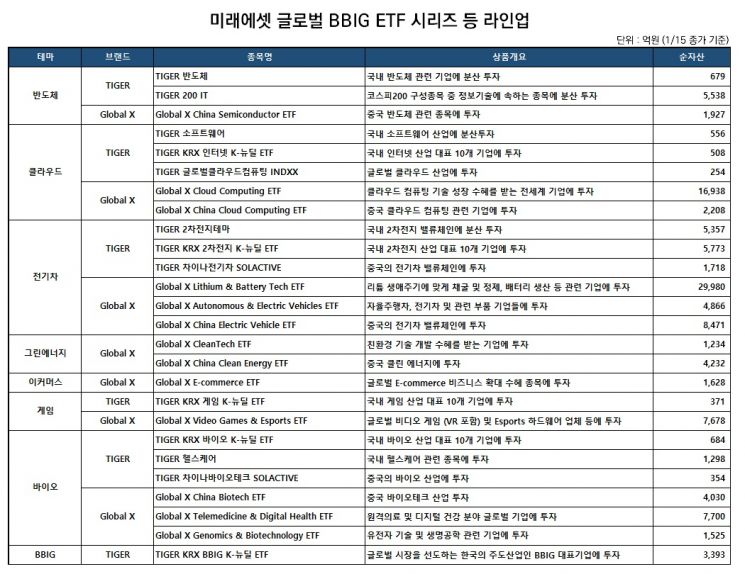

[Asia Economy Reporter Junho Hwang] Mirae Asset Global Investments' 'Mirae Asset Global BBIG ETF Series,' listed in Korea, the United States, and Hong Kong, surpassed 10 trillion KRW in net assets on the 23rd. The BBIG ETF series focuses on investing in companies related to future promising industries such as Battery (B), Bio (B), Internet (I), and Games (G).

The product with the largest asset size is the Global X Lithium & Battery Tech ETF listed on the U.S. stock market, with net assets reaching 3 trillion KRW (based on closing price on the 15th). The Global X Cloud Computing ETF, which invests in companies related to cloud computing, also has net assets of 1.7 trillion KRW. The returns for each product last year were 126% and 77%, respectively.

Among domestically listed products, the combined net assets of the five 'TIGER KRX BBIG K-New Deal ETF' series products exceeded 1 trillion KRW within three months of listing.

Choi Kyung-joo, Vice Chairman of Mirae Asset Global Investments, said, "BBIG is not a theme limited to Korea but a long-term trend connected to changes in the global economic paradigm," adding, "We will continue to provide products that invest in competitively positioned companies from a long-term perspective, such as the global BBIG ETFs, which are expected to benefit from the Fourth Industrial Revolution."

Mirae Asset offers over 400 ETFs across 10 countries including Korea, the United States, Canada, Australia, and Hong Kong, with assets under management exceeding 65 trillion KRW as of the end of last year, strengthening its ETF business in the global market. It is introducing various new growth theme ETFs to global investors in line with global investment trends.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)