and 22%, respectively, this year. All these ETFs maintained a weighting of over 20% in Kia Motors and Hyundai Motor Company and included affiliate stocks such as Hyundai Mobis and Mando, which positively contributed to the increased returns.

The securities industry expects the growth of electric vehicles to continue, considering each country's progressive stance on eco-friendly policies. Jumin Woo, a researcher at Meritz Securities, explained, "Unlike the previous administration, changes in fuel efficiency, carbon emission regulations, and subsidy policies in the U.S. will drive structural growth in the domestic electric vehicle and battery markets." He added, "The trickle-down effect from the growth in electric vehicle demand is likely to concentrate on domestic companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)