Experience with Woori Bank Financial Authentication Service

Automatic Connection of Cloud Certificate

Bank and Public Institution Login in '3 Seconds'

On the 10th, the first day after the exclusive status of the public certificate ended, I received a financial authentication service jointly developed by the financial sector and 22 banks, and when I applied for civil complaints on the Ministry of Health and Welfare website, the certificate stored in the cloud was automatically connected.

On the 10th, the first day after the exclusive status of the public certificate ended, I received a financial authentication service jointly developed by the financial sector and 22 banks, and when I applied for civil complaints on the Ministry of Health and Welfare website, the certificate stored in the cloud was automatically connected.

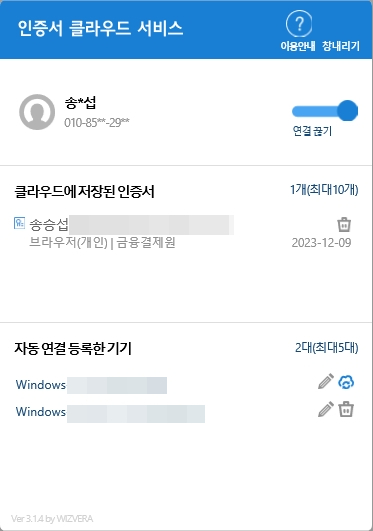

[Asia Economy Reporter Song Seung-seop] 'Certificate connected to cloud. Please select the certificate and enter the password.' When attempting to log in to a public institution on a personal computer after receiving the Financial Certification issued by the Korea Financial Telecommunications & Clearings Institute (KFTC) through Woori Bank, a message appeared within about 3 seconds indicating that the certificate stored in the cloud was connected. There was no annoying Active X or security program installation alert.

On the 10th, when using the KFTC's Financial Certification Service through Woori Bank after the exclusive status of the public certificate ended, the issuance procedure was somewhat complicated, but once registered, it was easy and fast to log in to various public institutions. The Financial Certification Service is a new certificate jointly introduced by KFTC and the banking sector to replace the existing public certificate. Woori Bank and Daegu Bank had pre-established related systems and have been providing the service since the 17th of last month and the 4th of this month, respectively.

To receive certification, about eight steps are required starting from installing the application (app). These include agreeing to terms, taking a photo of an ID card or entering an existing security card number, and account verification. It took about 10 minutes to enter the PIN number, pattern, and biometric information sequentially.

Once the initial registration is completed, it can be used more conveniently than the existing public certificate. The certificate is automatically stored in the cloud, so users do not need to move or copy it separately. There is no installation of various security programs for login. When using the Financial Certification Service on the Ministry of Employment and Labor's 'Civil Service Yard' or the Ministry of Health and Welfare's 'Bokjiro,' tasks could be requested without any additional procedures. Customers using internet or mobile banking can use it free of charge. Only one certificate is issued per person.

Issuance Procedure Somewhat Difficult but Excellent Security and Convenience

The Financial Certification Service has a more complicated issuance procedure compared to private certificates provided by the three major telecom companies' PASS, Naver, Kakao, and other big tech companies. For example, PASS or Naver certificates are issued after only three or four steps within about a minute. KakaoPay certificates are evaluated as simplified to the extent that users are 'signed up without knowing.'

The reason why the KFTC Financial Certification Service is relatively complicated is explained as requiring a relatively strict identity verification process to be widely used by many financial institutions and public institutions. Certificates issued by telecom companies, big tech, or fintech companies may face restrictions on financial transactions or public institution use if they do not go through the real-name verification process stipulated by the Financial Real Name Act.

The certificate was not copied or moved from the mobile phone to the PC, but since the certificate is stored in the cloud, it connects automatically.

The certificate was not copied or moved from the mobile phone to the PC, but since the certificate is stored in the cloud, it connects automatically.

The Financial Certification Service is also evaluated as superior to the public certificate in terms of security because it is stored in KFTC's own cloud. Public certificates had to be stored directly by users on hardware or on removable storage devices (USB), which carried risks of hacking or loss.

The Financial Certification Service will be gradually expanded to 22 banks starting from the 10th, but it is not immediately available on all government websites. The government plans to apply new electronic signature systems such as private certificates starting from January next year, beginning with simplified year-end tax settlement services on Hometax, issuance of resident registration certificates on Government24, and use of the National Sinmungo (People's Petition) system.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)