[Asia Economy Reporter Ji-hwan Park] As sustainability reporting is increasingly recognized as a crucial element of corporate reporting, it has been found that global companies are disclosing more sustainability information such as ESG.

According to the KPMG Survey of Sustainability Reporting 2020, which analyzed sustainability reporting of companies in 52 countries worldwide, 80% of the top 100 companies by country disclosed sustainability information this year. This is a 5 percentage point increase compared to the 2017 survey results.

The report compared and analyzed two groups: N100 and G250. N100 selected the top 100 companies by revenue in each of the 52 major countries including South Korea, the United States, the United Kingdom, Japan, China, and India, analyzing a total of 5,200 companies. G250 surveyed the top 250 companies by revenue among the Fortune 500 companies selected in 2019, with most G250 companies included in the N100 group.

This year, the sustainability reporting rate of G250 companies was 96%. Since 2011, the reporting rate has been over 90% annually. The N100 companies increased from 64% in 2011 to 80% this year, a 16 percentage point rise, gradually narrowing the gap with G250.

By region, the Americas, including Mexico (100%), the United States (98%), and Canada (90%), showed the highest sustainability reporting rate globally with an average of 90%. The Asia-Pacific region (average 84%) followed, increasing by 6 percentage points compared to the 2017 survey. Japan (100%), Malaysia (99%), India (98%), Taiwan (93%), and Australia (92%) were among the global leaders. Europe’s sustainability reporting rate remained steady at an average of 77%, with a slowdown observed in Western Europe.

By industry, N100 companies disclosed sustainability information at rates above 70% in all sectors except retail. Similar to the 2017 survey, media & telecommunications, mining, automotive, oil & gas, chemical, and forestry & paper industries showed the most active sustainability information disclosure. In the G250 group, media & telecommunications, retail, oil & gas, and healthcare achieved a 100% sustainability reporting rate this year.

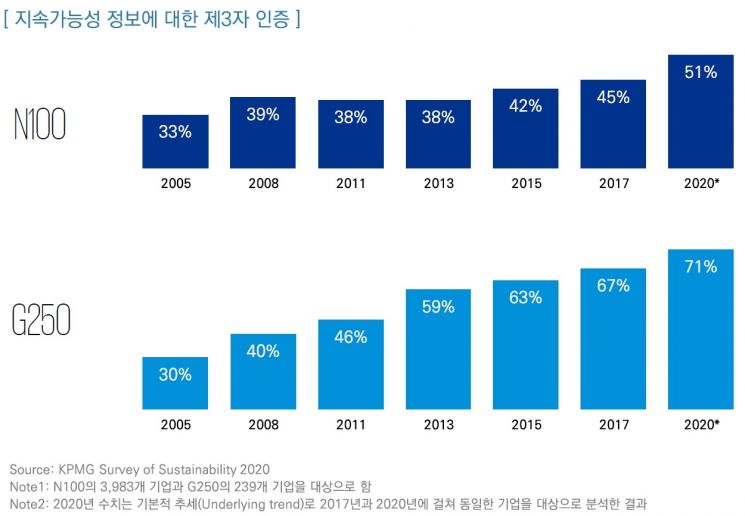

The report stated that assurance of sustainability information such as ESG has become a standard practice for companies. Among G250 companies, 71% received independent third-party assurance for their sustainability information. For the N100 group, the third-party assurance rate exceeded 50% for the first time since KPMG began surveying sustainability reporting.

The importance of biodiversity has been emphasized due to COVID-19, as evidence suggests that habitat destruction is the reason viruses have transferred from nature to humans. KPMG’s first survey this year on whether companies report risks related to biodiversity loss showed that 23% of N100 companies and 28% of G250 companies do so, indicating both groups are at a nascent stage. The report analyzed that many companies still lack understanding of the business impact, modeling, and methodologies related to biodiversity risks.

The Task Force on Climate-related Financial Disclosures (TCFD) issued recommendations in 2017 to enable financial disclosures reflecting climate change risks. According to KPMG’s survey, 18% of N100 companies and 37% of G250 companies disclosed corporate information in line with TCFD recommendations this year, indicating progress but still insufficient levels.

The number of companies disclosing carbon reduction targets has significantly increased. For N100 companies, the rate rose 15 percentage points from 50% in 2017 to 65% this year, and 76% of G250 companies set carbon reduction targets this year.

Regarding the UN’s Sustainable Development Goals (SDGs), 69% of N100 companies and 72% of G250 companies reported linking their business activities to the SDGs in their corporate reports this year. However, the report pointed out that most SDG reporting remains incomplete and often lacks connection to business objectives. Notably, the majority of N100 (86%) and G250 (90%) companies focus only on positive SDG impacts, with insufficient transparency on negative impacts.

Lee Dong-seok, leader of the ESG Service Specialist Team at Samjong KPMG, stated, "Amid the COVID-19 crisis, companies must swiftly establish response strategies for ESG and sustainability reporting in line with systematic demands from investors and stakeholders for ESG and sustainable management."

He added, "As demands for corporate social responsibility and non-financial information disclosure increase, companies need to establish an integrated reporting system that links their non-financial activities and performance with financial results and manage non-financial information such as ESG."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.