Korea FPSB Launches 'Tell Me Your Wish' Financial Planning Campaign

The Most Interested Areas in Financial Planning Are Real Estate, Expense Management, Investment, and Retirement

[Asia Economy Reporter Kim Hyo-jin] A survey found that 3 out of 10 financial consumers are most interested in the 'housing funds and real estate' area among financial planning fields. This is interpreted as reflecting curiosity about the recent rise in housing prices and the government's real estate policies.

On the 15th, the Korea FPSB, the international Certified Financial Planner (CFP) certification body, announced that this result came from conducting a nationwide customized financial planning campaign called "Tell Me Your Wish" to overcome the COVID-19 pandemic as part of World Financial Planning Day this year.

The area of financial planning that attracted the most interest was 'housing funds and real estate' (28.6%). Next was consumption-related 'income and expenditure management' (23.4%). Investment-related 'lump-sum savings and asset allocation' (16.1%) and retirement-related 'retirement fund preparation' (11.7%) followed. 'Debt management' (8.8%), 'risk management and insurance planning' (5.8%), 'marriage and education funds' (9.1%), and 'inheritance and gift planning' (0.7%) all had interest levels below 10%.

When asked what kind of consultant they would like to receive financial planning advice from, 31.1% answered 'a knowledgeable FP,' indicating that they valued the consultant's expertise the most. This was followed by 'an FP with a good attitude' (20.5%), 'extensive consulting experience' (18.0%), 'objectivity' (13.1%), and 'communication skills' (12.3%).

Starting next year, more professional services will be available through financial product advisory services. Regarding willingness to pay for financial planning consultations or financial product advice, 42% answered 'not sure yet.' This was followed by 39.5% who said 'would pay and receive,' and 14% who said 'would not receive if it costs money,' showing a generally passive attitude toward paying fees for consultations.

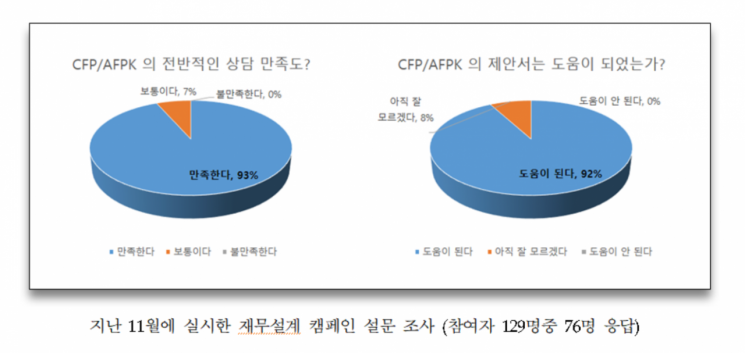

Regarding the consulting ability and attitude of CFPs and AFPKs, 93.4% responded that they were 'satisfied.' As for whether the financial planning proposals provided after the consultation were helpful, 92.1% answered 'helpful.'

Kim Yong-hwan, Chairman of Korea FPSB, said, "The proportion of financial consumers who experienced the campaign and said they would receive financial planning consultations from experts again reached 86%," emphasizing, "Financial companies need to train more financial planning experts in line with the high interest of financial consumers in financial planning."

Korea FPSB plans to establish a permanent consultation site to provide financial planning consultations.

Meanwhile, this campaign, conducted over a month from last October, involved 129 financial consumers applying, with 28 CFPs and domestic financial planners (AFPK) providing consultations and one-on-one customized proposals.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.