Ruling Party's Proposed Amendment Examined Through the Shareholding Structures of the Four Major Groups

Key Groups' Voting Rights Only in the 10% Range, Vulnerable to Management Takeover Attacks

[Asia Economy Reporter Changhwan Lee] The Democratic Party of Korea is pushing to amend the 3% rule, the biggest issue in the revision of the Commercial Act, from cumulative recognition of major shareholders to individual recognition. However, the business community still fears the possibility of speculative forces infringing on corporate management rights.

Major groups such as Samsung, Hyundai Motor, and SK have pointed out that even if major shareholders' voting rights are recognized up to 3% individually, the total voting rights of all major shareholders are limited to around 10% due to the shareholding structure. This could make them vulnerable if hedge funds or hostile forces attack over the appointment of audit committee members.

According to political circles on the 11th, the Democratic Party is reportedly placing weight on partially modifying the 3% rule, which companies strongly oppose among the so-called three corporate regulation laws, including the Commercial Act and Fair Trade Act amendments and the enactment of the Financial Group Integrated Supervision Act. The core of the 3% rule is to separately elect audit committee members and limit major shareholders' voting rights to 3% during this process.

The Democratic Party initially intended to push forward with the government's original plan of cumulative 3%, but due to strong opposition from the business community, it is reportedly considering a plan to recognize voting rights up to 3% individually, including special related parties, rather than cumulatively summing major shareholders' voting rights.

The 'Listed Company Act' proposed by Democratic Party lawmaker Kim Byung-wook, the party's secretary of the National Assembly's Political Affairs Committee, in September also centers on this content. The Democratic Party is considering submitting the bill to the relevant standing committees, the Judiciary Committee and the Political Affairs Committee's bill subcommittees, around the 16th or 17th at the earliest.

However, companies believe that even if 3% is recognized individually per major shareholder, the low shareholding ratio of major shareholders still leaves the key audit committee seats vulnerable to hostile external forces.

