Over 100-Year-Old Bank Branch Disappears, 1st Floor Branch Yields to Fashion and Cosmetics Stores

Expansion of Non-Face-to-Face Services Leads to Consolidation of Bank, Card, and Insurance Branches

[Asia Economy Reporter Park Sun-mi] Woori Bank Myeongdong Financial Center, which was the second most expensive land in Seoul with a publicly announced price of 192 million KRW per square meter, completed remodeling last September and gave up its 1st and 2nd floor branches to stores selling cosmetics and clothing. Only the automated teller machines (ATMs) remain on the 1st floor, and the branch relocated to the 3rd and 4th floors, where customer accessibility has significantly decreased.

Shinhan Bank closed its Jongno 3-ga branch in March this year, which had been in the same location for over 100 years since November 1919. This branch, which experienced the Japanese colonial period through the Korean War, was recorded as the longest-standing branch among those closed in the past five years. The branch was merged with the Jongno Central branch located in Jongno 4-ga and is currently operated as Shinhan Bank's first large-scale branch, the Jongno Central Financial Center.

Exterior view of LU42, a fashion and cosmetics select shop located on the 1st and 2nd floors of Woori Bank Myeongdong Financial Center.

Exterior view of LU42, a fashion and cosmetics select shop located on the 1st and 2nd floors of Woori Bank Myeongdong Financial Center.

With the spread of the novel coronavirus infection (COVID-19), the financial industry including banks, insurance, and card companies has accelerated the transition to non-face-to-face services, leading to a series of offline branch closures. Unprofitable branches that customers do not visit are being shut down one after another. Iconic branches known as landmarks within banks are being eliminated or relocated to upper floors of buildings where customer foot traffic is low. As branches are streamlined, workforce restructuring has become inevitable.

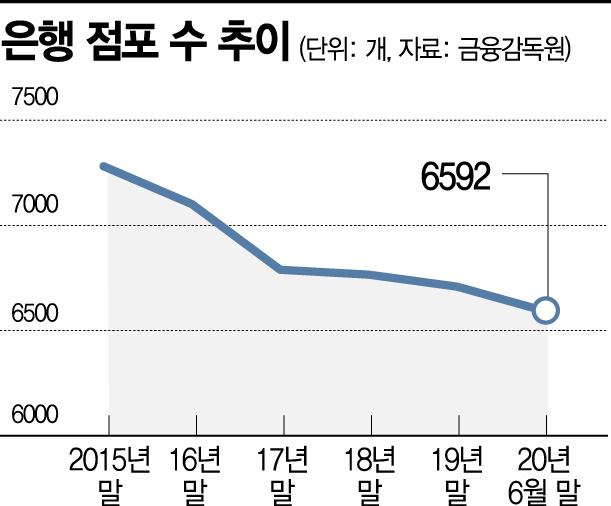

According to the Financial Supervisory Service on the 5th, the number of domestic bank branches (including branches and sub-branches) decreased from 7,281 in 2015 to 6,592 by the end of the first half of this year. After falling below 6,700 in 2017 and maintaining that level until the end of last year, the number sharply declined this year. In particular, the four major domestic banks?KB Kookmin, Shinhan, Woori, and Hana?had 3,430 branches as of the end of June, down by more than 100 from 3,543 a year earlier. Branch consolidations are ongoing, with about 40 bank branches and sub-branches closing last month. ▶Related article page 7

Branch Reduction is a Common Phenomenon in Banks, Card Companies, and Insurance

"Non-face-to-face Services Expand Due to Online and Mobile Consumption"

The situation is similar for insurance and card companies.

The number of branches (including headquarters, branches, and sales offices) of 26 life insurance companies operating domestically decreased by nearly 1,000 from 3,855 at the end of 2015 to 2,960 as of the end of June this year. The big three life insurers?Samsung, Hanwha, and Kyobo?reduced their branches from 2,118 to 1,890 during this period, accounting for 25% of the total branch reduction. The number of sales offices of non-life insurance companies also decreased by 134 from 1,793 a year ago to 1,659 as of the end of June this year.

For card companies, the number of branches (including branches and sub-branches) of eight companies shrank from 285 at the end of 2015 to 180 as of the end of June this year, a reduction of about 100. Hyundai Card reduced its branches from 53 to 31 this year, and Hana Card also cut from 15 to 8.

Financial authorities are cautious about the rapid reduction of branches by financial companies, concerned about digitally marginalized groups such as the elderly. However, the industry views the digital transformation trend as already established, making offline branch consolidation an inevitable choice for management efficiency. Especially with the expansion of financial companies participating in open banking and the advent of the MyData era, non-face-to-face financial services are becoming more diverse, and branch reductions are expected to accelerate further.

Byun Hye-won, a research fellow at the Korea Insurance Research Institute, explained in the report "Diagnosis and Tasks of the Insurance Industry" published on the 3rd, "With the expansion of online and mobile consumption, the point of contact for insurance information search and purchase is shifting from face-to-face to non-face-to-face, and this trend is expected to accelerate further due to COVID-19." She added, "As fintech startups and big tech companies enter the insurance market, consumer expectations for digital-friendly insurance products and services are also rising."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)