As social distancing and remote work measures have been strengthened due to the novel coronavirus infection (COVID-19), people have been spending more time at home. Meals and shopping that were previously done outside are now being handled through the internet or smartphone applications. According to Statistics Korea, the online shopping transaction amount reached 14.2445 trillion KRW in October last year, a 20.0% increase compared to the same period the previous year. Since August last year, the online shopping transaction amount has remained at the 14 trillion KRW level every month. Accordingly, there is growing confidence in the forecast that this year's online shopping transaction amount will surpass 160 trillion KRW. Along with the increase in online shopping transaction amounts, parcel delivery volumes have also been steadily rising. According to data received by Kang Jun-hyun, a member of the National Assembly Land, Infrastructure and Transport Committee from the Ministry of Land, Infrastructure and Transport, the parcel delivery volume from the beginning of last year to August reached approximately 2.16034 billion units, a 20.0% increase compared to the same period the previous year. Demand for corrugated cardboard used in food delivery trays and parcel boxes has also increased. Asia Economy examines the performance and financial status of paper manufacturers Seha and Taerim Packaging, which are growing alongside the spread of contactless consumption culture, and assesses their future growth potential.

[Asia Economy Reporter Park Hyung-su] Taerim Packaging, the nation's top corrugated cardboard box manufacturer, did not benefit significantly this year from the expansion of the contactless consumption culture. Although profit margins have declined due to falling prices of corrugated cardboard boxes caused by excessive competition among companies, performance is expected to gradually improve as supply continues to lag behind demand.

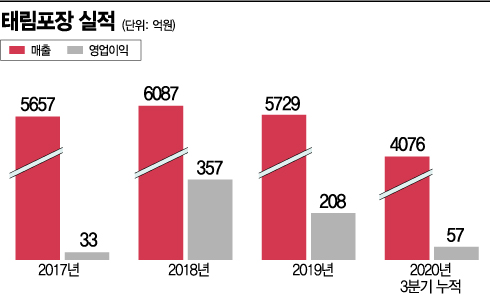

According to the Financial Supervisory Service's electronic disclosure system on the 4th, Taerim Packaging recorded cumulative sales of 407.6 billion KRW and operating profit of 5.7 billion KRW through the third quarter of this year. Sales decreased by 5.3% and operating profit dropped by 75.5% compared to the same period last year.

Kim Jong-min, a researcher at Samsung Securities, explained, "Taerim Packaging's operating profit in the third quarter was 1.3 billion KRW, down 81% from the same period last year," adding, "This is because prices of corrugated cardboard boxes fell due to excessive competition among companies." He continued, "Since the fourth quarter of last year, prices of corrugated cardboard boxes have been rebounding," and "There is a movement to reflect the sharp rise in raw material prices in box prices."

Taerim Packaging is a paper manufacturer that produces corrugated cardboard used for parcel delivery and packaging. The corrugated cardboard industry is broadly divided into waste paper, raw paper, and products (raw sheets, boxes). Waste paper is the most basic raw material used to make raw paper such as surface paper, corrugated medium, and back paper. When raw papers are combined, they form raw sheets, and raw sheets are assembled to make boxes. Taerim Packaging's sales composition is 84% products and 16% raw paper.

As of the end of the third quarter last year, Taerim Packaging held a 16.9% market share in the domestic corrugated cardboard box market. It produces raw paper through its affiliates, holding a 4.4% market share in the raw paper market. The corrugated cardboard industry has high fixed costs, creating high entry barriers. Large oligopolistic companies have an advantage in price-setting power. However, due to the market characteristics, it is difficult to have proprietary brands, resulting in a non-branded nature. There is little quality differentiation from competitors' products, leading to fierce price competition among suppliers. Because the products are large relative to their price, logistics costs are high, and most production is consumed domestically.

With the surge in online shopping transaction amounts this year, consumption of parcel boxes has also increased. This is not expected to be a temporary phenomenon caused by the spread of COVID-19. As online shopping companies competitively launch membership services, consumers are increasingly purchasing even small daily necessities online. Amazon, the world's largest e-commerce company, is preparing to enter the Korean market. This is why the online shopping market is expected to continue growing steadily. Corrugated cardboard companies are currently operating their factories at 80-90% capacity due to the increase in parcel deliveries. Seasonally, demand for packaging boxes continues to rise during the year-end and holiday gift seasons.

Demand has rapidly increased, but production has not kept pace. In July last year, the Ministry of Environment implemented a 'waste paper import declaration system' for corrugated cardboard's basic raw material, waste paper, due to concerns that contaminated waste paper imports could cause environmental pollution. As customs procedures became more stringent, waste paper imports decreased. In October and November, fires occurred consecutively at raw paper production plants, leading corrugated cardboard raw paper manufacturers to raise prices by 20-25% after the fires. Due to the severe imbalance between supply and demand, expectations for performance improvement of raw paper and box companies have increased.

Taerim Packaging also has the possibility of overseas expansion by utilizing the overseas distribution network of its largest shareholder, Seha Sangyeok. Seha Sangyeok, which completed the acquisition process earlier this year, explained that overseas expansion is expected as they can target the e-commerce markets in Southeast Asia and Central America, which are just beginning to take their first steps.

NICE Credit Rating recently noted that there is a trend of consolidation through mergers and acquisitions of existing large paper companies and equipment acquisitions within small and medium-sized paper companies, leading to larger scale within the industry. It forecasted that the current corrugated cardboard market structure will shift to an oligopolistic market structure, easing the level of price competition.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)