Indication of High-Risk Financial Institution Expulsion... "No More Exceptions"

Bank Funding Difficulties Amid Rapid Debt Increase

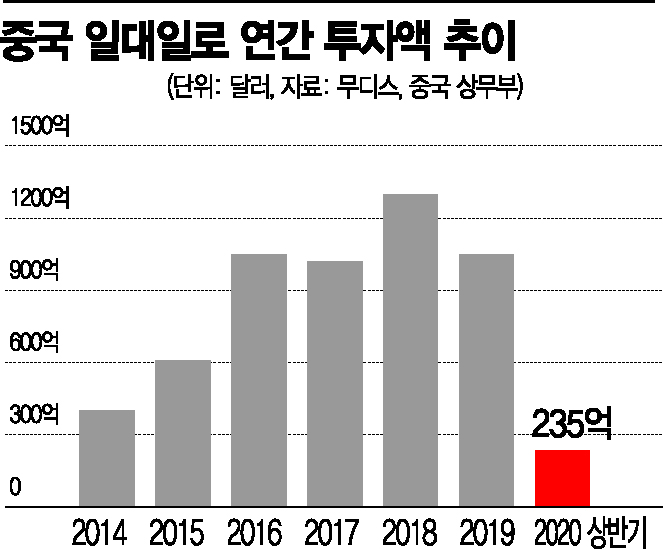

[Asia Economy Beijing=Special Correspondent Jo Young-shin, Reporter Lee Hyun-woo] As Chinese financial authorities have decided to liquidate Baoshang Bank, which was nationalized last year due to a bad debt crisis, it is expected that restructuring of financial institutions within China will accelerate. This unprecedented measure follows earlier warnings that there would be no longer the same level of support amid a series of defaults by local state-owned enterprises. The Belt and Road Initiative (land and maritime Silk Road), known as the Chinese government's largest investment project, is also reported to have seen a significant decline in overseas investment funds this year. Experts analyze this as an indicator that the Chinese government's financing is becoming increasingly difficult amid the prolonged COVID-19 pandemic and the US-China trade dispute.

According to China's state-run People's Daily and Xinhua News Agency on the 25th, the China Banking and Insurance Regulatory Commission approved Baoshang Bank's bankruptcy application on the same day. This is the first time in 22 years since the bankruptcy of Hainan Development Bank in 1998 that the Chinese government has approved a local bank's bankruptcy application. Baoshang Bank, a small local bank in the Inner Mongolia region of China, had established 209 shell companies from 2005 until last year and borrowed 156 billion yuan (approximately 26.3 trillion KRW) using them. When the bad debts worsened, Chinese financial authorities took control of the bank.

The People's Bank of China, the central bank, acquired Baoshang Bank in May last year through its subsidiary, the Deposit Insurance Fund Management Co., Ltd., and fully nationalized it. The bankruptcy of a nationalized bank is considered highly unusual even within China. People's Daily reported, "The bankruptcy of this bank, which has been under public management since May last year, was a foreseeable shock," adding, "The final bankruptcy decision is significant."

Earlier, the Chinese government also drew a line stating that there would be no further financial support regarding the chain defaults of local state-owned enterprises. On the 23rd, the state-run Global Times announced that at a special meeting of the Financial Stability and Development Committee under the State Council, it was declared that illegal activities related to state-owned enterprises' corporate bond defaults would be strictly punished. This effectively means that the previous practice of always announcing financial support or debt relief before local state-owned enterprises fell into default is now over.

Chinese state media reported that this decision is interpreted as the Chinese financial authorities' intention that no more hopeless projects or financial institutions will be bailed out. Xinhua News Agency reported that the Chinese financial authorities are revising and supplementing the market exit system procedures for high-risk financial institutions and have declared that there will be no exceptions to ensure financial system stability.

The Belt and Road Initiative, a national project promoted by the Chinese government since 2014, is also reported to have seen a significant reduction in investment funds. According to CNBC on the 24th (local time), Moody's, an international credit rating agency, reported that while overseas investment in China's Belt and Road projects reached $104.7 billion last year, only $23.5 billion had been invested by the first half of this year.

The decrease in investment is analyzed as being due to the Chinese government facing difficulties in bearing the credit burdens of the investment recipient countries. Michael Taylor, Senior Credit Officer for Asia-Pacific at Moody's, told CNBC in an interview, "The Belt and Road project recipient countries have vulnerable economies that rely solely on natural resources or tourism, or where remittances from abroad constitute a large portion of investment. These countries have suffered significant damage due to the COVID-19 pandemic," adding, "The credit burdens of these countries will continue next year, and it will be difficult for China's investment funds to increase."

Earlier, the Institute of International Finance (IIF) also warned that China's non-financial corporate debt exceeded 165% of GDP in the third quarter of this year. China's debt growth rate is the highest among emerging countries and is already considered to have surpassed the level of advanced countries. Alicia Garcia Herrero, Chief Economist for Asia-Pacific at international credit insurer Euler Hermes, explained in an interview with Hong Kong's South China Morning Post (SCMP), "China needs to be more cautious about Belt and Road investments going forward," adding, "There is a risk that China may not be able to recover debts from the countries it has invested in at all."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.