Samsung Electronics' Operating Profit Last Year Highest in 2 Years Thanks to Semiconductor Market Improvement

Semiconductor Market Improvement Expected to Continue This Year with Supercycle (Long-Term Boom) Outlook

Samsung Electronics' Operating Profit Expected to Increase Significantly to 46 Trillion Won This Year Compared to Last Year

[Asia Economy Reporter Changhwan Lee] Samsung Electronics' achievement of its highest profit in two years is largely due to the improvement in its core semiconductor market. Following the COVID-19 pandemic last year, increased demand for information and communication technology (IT) led to a successful rebound in memory semiconductor prices, playing a significant role.

The market expects Samsung Electronics' performance to improve even more sharply this year. In particular, there is high anticipation for a semiconductor super cycle (long-term boom). As semiconductor demand continues to rise while supply remains limited, prices are expected to keep increasing. It is anticipated that Samsung will record its highest performance in three years since the record boom in 2018.

Besides semiconductors, other business units such as smartphones, home appliances, and displays are also expected to continue improving as COVID-19 damages decrease following vaccine distribution.

Last year's operating profit surged 29%, with improvements across semiconductors, home appliances, and displays

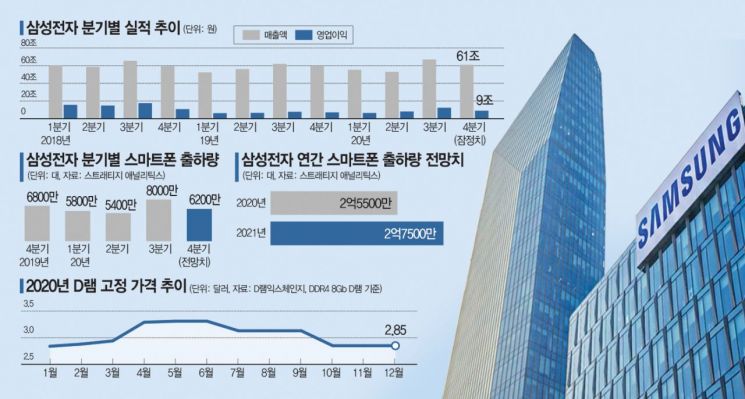

On the 8th, Samsung Electronics announced that last year's sales amounted to 236.26 trillion KRW, a 2.5% increase compared to 2019. However, operating profit surged by 29% to 35.95 trillion KRW.

This significant profit improvement was due to the rise in unit prices of its core product, memory semiconductors. According to market research firm DRAMeXchange, the fixed price of memory semiconductor DRAM (DDR4 8Gb) rebounded from around $2.8 at the beginning of last year to $3.3 in June. Unlike the sharp drop from $6 at the start of 2019 to $2.9 at the end of the year, prices rose last year.

Thanks to this, Samsung Electronics' semiconductor division, Device Solutions (DS), is estimated to have an operating profit of about 19 trillion KRW last year, a roughly 35% improvement from 14 trillion KRW the previous year. It is analyzed that the semiconductor division accounted for more than half of Samsung Electronics' total operating profit last year.

The Consumer Electronics (CE) division also saw significant performance improvements. Sales of home appliances increased centered on the 'Bespoke' series, and TV sales exceeded 49 million units annually (according to Omdia), up from 44.07 million units in 2019, contributing to performance improvement. Last year, the CE division's operating profit is estimated to have surged about 40% to 3.5 trillion KRW from 2.5 trillion KRW the previous year.

The Display (DP) division also posted excellent operating profit of around 2.2 trillion KRW, a 46% improvement from the previous year, as OLED (organic light-emitting diode) and LCD panel prices rose significantly in the second half of last year.

Even looking only at the fourth quarter results announced that day, improvement continued. Samsung Electronics' Q4 sales were 61 trillion KRW, and operating profit was 9 trillion KRW, up 1.8% and 25.7% respectively from the same period last year. The financial investment sector estimates that the semiconductor division's operating profit improved by 26% to 4.3 trillion KRW compared to the previous year.

However, Q4 results slowed compared to the earnings surprise in Q3. Although the overall semiconductor market was favorable last year, in Q4, prices of memory semiconductors such as server DRAM fell, and the KRW-USD exchange rate plunged, causing operating profit to decrease by more than 1 trillion KRW compared to Q3.

The semiconductor industry holds high expectations for a super cycle this year. Not only are prices of memory semiconductors like DRAM and NAND flash rising, but prospects for Samsung Electronics' system semiconductor business, which it is nurturing as a new future growth engine, are also positive.

Samsung Electronics Vice Chairman Lee Jae-yong is inspecting the construction site of Plant 3 in Pyeongtaek, Gyeonggi Province, on the 4th.

Samsung Electronics Vice Chairman Lee Jae-yong is inspecting the construction site of Plant 3 in Pyeongtaek, Gyeonggi Province, on the 4th. [Image source=Yonhap News]

"Semiconductor Super Cycle This Year" Forecast for Highest Performance in Three Years

Market research firm TrendForce forecasts that DRAM fixed prices will rise about 5-10% in Q1 this year compared to the previous quarter. Spot prices, which serve as a leading indicator for DRAM fixed prices, rose more than 30% last month, signaling future fixed price increases. Another market research firm, IDC, expects global semiconductor demand this year to increase by 19% for DRAM and 34% for NAND flash compared to last year.

South Korea's semiconductor exports are also showing a sharp increase. According to the Ministry of Trade, Industry and Energy, Korea's semiconductor exports last month reached $9.46 billion, a 30% increase year-on-year. This is the highest level in two years and four months since August 2018. Last year's total semiconductor exports were $99.2 billion, a 5.6% increase from 2019, making it the second highest after the record $126.7 billion in 2018.

System semiconductor exports are also rapidly improving. Last month, system semiconductor exports surged 45% year-on-year to $2.99 billion. This is interpreted as largely influenced by the growth of Samsung Electronics' foundry (semiconductor contract manufacturing) business. The financial investment sector expects Samsung Electronics' system semiconductor sales, which were around 15 trillion KRW in 2018, to exceed 20 trillion KRW this year.

According to FnGuide, as of this day, domestic securities firms estimate Samsung Electronics' operating profit this year to be in the 46 trillion KRW range, a 30% increase from the previous year. Of this, more than 25 trillion KRW in profit is expected to come from semiconductors. Some securities firms even predict operating profit will surpass 50 trillion KRW.

Researcher Taewoo Kwon of DS Investment & Securities said, "We expect to enter a memory semiconductor upcycle this year and see significant performance improvement. We also have high expectations for profit growth in the system semiconductor division, centered on foundry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)