Korea Insurance Research Institute

'AI Risks and the Need for Dedicated Insurance' Report

[Asia Economy Reporter Ki Ha-young] As accidents caused by AI malfunctions and errors occur, such as the controversy over the AI chatbot 'Iruda' due to sexist and hateful remarks, there are calls for the development of related insurance to help companies respond to AI risks.

According to the report "AI Risks and the Need for Dedicated Insurance" released by the Korea Insurance Research Institute on the 17th, as many companies recently adopt and utilize AI technology, there is a demand for the development of AI-specific insurance specialized in AI risks.

According to a survey conducted by the U.S. market research firm Gartner targeting 3,000 Chief Information Officers (CIOs) from 89 countries worldwide, the number of companies responding that they "use AI technology" increased from 10% to 37% over the past four years (2015?2019). 91.5% of global companies such as Google, General Motors (GM), and Pfizer answered that they "continue to invest in AI technology."

However, as the adoption of AI technology has rapidly increased in a short period, concerns about AI failures have been raised. New types of accidents caused by AI malfunctions and errors, which were previously unpredictable, are occurring. In fact, the chatbot Iruda, developed by a domestic startup, became controversial due to sexist and socially vulnerable hateful remarks caused by incorrect algorithm data learning, leading the company to temporarily suspend the service. In the U.S., an incident occurred where a pedestrian was physically injured and died due to a malfunction in the autonomous driving algorithm of the ride-sharing company Uber.

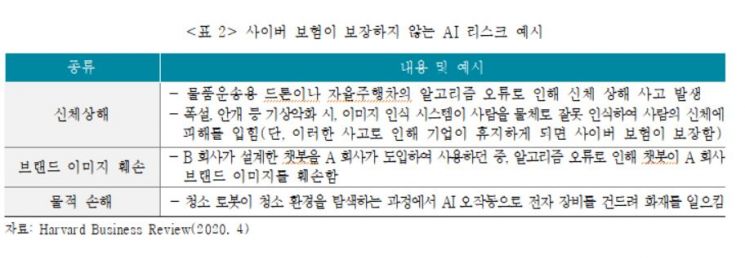

The report pointed out that since global companies are evaluated to have low awareness and response levels to AI risks, it is necessary to develop and utilize related insurance so that companies can efficiently respond to AI risks. In particular, current cyber insurance only covers data and security-related risks among AI risks, so it does not cover physical injuries or material damages such as brand damage caused by AI algorithm defects.

At the same time, there was also a suggestion that insurance companies themselves need to prepare for AI risks. Currently, the most active area of AI technology utilization in insurance companies is customer consultation services using AI chatbots. Services are provided mainly in areas with high consultation frequency from policyholders, such as insurance contract inquiries and maintenance, premium payment and transfer management, insurance claim and policy loan guidance, and customer support tasks.

The report advised, "Korean insurance companies are also increasing the adoption of AI technology, such as using AI chatbots for customer consultation and applying AI technology to prevent insurance fraud," and added, "Insurance companies themselves must also prepare for AI risks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)