Music Copyright Shares Bought and Sold Like Stocks Generate Royalties

Resellers of Limited Editions Like Lego and Breeders Selling Pets Gain Attention

Risky to Switch to Full-Time Based on Success Experience... "Support Needed for Proper Investment"

[Asia Economy Reporter Lee Gwanju, Intern Reporters Gong Byeongseon, Kim Suhwan, Ryu Taemin, Park Juni, Song Seungseop] Office worker Choi Seokmin (30) invests 200,000 to 300,000 KRW from his monthly salary into music copyright every month. The first song he invested in was So Chan-hwi's "Tears." He purchased a 0.3% share of the copyright (17 shares out of a total of 4,811 shares) in January at 39,547 KRW per share, totaling 670,000 KRW. After 9 months, the stock price rose to 50,500 KRW, recording a 27.7% return. The royalties he has received so far amount to about 30,000 KRW. To date, he has invested a total of 2.57 million KRW, achieving a 32.6% return from capital gains, and total royalty income of 86,402 KRW. Choi said, "Compared to stocks, price changes are more predictable, and the advantage is that royalties come in every month as well as the value of the shares." He added, "I am currently investing in about 20 songs."

Youth Investment Diversifying Beyond Stocks

The platform where Choi buys and sells music copyrights is called "Musicow." About 630 songs are traded on this platform. Among its 170,000 users, 76% are in their 20s and 30s. Jung Hyejeong (35, female) said, "Although the low trading volume makes liquidity poor, I can accurately assess the value of the songs listed for investment, so I will continue to invest in various songs."

"Breeder" is also gaining popularity as an investment method among young people. Breeders are people who raise small creatures and resell them for profit. Kim Seonghak (30), who works at a public enterprise, is an ornamental shrimp breeder. He buys shrimp at 3,000 to 5,000 KRW each, raises them, and sells them at double the price to make a profit. Transactions mainly take place in online cafes or open markets where hobbyists gather. Kim said, "Most breeders start as a hobby, then expand their scale, and some eventually open their own shops." Biological investments are made not only in shrimp but also in mantises, ants, fish, turtles, and all fields where enthusiasts have formed communities. Especially reptile breeders are numerous, and rare species often cost several million KRW.

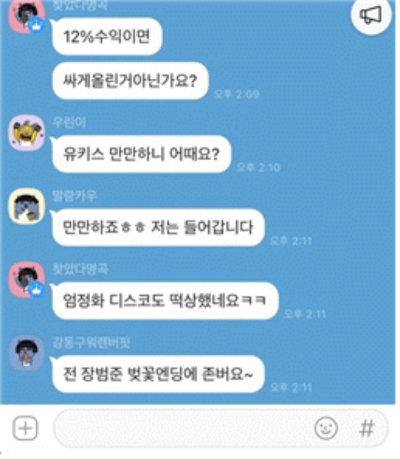

A representative example of turning hobbies into money-making is the "re-seller." This involves reselling popular but limited-quantity shoes, clothing, toys, etc., at higher prices. Selling limited edition Lego sets is called "Lettech," and trading limited edition Starbucks items is called "Stech," showing how common these investment methods have become among young people. Graduate student Han Taekho (28, pseudonym) recently bought famous sports brand shoes for 220,000 KRW and sold them for 800,000 KRW. He said, "Competition to buy items expected to rise in price is fierce, and lining up early in the morning is common. Some even hire part-timers to secure goods." Han added, "I think this field suits me well, and I am even considering opening a specialized resale shop." Joo Kyungmin (30), who runs an online startup, chose small-scale real estate investment. He invested 4.3 million KRW over the past year and recorded a 12% return. He uses financial platforms such as mobile payment services "Toss" and "KakaoPay." He said, "Once I invest, I don't have to worry much, and the monthly income comes steadily, which is good."

A Glimpse of Changing Views on Occupations... Time to Pay Attention to Education and Taxation

Youth tend to focus on online-based fields that allow small investments and require less specialized knowledge. This trend seems to be driven by uncertainties in employment and home ownership, similar to the stock craze. The accessibility of digital platforms also favors the younger generation. Professor Choi Jaebung of the Department of Mechanical Engineering at Sungkyunkwan University said, "An era has opened where investing in all kinds of things like playing games on smartphones is possible."

Of course, youth investment has its pros and cons. The "YouTuber" field, which seemed to replace traditional jobs as many jumped in, is no exception. Full-time YouTuber Ahn Mo (35) said, "I invested 4 million KRW in equipment like cameras with the expectation of making big money, but my income has been zero for five months." He added, "I think I should have learned video editing and other necessary skills before going full-time." Most young people interviewed also recognized that relying on a few big profit experiences and jumping in without preparation is risky. Although income can be unstable, the risk increases because a larger investment is needed to earn enough to make it a career.

There are voices saying that youth investment should not be dismissed as "reckless attempts to make easy money" or "thoughtless blind investment," but rather that attention should be paid to institutionalizing it. It should be recognized as a social phenomenon reflecting changes in occupational views. Professor Wi Jeonghyun of the Department of Business Administration at Chung-Ang University said, "The government needs to provide facilities, equipment, and education so that young people can engage in proper investment," meaning "giving them the tools to fish." Experts also point out that as young people continue to develop new investment methods and destinations, appropriate taxation policies should be established, and digital information gaps should not lead to economic disparities.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)