Housing Prices Surge by 210 Trillion Won in One Year... Concerns Over Real Economy Trigger

[Asia Economy Reporter Kangwook Cho] Since the Moon Jae-in administration took office, the amount of money flowing into the real estate market has increased by nearly 500 trillion won, reaching a total of nearly 2,300 trillion won. In particular, amid low interest rates and a continued rise in housing prices, the amount surged by more than 210 trillion won in just the past year. Consequently, concerns have been raised that if housing prices plummet or interest rates rise, this could lead to defaults and act as a trigger for instability in the real economy.

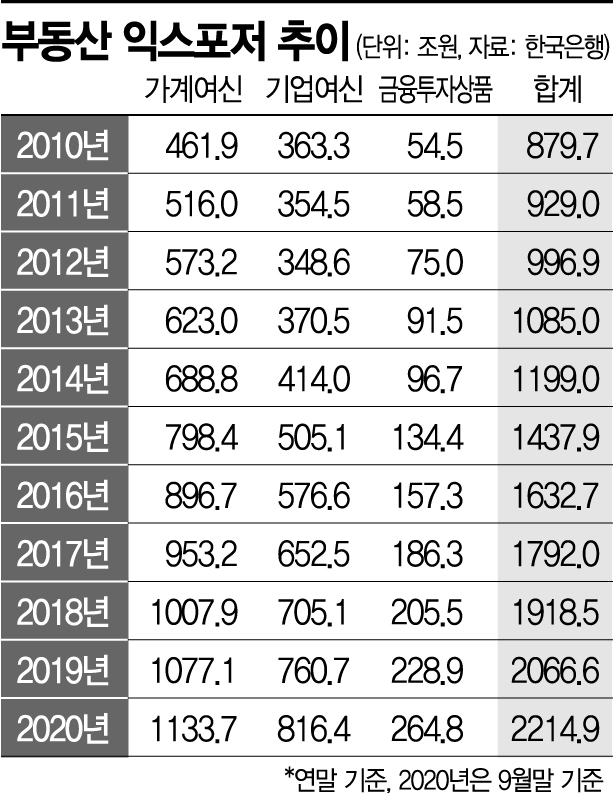

According to the Bank of Korea’s “2020 Second Half Financial Stability Report” released on the 7th, real estate finance exposure stood at 2,214.9 trillion won as of the end of September last year, marking a 10.5% increase compared to the same period the previous year. At the end of September 2019, real estate finance exposure was 2,003.9 trillion won. This means it rose by more than 200 trillion won in just one year.

Real estate finance exposure refers to loans to households and real estate-related companies as well as funds invested in real estate-related financial investment products. It was below 1,000 trillion won at 879.7 trillion won in 2010 but has steadily increased, surpassing 2,000 trillion won for the first time last year.

The problem is that despite the current government’s all-out efforts to “control housing prices” by implementing more than twenty real estate measures, money continues to flood into the real estate market. Over the past year alone, 211 trillion won flowed into the real estate market, increasing by 52.75 trillion won per quarter. Arithmetically, this means that by the end of last year, a total of 2,270 trillion won was accumulated in the real estate market. Compared to the end of 2017 (1,792 trillion won), shortly after the Moon Jae-in administration began in May 2017, this represents an increase of about 480 trillion won.

In particular, the trend of individuals borrowing to buy homes has intensified under the current administration, accelerating the inflow of funds into the real estate market over the past three years. The growth rate of real estate finance exposure decreased from 9.8% in 2017 to 7.0% in 2018 but rose again to 7.7% in 2019 and surged to 10.5% in the third quarter of last year, reaching double digits. Moreover, housing-related loans such as mortgage and jeonse (long-term lease) loans steadily increased, with household loans accounting for 1,133.7 trillion won (51.2%) of total exposure as of the third quarter last year, exceeding half. This is 1.4 times the corporate loans (816.4 trillion won, 36.9%).

'120 Trillion' Commercial Real Estate Loans Raise Concerns Over Defaults Amid Rising Vacancy Rates

The commercial real estate sector is considered the biggest risk within the domestic real estate market. According to the Financial Supervisory Service, the outstanding balance of real estate and rental business loans among corporate loans by domestic banks steadily increased each quarter: 174.5124 trillion won at the end of September 2018, 181.0023 trillion won at the end of March 2019, 191.307 trillion won at the end of September 2019, 198.0295 trillion won at the end of March last year, and 209.7494 trillion won at the end of September last year.

The Bank of Korea already warned in the first half of last year that the domestic commercial real estate market was showing signs of a late boom or entering a downturn phase, characterized by rising prices but declining transaction volumes. It also estimated that if rental yields and market price shocks materialize, a loan loss provision of about 2.6 trillion won would need to be set aside.

Warnings have also come from overseas. Adam Slater, an economist at Oxford Economics, a UK economic analysis institute, analyzed in an October report last year that commercial real estate prices in countries such as South Korea, the United States, and Australia could plummet, causing severe loan losses for banks. The report noted that during the 2008 global financial crisis, which shook the world economy, about 25-30% of the loan loss write-offs by US banks originated from commercial real estate loans.

Senior Research Fellow Byungho Seo of the Korea Institute of Finance pointed out, “The 120 trillion won scale of commercial real estate loans is highly likely to become impaired due to rising vacancy rates,” adding, “If deferred loan defaults such as small business loans also materialize, loan loss costs could surge.”

Meanwhile, more than half of real estate brokers in the Seoul metropolitan area expect vacancies to increase next year, especially in Seoul’s commercial properties. The majority also forecast a decline in commercial rents. Experts predict that uncertainty in the commercial real estate market next year will be greater than ever, with severe polarization by region and asset type.

Research Fellow Taehwan Kim of KB Management Research Institute said, “Next year’s commercial real estate market will be a year of unprecedented uncertainty,” adding, “As ultra-polarization beyond mere polarization is expected, careful analysis of market conditions and preparation for risks will be crucial.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)