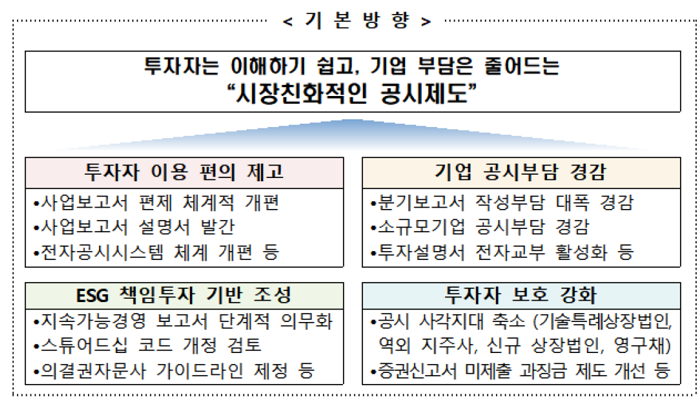

[Asia Economy Reporter Eunmo Koo] Financial authorities are promoting improvements to the corporate disclosure system to reduce the burden on companies and strengthen investor protection. They plan to rationally reduce companies' disclosure burdens by reorganizing quarterly reports, which had a high burden relative to their utilization, to focus on key information, and to enhance the convenience of investors' use of disclosure information by restructuring the business report system and disclosure items to be easier for general investors to understand.

On the 14th, the Financial Services Commission held a corporate disclosure system improvement meeting chaired by Vice Chairman Do Kyoo-sang, with industry stakeholders and private experts participating, and announced the "Comprehensive Improvement Plan for the Corporate Disclosure System."

According to the improvement plan, the disclosure system will first be reorganized to make it easier for investors to understand and utilize corporate disclosure information. Since the introduction of the business report in 2009, disclosure items have been added without consistent standards, making the system complex and difficult to understand. The authorities plan to adjust disclosure items and classification systems to be easier for investors to understand and to integrate overlapping or related disclosure items.

The structure of the Financial Supervisory Service's electronic disclosure system (DART) will also be improved for easier use. Currently, DART's menu is organized according to classifications under the Capital Markets Act, which is unfamiliar to the general public. In the future, DART will organize menus by topic to help investors easily find the information they want and will strengthen search functions.

To reduce the disclosure burden on companies, quarterly reports, which had a high burden relative to their utilization, will be reorganized to focus on key information, and disclosure burdens on small businesses will also be alleviated. Currently, quarterly reports follow the business report (annual basis) format, resulting in low utilization and high preparation burden. Going forward, a separate format for quarterly reports will be prepared to significantly reduce the preparation burden (reducing disclosure items by about 40%). Additionally, the scope of small business disclosure exemptions will be expanded, and omitted disclosure items will be increased to reduce disclosure burdens.

An institutional foundation will also be established to activate ESG (Environmental, Social, Governance) responsible investment. The authorities will provide "ESG Information Disclosure Guidance" to promote voluntary disclosure of sustainability management reports by listed companies and will pursue phased mandatory disclosure. They will also review the implementation performance of the Stewardship Code established in December 2016 and consider revisions to strengthen ESG-related fiduciary responsibilities.

Management and supervision of proxy advisory firms will be strengthened. First, guidelines for financial investment firms using proxy advisory firms will be established within this year, and based on progress, measures to establish management and supervision grounds under the Capital Markets Act will be considered.

Finally, to reduce disclosure blind spots and strengthen investor protection, disclosure obligations will be strengthened in vulnerable areas that may cause investor damage, such as technology-special listing companies and domestic-listed offshore holding companies, and the effectiveness and fairness of sanctions for disclosure regulation violations will be enhanced.

Specifically, if technology-special listing companies operate unused funds differently from the intended purpose of fundraising, they will be required to disclose detailed operation details. Disclosure related to offshore holding companies listed domestically will be expanded to address issues where investment risks were not sufficiently disclosed. Additionally, newly listed companies will be required to submit the previous quarter or half-year report, and disclosure related to perpetual bond issuance will be expanded.

The sanction system will also be refined. The scope and criteria for imposing fines related to failure to submit securities registration statements will be clearly defined, and fines will be imposed on unlisted companies that habitually fail to submit regular reports.

The financial authorities stated that tasks that can be promoted without legal amendments will be implemented promptly, and amendments to laws (submission of amendment bills to the National Assembly) and enforcement decrees will be pursued with the goal of the third quarter of this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)