Due to the impact of the novel coronavirus infection (COVID-19), the time people spend at home has increased, leading to a surge in demand for online video services (OTT). The global OTT company Netflix has surpassed 200 million subscribers worldwide. After exceeding 100 million subscribers in the third quarter of 2017, the number has doubled again in just over three years. OTT companies are investing huge amounts of money in content production to increase their subscriber base. Since 2015, Netflix has invested approximately 770 billion KRW to secure Hallyu content that has grown influential not only in Asia but worldwide. In December last year, 22 million households worldwide watched "Sweet Home" aired on Netflix. Not only Netflix but also competing OTT companies such as Walt Disney's "Disney+" and WarnerMedia's "HBO Max" have increased content investments, keeping domestic outsourcing production companies busy. This year, companies like KeyEast and Fan Entertainment plan to produce more dramas than last year. Asia Economy examines the drama production plans, financial structure, and investment capacity of outsourcing production companies this year to gauge their growth potential.

[Asia Economy Reporter Jang Hyowon] Drama production company Fan Entertainment is heating up. With five new dramas scheduled for production this year, a significant increase in performance compared to last year is expected. They also plan to own 100% of the intellectual property rights (IP) for some dramas, which is expected to improve profitability. Moreover, the land price of their owned building has more than doubled, expanding their total capital. Once China's ban on Korean content (Hallyu ban) is lifted, drama exports are also expected to increase.

Five Dramas Scheduled This Year

Fan Entertainment is a company primarily engaged in the production of broadcast videos and music albums. It is well known as the production company behind dramas such as "Winter Sonata," "Moon Embracing the Sun," "Fight for My Way," and "When the Camellia Blooms." As of the end of the third quarter last year, drama sales accounted for 79.1% of total sales. Album sales (7.3%), building rental (11.6%), and others (1.9%) followed.

Fan Entertainment's consolidated sales as of the end of the third quarter last year were 16 billion KRW, a 31.3% decrease compared to the same period the previous year. The sales decline is attributed to the fact that only one drama, the 16-episode mini-series "Record of Youth," aired on tvN last year.

This year, the situation is expected to change. Five new dramas are scheduled to air. The most anticipated work is "Racket Boys," which will air in May. This work was written by writer Jeong Bo-hoon of "Prison Playbook." It is confirmed to air on SBS and Netflix.

Notably, this work is the first since "Winter Sonata" for which Fan Entertainment will purely own 100% of the intellectual property rights (IP), raising expectations for maximizing profits. In the past, the drama market structure involved broadcasters supporting production costs while outsourcing companies produced and delivered dramas. Since broadcasters owned the rights such as copyrights, production companies had limited opportunities for additional profits.

However, recently, with the expansion of channels such as Internet Protocol Television (IPTV) and online video services (OTT), the market structure is gradually shifting to favor content suppliers. Accordingly, Fan Entertainment is actively pursuing an IP ownership strategy.

Seochungwoo, a researcher at SK Securities, said, "Fan Entertainment's sales and operating profit this year are expected to grow by 206% and 186% year-on-year to 76.5 billion KRW and 10 billion KRW, respectively. At least three of the dramas produced this year will be based on a revenue model where Fan Entertainment owns the IP, enabling rapid performance growth."

However, there is still a hurdle to overcome, namely China. The Hallyu ban in China is still ongoing. Fan Entertainment has experience co-producing the drama "Kill Me, Heal Me" with Huace Group, China's largest content production company, in 2015, laying the groundwork for entering the Chinese market. Since there is potential demand for Hallyu content in China, content exports are expected to surge once the ban is lifted.

Building as a 'Cash Cow'

Fan Entertainment's financial situation is stable. As of the end of the third quarter last year, the debt ratio was 51.9%. The debt ratio has been maintained between 50% and 60% over the past three years. Total borrowings amount to 18.1 billion KRW, consisting of short-term borrowings with interest rates in the 1% range and liquidity long-term debt, resulting in a relatively low interest burden.

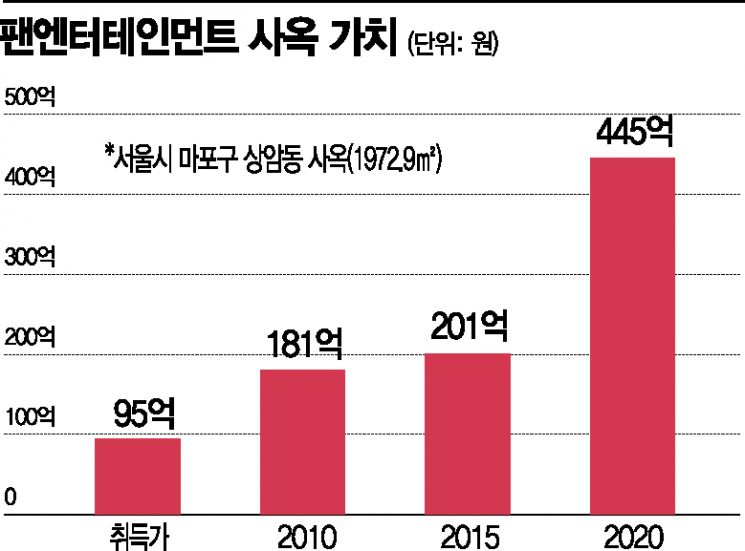

Additionally, the recent real estate value revaluation is expected to further improve the financial structure. On the 4th, Fan Entertainment announced that it revalued the land of its building located in Mapo-gu, Seoul, measuring 1,972.9㎡, increasing the book value from 20.1 billion KRW to 44.5 billion KRW.

The revaluation date was December 31 of last year, and the revaluation gain of 24.4 billion KRW is expected to be reflected in last year's results as other comprehensive income. In this case, since total capital will increase, if liabilities do not increase additionally, the debt ratio is expected to fall to the 30% range.

Previously, Fan Entertainment also improved its financial structure by revaluing its building land in 2010 and 2015. In 2010, the land book value increased by 8.6 billion KRW from 9.5 billion KRW to 18.1 billion KRW, and in 2015, it increased by about 2 billion KRW to 20.1 billion KRW. Over 10 years, a total revaluation gain of 35 billion KRW was realized. Fan Entertainment's total operating profit over the past 10 years is about 400 million KRW. Thus, the rise in real estate prices has contributed more to the company's finances than its business earnings.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)