Financial Authorities to Expand 'Platform Business' Scope

Banks Also Able to Enter Various 'Lifestyle Platform' Ventures

[Asia Economy Reporter Kim Hyo-jin] As banks open the way to order food or shop through their applications (apps), interest in the specific methods, feasibility, and profit and loss structures of related businesses is increasing in the banking sector. While banks show a positive response to the fact that a new business channel has been established, there are concerns that they may only repeat trial and error since the market is already highly competitive.

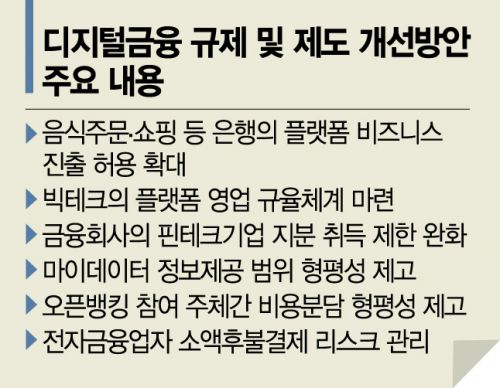

According to financial authorities on the 11th, the Financial Services Commission held a 'Digital Finance Council' meeting the day before and decided to expand banks' platform business areas. Accordingly, banks will now be able to engage in various 'lifestyle platform' businesses such as food ordering and shopping like 'Baedal Minjok', and real estate services. The financial authorities' position is to try to enable service launches using regulatory sandboxes even before specific institutional improvements are made.

An official from a commercial bank said, "The financial authorities' policy raises expectations for the activation of various types of platform businesses," adding, "It is significant in that banks can form diversified revenue structures beyond traditional banking."

The key issue is the content and feasibility of the business, and the general view is that it is still difficult to present a clear picture regarding this. Another commercial bank official explained, "For now, I think they will step in without overextending and then observe the progress."

Within the banking sector, cautious voices also foresee participation in the business through existing investment and partnership methods. Similar to investing in startups with various innovative technologies as part of innovative finance, banks may make direct or indirect investments in promising startups engaged in food delivery or shopping businesses.

It is also explained that banks could participate in the business by embedding functions such as easy payment into the apps of delivery startups or entering the market through partnerships with different types of companies like card companies.

'Limitless Potential' Observations Alongside Concerns Over Trial and Error and Profitability

A bank official said, "Platform businesses are characterized by continuously integrating ideas and expanding and developing on an already established foundation," adding, "Especially, the potential for partnerships with different types of companies is limitless." Another bank official pointed out, "In other words, platform business cannot be entirely new," and added, "It might just open additional channels and, without significant profits, repeat trial and error and refinement from a long-term perspective."

Meanwhile, financial authorities plan to allow credit card companies to engage in comprehensive payment services, which are currently scheduled for introduction, to ensure fair competition between big tech (large information and communication companies) and credit card companies. The authorities also plan to establish operational regulatory systems in response to concerns about market dominance abuse and user harm related to big tech's entry into financial platforms.

Additionally, to enhance the symmetry of information exchange related to personal credit information management (MyData), financial authorities intend to allow banks to access consumer shopping information held by big tech. Restrictions on financial companies' acquisition of fintech company shares will also be eased. At the same time, the financial authorities have decided to relax the face-to-face obligations of insurance planners with contract holders.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.