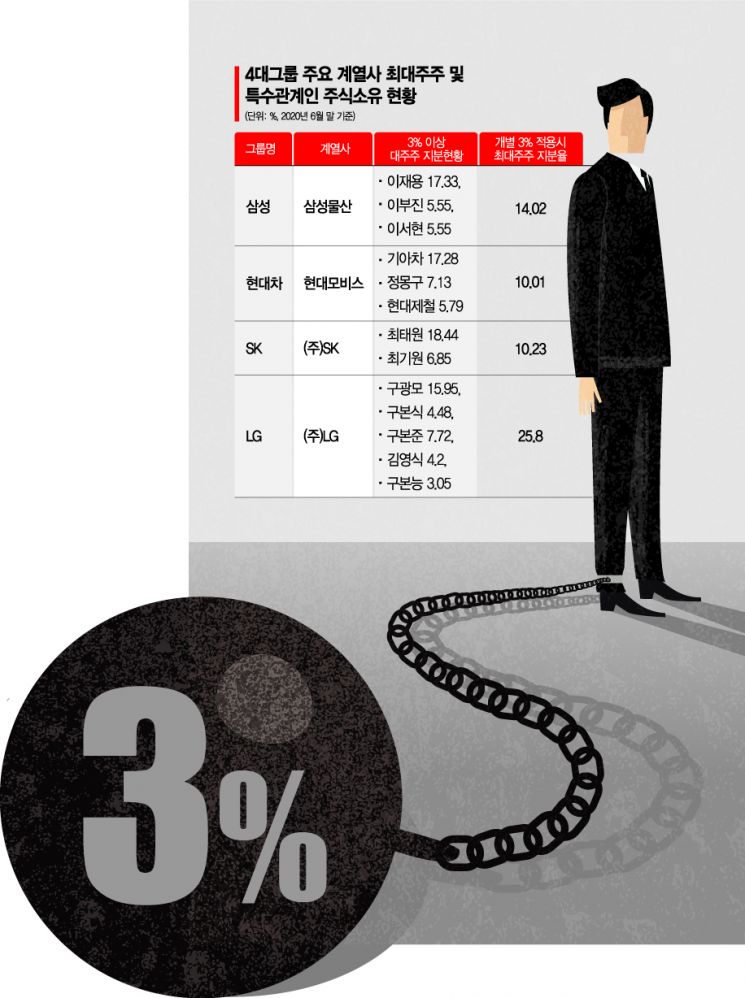

Leading domestic companies such as Samsung, Hyundai Motor, and SK could also face threats to their management rights. In the case of Samsung C&T, which serves as the holding company of the Samsung Group, Vice Chairman Lee Jae-yong holds 17.33% of shares, while his sister Lee Boo-jin, President of Hotel Shilla, and Lee Seo-hyun, Director of the Samsung Welfare Foundation, each hold 5.55%.

According to the Commercial Act amendment, when electing audit committee members, their shareholding ratios would be recognized only up to 3% each, and even if the shares of special related parties under 3% are combined, voting rights can only reach up to 14.02%. If hedge funds split their shares into 3% chunks, divide into multiple corporations, and ally with other shareholders, they could easily take control of Samsung C&T's audit committee seats.

The shareholding structures of Hyundai Motor and SK are even more vulnerable. Hyundai Mobis, the holding company of Hyundai Motor Group, has Kia Motors holding 17.28%, Honorary Chairman Chung Mong-koo holding 7.13%, and Hyundai Steel holding 5.79%. Even combining the total recognized shares of 9% and other special related parties' shares, it amounts to only about 10%. SK Group also has about 10% of shares recognized for major shareholders including Chairman Chey Tae-won.

Even if the 3% rule is relaxed individually, the chance of audit committee seats being taken by hostile forces increases 4.6 times

If the maximum voting rights of major shareholders are recognized only up to 10% when electing audit committee members, companies are fully exposed to attacks by speculative forces such as hedge funds or hostile M&A (mergers and acquisitions) forces. In fact, in 2004, the foreign hedge fund Sovereign acquired 14.99% of SK shares, split them into 3% chunks, and dispersed them across five funds to attack SK Group's management rights.

Last year, activist fund Elliott attempted to participate in management while holding 2.9% and 2.6% stakes in Hyundai Motor and Hyundai Mobis, respectively. While leading conglomerates struggle to defend management rights, there are claims that the legal amendments could be even more fatal for medium-sized and small companies.

The business community argues that the 3% rule itself is rare overseas and likely infringes on property rights under the Constitution, so it is preferable to abolish it. If the amendment must proceed, they demand that voting restrictions be lifted when speculative forces attack or that the recognized shareholding ratio be significantly increased to provide companies with means to defend management rights in times of crisis.

The Korea Listed Companies Association analyzed that if the separate election of audit committee members and the strengthening of voting rights restrictions on major shareholders are passed, the likelihood of audit committee candidates proposed by external shareholders being appointed could increase by 11.4 times compared to the current system. Even applying the individual 3% rule as per the ruling party's amendment, the possibility rises 4.6 times.

Lee Jae-hyuk, Executive Director of the Korea Listed Companies Association, said, "The Commercial Act amendment could trigger serious management disputes due to the activities of hedge funds," adding, "Especially holding companies could suffer severe damage, which is inconsistent considering the government has encouraged conversion to holding companies for transparent shareholding relationships."

The business community is also concerned that other contentious issues in the corporate regulation laws might pass in their original form, overshadowed by the 3% rule controversy. They argue that not only the 3% rule but also the multiple derivative suit system, abolition of exclusive prosecution rights, and strengthening of holding company shareholding regulations need revision.

In particular, the multiple derivative suit system in the Commercial Act amendment allows filing derivative suits against multiple companies at low cost, raising concerns about abuse to shake corporate management rights. If the Fair Trade Commission's exclusive prosecution rights are abolished under the Fair Trade Act amendment, anyone could directly accuse companies without going through the Fair Trade Commission, leading to indiscriminate accusations by competitors and overlapping investigations by the Fair Trade Commission and prosecutors, causing significant confusion.

An official from an economic organization said, "Not only the 3% rule but other regulatory bills are critical for companies," adding, "Since the National Assembly schedule remains and there is a possibility of further amendments, we will continue to visit the National Assembly and persistently persuade lawmakers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.