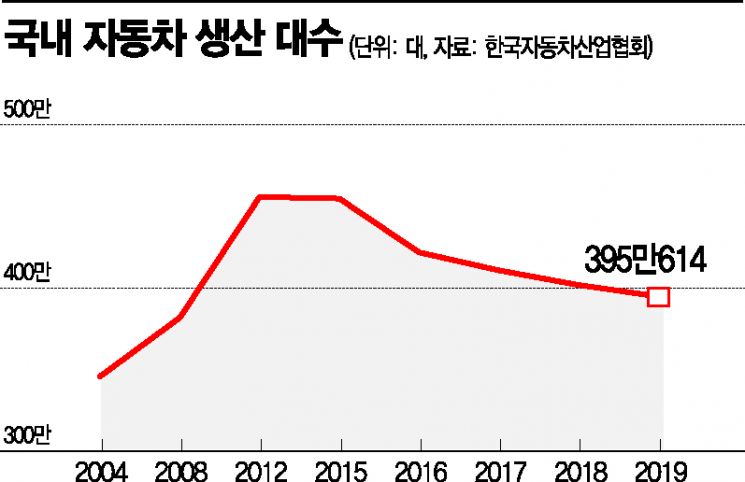

Concerns Over Domestic Car Production Falling Below 3.5 Million Units This Year

Rising Crisis in Korea's Auto Industry Amid COVID-19 and Union Strikes

[Asia Economy Reporters Su-yeon Woo, Ji-hee Kim] "The aftermath of the novel coronavirus infection (COVID-19) and labor union strikes... The number of production disruptions this year has already exceeded 80,000 units. We sincerely hope the strikes will stop now." (Moon Seung, Chairman of the Korea GM Cooperative Association)

As the annual production system of 3.5 million vehicles faces collapse for the first time in 16 years, concerns about mutual destruction are growing within the parts industry.

According to the Korea Automobile Industry Cooperative on the 3rd, there were 824 first-tier suppliers directly trading with domestic automakers (Hyundai, Kia, Korea GM, Renault Samsung, Ssangyong, Zyle Daewoo Bus, Tata Daewoo) as of last year. Among them, 555 companies, or 67.4%, are small and medium-sized enterprises with an average sales revenue of less than 100 billion KRW over three years. Following the collapse of 4 million units last year, production is expected to fall below 3.5 million units this year, making the bankruptcy of these parts companies increasingly likely.

Parts Companies Suffering from Union Strikes... "Please Stop the Strikes"

