Government Finalizes 90% Realization Rate for Real Estate Official Prices

Holding Tax Soars from Next Year on High-Value Apartments Over 1.5 Billion Won

Property Tax Rate Reduction Decided for Homes Under 600 Million Won

[Asia Economy Reporter Moon Jiwon] As the government has finalized a plan to raise the official real estate prices to 90% of market value, it is expected that the property tax burden on owners of high-priced homes and multiple houses will significantly increase starting next year. Accordingly, there is also an analysis that apartment listings aimed at avoiding property tax may flood the market in the first half of next year.

To reduce the burden on ordinary citizens caused by the sharp increase in official prices, the government decided to lower the property tax rate only for homeowners with one household and one house whose official price is 600 million KRW or less. However, given the recent rapid rise in housing prices mainly in the metropolitan area, opinions suggest that a substantial increase in tax burden for many citizens is inevitable.

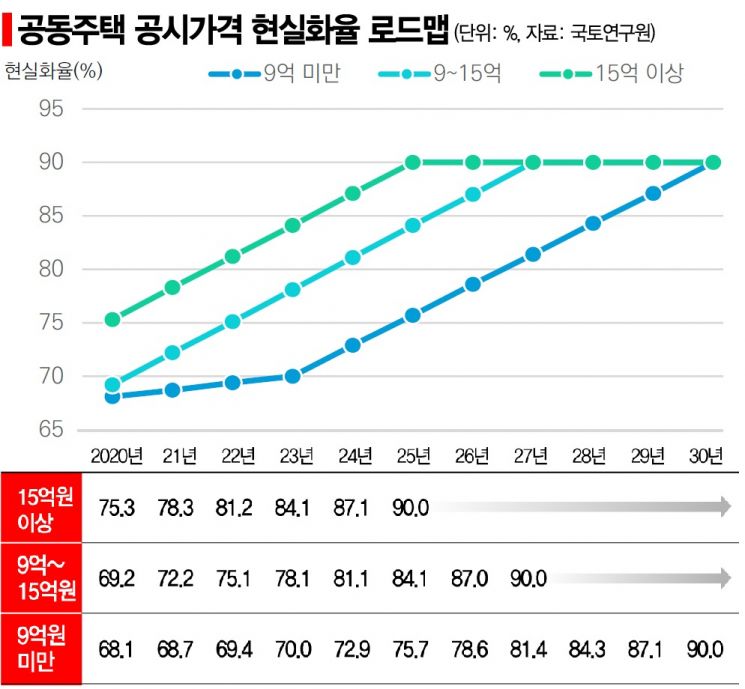

According to the Ministry of Land, Infrastructure and Transport on the 3rd, the government decided to raise the official real estate prices to about 90% of market value. For apartments and other multi-family housing, the realization rate will be raised from 69.0% this year to 90% over 10 years; for detached houses, from 53.6% to 90% over 15 years; and for land, from 65.5% to 90% over 8 years.

High-priced homes in Gangnam, Yongsan, etc. face 'property tax bomb' realization

Accordingly, in areas such as Gangnam in Seoul, where most apartments exceed 1.5 billion KRW in market value, the property tax burden is expected to surge starting next year. For apartments in this price range, the official price will be raised by 3 percentage points annually from next year. Thus, the current realization rate of 75.3% for high-priced homes will reach 90% within five years.

Since the official price is used as a basis for calculating real estate-related taxes such as property tax and health insurance premiums, raising the official price will increase various taxes and charges accordingly.

According to a property tax increase simulation commissioned by Shinhan Bank Real Estate Investment Advisory Center, the property tax for a single homeowner owning one 84㎡ unit in 'Raemian Daechi Palace' in Daechi-dong, Gangnam-gu, will increase 5.1 times from 9.07 million KRW this year to 46.32 million KRW in 2025. The simulation assumes the owner is under 59 years old and the housing price rises 5% annually.

The property tax for an 84㎡ unit in 'Raemian Prestige' in Banpo-dong, Seocho-gu, is also estimated to increase by 289% from 11.58 million KRW to 45.03 million KRW during the same period, and for a 120㎡ unit in 'Dogok Rexle' in Dogok-dong, Gangnam-gu, it will rise from 9.18 million KRW to 31.95 million KRW. The property tax for an 82㎡ unit in Jamsil Jugong 5 Complex, Jamsil-dong, Songpa-gu, will also increase significantly from 8.37 million KRW to 28.96 million KRW.

Realization rate for homes under 900 million KRW raised slowly over 3 years... faster for high-priced homes

The government set different speeds to reach the 90% realization rate depending on the type and price range of real estate, as the realization rates vary.

For homes under 900 million KRW in market value, considering the wide variance in realization rates among individual properties, the rate will be raised slowly by 1 to 1.5 percentage points annually from 2021 to 2023, then increased by about 3 percentage points annually thereafter.

The average realization rate for multi-family housing under 900 million KRW will rise from the current 68.1% to 70% by 2023, and then reach the 90% target by 2030. For detached houses under 900 million KRW, with an average realization rate of 52.4%, the rate will reach 55% by 2023 and then 90% by 2035.

For homes over 900 million KRW, since the realization rate has already been significantly raised to achieve better balance than mid- to low-priced homes, the rate will be increased by about 3 percentage points annually starting next year. For multi-family housing, homes priced between 900 million and 1.5 billion KRW will reach a 90% realization rate in 7 years, and those over 1.5 billion KRW in 5 years.

For land, which is priced per unit area and has less variance depending on usage, the rate will be raised by about 3 percentage points annually from next year, the same as for homes over 900 million KRW.

The Ministry of Land explained that the average increase rate was set at 3 percentage points considering "not prolonging the realization period excessively while also taking into account the burden caused by a rapid rise in official prices in a short period." It added, "To consider the burden from a sharp rise in official prices of properties with significantly low realization rates, the annual increase cap is applied at 6 percentage points."

Lower property tax rates for homes under 600 million KRW to ease burden

If the official prices rise as planned by the government, even owners of mid- to low-priced homes will inevitably face increased tax burdens. Considering this, the government decided to lower the property tax rate starting next year for homeowners with one household and one house whose official price is 600 million KRW or less.

Within the ruling party and government, there was debate over whether to set the property tax reduction threshold at '600 million KRW or less' or '900 million KRW or less,' but ultimately the benefit was limited to homes priced at 600 million KRW or less. As a result, the number of beneficiaries is expected to decrease accordingly.

The Ministry of Land stated, "Considering the purpose of stabilizing housing for ordinary citizens and easing the tax burden caused by the realization of official housing prices, the threshold was set at 600 million KRW," and added, "The tax rate will be lowered by 0.05 percentage points for each taxable standard bracket."

For official prices up to 100 million KRW, property tax will be reduced by up to 30,000 KRW; for 100 million to 250 million KRW, by 30,000 to 75,000 KRW; for 250 million to 500 million KRW, by 75,000 to 150,000 KRW; and for 500 million to 600 million KRW, by 150,000 to 180,000 KRW. The reduction rate ranges from a maximum of 50% to a minimum of 22.2%, with the greatest benefit for homes priced at 100 million KRW or less.

The government expects that a significant portion of single-home owners will benefit from this tax rate reduction. Homes with official prices of 600 million KRW or less account for 94.8% (10.3 million households) of all homes owned by single-home owners.

Overall, the tax support effect is expected to be 478.5 billion KRW annually (about 1.44 trillion KRW over 3 years). The government plans to apply the tax rate reduction for three years until 2023 and will decide whether to change it later after reviewing housing market fluctuations and the effects of official price realization. The reduced tax rate will be applied starting from the property tax levied next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)