Foreigners Begin Active Buying from November

Nearly 6 Trillion Won Purchased in One Month

Individual Investors Also Play a Major Role

Experts Predict Further Rise

[Asia Economy Reporter Song Hwajeong] The KOSPI has surpassed the 2700 mark for the first time in history, drawing attention to how much further it can rise. The buying spree by foreign investors, which has created a new chapter in KOSPI's history, is expected to continue for the time being, raising hopes for a continued streak of record highs.

As of 9:43 a.m. on the 4th, the KOSPI rose 1.30% (34.93 points) from the previous day to 2731.15 points, quickly climbing into the 2730 range. At the end of last month, most securities firms had forecast the upper band of the KOSPI for December at 2700, but the index broke through this upper band just four days into December.

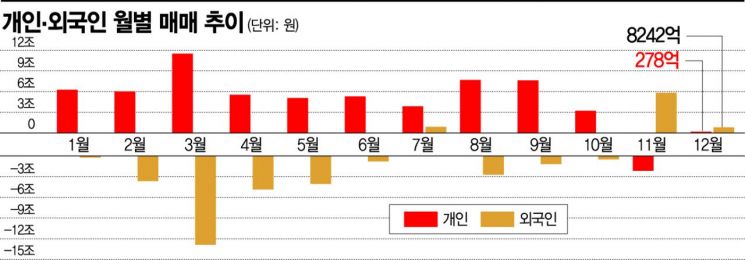

The main driver behind the recent record-breaking rally of the KOSPI has been foreign investors. Since November, foreign investors have actively purchased in the domestic stock market, initiating the KOSPI's record-breaking streak. Having sold about 30 trillion won in the domestic market until the end of October this year, foreign investors bought nearly 6 trillion won worth of stocks in November alone, leading the KOSPI's rise. Up to the day before this month, they purchased 824.2 billion won, and on this day, they net bought about 240 billion won in the KOSPI, driving the breakthrough of the 2700 mark.

Foreign buying was concentrated in semiconductor and secondary battery stocks, leading the KOSPI's record-breaking rally. Since last month until the day before, foreign investors net bought LG Chem the most, with 1.7253 trillion won, followed by Samsung Electronics at 1.6078 trillion won. Other net purchases included SK Hynix (1.181 trillion won), Samsung SDI (334.5 billion won), and Kakao (286.2 billion won). These stocks, which have seen concentrated foreign net buying, have recently been setting new records in succession. LG Chem reached an intraday high of 863,000 won, marking a 52-week high. Samsung Electronics, which surpassed 70,000 won intraday the previous day, rose to 72,100 won intraday, breaking its record for the second consecutive day. SK Hynix also hit a new high at 119,500 won on the same day.

The role of individual investors in the KOSPI's record streak cannot be overlooked. Previously, it was individual investors who pulled the KOSPI out of the panic market caused by the novel coronavirus (COVID-19). They laid the foundation for the KOSPI's all-time high streak through continuous buying. Although buying momentum has slowed since October, on the day foreign investors dumped the largest volume ever on the 30th of last month, individual investors countered with the largest ever purchases, effectively defending the index. They are the unsung heroes behind the KOSPI's record-breaking rally. Recently, individual investors have been continuously buying in the KOSDAQ, leading to the recovery of the KOSDAQ 900 level.

With supply and demand supported, there are forecasts that the KOSPI could rise further. As vaccine development accelerates and vaccination begins in some advanced countries such as the UK and the US, expectations are reflected that Korean exports will improve through the normalization of external demand and trade.

Since foreign net buying has not ended quickly in the past, the sustainability is considered high. Huh Jaehwan, a researcher at Eugene Investment & Securities, explained, "Looking at cases since 2008 where foreign net buying continued on a monthly basis, except for phases where selling dominance lasted about a month, on average, net buying of about 2 trillion won per month continued for 8 months, with a median of 4 months." He added, "Recent conditions such as the won-dollar depreciation, rising long-term interest rates in the US and Korea, and rising oil prices are aligning, so foreign net buying is unlikely to end soon."

There is also a view that the bullish trend will continue until the first quarter of next year. Lee Euntaek, a researcher at KB Securities, said, "Since 2001, in 10 out of 11 cases where the KOSPI surged, the following month was also bullish, with an average increase of 6.3%. Two months later, the month after that, the market was bullish 8 times with an average increase of 1.9%." He also noted that although there are many macro risk factors in December this year, the market is likely to show a more resilient performance than expected. He added, "There have been four instances this year where the market surged more than twice within a year (monthly increase of 11%), and in most cases, the 5-6 month returns exceeded 10%. The bullish trend is expected to continue until the first quarter of next year."

The sectors where foreign buying is concentrated are expected to lead the market for the time being. Researcher Huh said, "Since November, considering market capitalization, the intensity of foreign net buying by sector has been quite strong in chemicals, electrical and electronics, and machinery sectors. Especially in the chemical sector, foreign investors reversed from net selling earlier this year to almost fully recover the selling volume since November. Interest in the chemical, electronics, and machinery sectors purchased by foreigners remains valid."

However, there is also an analysis that the market may take a breather next week. Kim Sunggeun, a researcher at Korea Investment & Securities, said, "Next week, the KOSPI is expected to move between 2660 and 2740. The FDA vaccine advisory committee meeting scheduled for the 10th may raise hopes for vaccine approval, but due to the high price burden, the upward momentum may slow down for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.