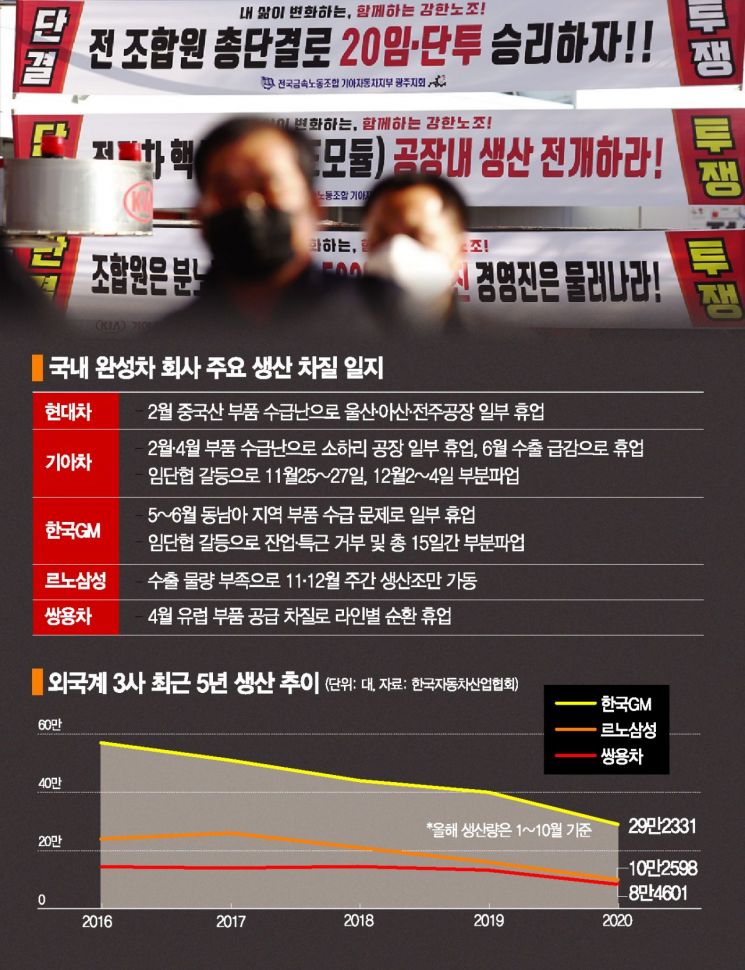

The most serious situation is with Korea GM suppliers. The tentative agreement on wages and collective bargaining (wage and collective agreement) that the Korea GM labor and management parties had painstakingly reached was rejected in a union vote on the 1st, raising the risk of another strike. Korea GM experienced production disruptions of 60,000 units in the first half of this year due to COVID-19. Adding the 20,000 units lost due to union strikes, the total production loss this year has exceeded 80,000 units.

Moon Seung, chairman of the Korea GM Cooperative Association representing Korea GM suppliers, said, "Parts companies are not parties to the wage and collective bargaining negotiations, but they are suffering the most damage," adding, "Even if labor and management fight, we hope they avoid strikes; we can only watch helplessly, which is frustrating." He continued, "Everyone struggled with COVID-19 in the first half, but we endured with hope that the situation would improve in the second half. However, with union strikes worsening the situation in the second half, a sense of crisis is spreading that even a small shock could cause collapse."

The situation is not much different for Renault Samsung Motors suppliers. Renault Samsung suffered severe work shortages this year due to difficulties in last year's wage and collective bargaining negotiations, which prevented timely securing of export orders. Export volumes, which had exceeded 100,000 units annually, plummeted by 77% to 19,222 units through November this year compared to the previous year. Since last month, Renault Samsung has eliminated night shifts and is operating the Busan plant only with day shifts, and plans to take four days off this month as well.

Na Gi-won, chairman of the Renault Samsung Suppliers Association, said, "Parts companies have reduced work to a three-day workweek, and the number of working days in December is expected to be around 10 days. The Renault Samsung union is fighting for wage increases, but suppliers are struggling even to pay their employees' salaries." He added, "If the XM3 European export next year goes as planned, we expect the situation to improve from February, but we are concerned that the union might again hinder progress with strikes."

Unions Enter Deadlock After Exhausting Strike Options

A bigger problem is that labor-management conflicts are showing signs of prolonged stalemate. Kia Motors and Korea GM unions have responded with partial strikes, but long-term strikes are burdensome for unions amid unfavorable public opinion.

Moreover, with Hyundai Motor's union?the largest in the metalworkers' union?achieving a no-strike wage and collective agreement this year, the maneuvering room for other automakers has narrowed. The Kia Motors union, which conducted a three-day strike last month and continues partial strikes this month, is pressing management by focusing on restoring 30 minutes of overtime. Although management initially offered the same wage and performance bonus conditions as Hyundai Motor and promised employee stock ownership plans if there were no strikes, the union's use of strike options prevented even that. From the Kia Motors union's perspective, they have no choice but to insist on restoring overtime to differentiate themselves from Hyundai Motor's union.

The Korea GM union, which reached a tentative agreement after 24 rounds of negotiations, found itself in a difficult position after the agreement was rejected in a member vote. The Korea GM union plans to suspend strikes and refusal of overtime and special work for now and focus on workplace protests until the next dispute committee is formed.

Renault Samsung's labor-management wage and collective bargaining negotiations have been deadlocked for three months since the practical negotiations in September. The re-election of Park Jong-gyu, classified as a hardliner, as union chairman last month has increased the possibility of prolonged labor conflicts similar to last year. The Renault Samsung union has already secured legal strike rights by receiving a decision to suspend dispute mediation from the Central Labor Relations Commission.

Lee Hang-gu, a research fellow at the Korea Automotive Technology Institute, said, "As the number of exclusive parts suppliers for the three foreign companies (Korea GM, Renault Samsung, Ssangyong) has significantly decreased recently, polarization among parts companies is intensifying," adding, "With the resurgence of COVID-19 making year-end demand uncertain, difficulties for parts companies are expected to worsen next year as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.