36.07% Stake and Management Rights 'Sale Price 1 Trillion' Preferred Negotiation Partner Selected

DICC Lawsuit Supreme Court Verdict... 'Doosan Group Self-Rescue Plan' Variable

[Asia Economy Reporter Ki-min Lee] Among the implementation details of Doosan Group's self-rescue plan, the largest-scale task of selling Doosan Infracore is expected to hinge on the litigation risk involving Doosan Infracore China Corporation (DICC) until the sale is completed within this year.

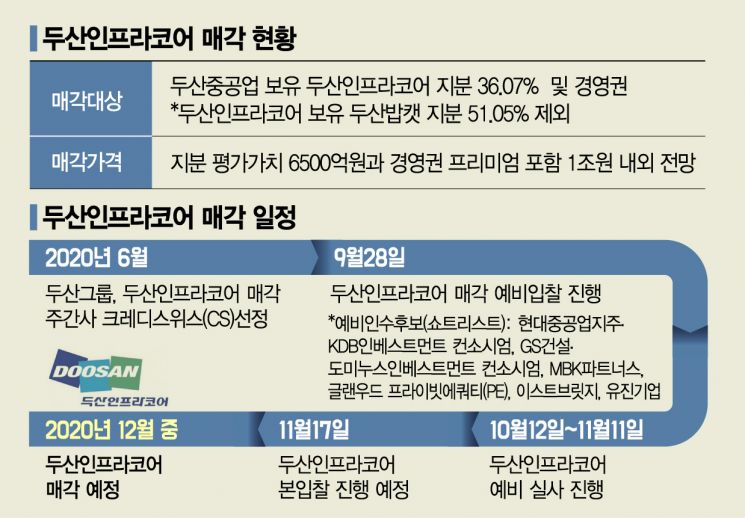

According to investment banking (IB) industry sources on the 11th, preliminary bidders who have entered the Doosan Infracore sale are conducting on-site due diligence at the Incheon and Bucheon plants from the 9th through today, ahead of the main bidding. Earlier, following Doosan Group’s preliminary bidding for Doosan Infracore on September 28, six companies emerged as preliminary bidders (shortlist): the consortium of Hyundai Heavy Industries Holdings and KDB Investment, the consortium of GS Construction and Dominus Investment, MBK Partners, Glenwood Private Equity (PE), East Bridge, and Eugene Corporation. It is known that only five companies participated in the on-site due diligence. These companies plan to participate in the main bidding scheduled around the 17th of this month after completing the due diligence. Doosan Group is expected to select the preferred negotiation partner for the sale of Doosan Infracore by the end of this year once the main bidding concludes.

If Doosan Infracore is sold as scheduled, Doosan’s self-rescue plan will also be completed within the year. Previously, Doosan proposed a self-rescue plan to the creditors to secure 3 trillion KRW for financial structure improvement. Over the past eight months, Doosan has raised 2.21 trillion KRW by selling assets and affiliates, starting with the golf course Club Mow CC, followed by Neoflux, Doosan Tower, Doosan Solus, and the Motrol business division. Including the sale price of the 36.07% stake and management rights of Doosan Infracore held by Doosan Heavy Industries, Doosan’s self-rescue plan implementation will be concluded.

However, industry analysis suggests that the sale of Doosan Infracore within this year may not proceed smoothly. Concerns arise that the DICC litigation risk could become a variable in the sale of Doosan Infracore. When Doosan Infracore established DICC in 2011, it raised 380 billion KRW corresponding to a 20% stake from financial investors (FIs) such as IMM, Mirae Asset Global Investments, and Hana Financial Investment Private Equity (PE). The contract allowed investors to sell part of their Doosan Infracore shares if an IPO did not occur in the future.

Since DICC was not listed, the FIs exercised their drag-along rights to sell shares to third parties, but the attempt failed, leading to a lawsuit in 2015 demanding payment of approximately 719.6 billion KRW for stock purchase. If Doosan Infracore ultimately loses the case, it will have to pay about 1 trillion KRW including legal interest to the FIs. The first trial favored Doosan Infracore, the second trial favored the investors, and only the Supreme Court ruling remains. Even if Doosan Infracore wins, if the FIs exercise the drag-along rights again, they can sell the 20% DICC stake to a third party.

Initially, Doosan considered a plan to take responsibility for contingent liabilities that might arise from DICC when announcing the sale of Doosan Infracore, but it is reported that no definite method has been presented. Some speculate that since this involves opposition from Doosan Heavy Industries shareholders or potential breach of fiduciary duty by the board, it may be difficult to propose a responsibility plan, and Doosan might reverse its previous stance.

An industry insider said, "The litigation debt related to DICC is a large burden for the bidders, but since the Supreme Court decision for Doosan Infracore has not yet been made, there is room for negotiation. Moreover, since the sale of Doosan Infracore will conclude the implementation of Doosan’s self-rescue plan, both Doosan and the creditors will want to receive a proper price."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.