Strengthening Contactless Channels like Unmanned Stores and Kiosks

Face-to-Face Marketing Costs Decrease Due to COVID-19

OTT and IPTV Usage Increase Causes Traffic Surge

[Asia Economy Reporter Koo Chae-eun] SK Telecom, KT, and LG Uplus, the three major telecom companies, are expected to post solid results in the third quarter (July-September) despite the prolonged COVID-19 pandemic. This is due to a combination of factors including an increase in 5G subscribers with high average revenue per user (ARPU) following the release of new products such as the Galaxy Note20, reduced costs for face-to-face marketing due to COVID-19, and strong performance from non-telecom subsidiaries. The impact of COVID-19 was offset by increased demand for content and the spread of non-face-to-face culture, resulting in overall resilient third-quarter performance.

Telecom 3 Companies' Performance 'Holding Up'

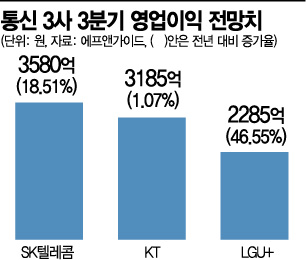

According to FnGuide on the 26th, the expected operating profit for SK Telecom, KT, and LG Uplus in the third quarter (based on estimates from three or more securities firms) is 905 billion KRW, a 16% increase compared to the previous year. Looking at each telecom company, SK Telecom's third-quarter revenue is projected to grow 2.87% year-on-year to 4.692 trillion KRW, with operating profit increasing 18.51% to 358 billion KRW. Despite the 5G era, the stable market share ratio of '5:3:2' is maintained, and the rise in 5G ARPU is leading to improved performance. The strong performance of 'cash cow' subsidiaries such as SK Broadband, ADT Caps, SK Infosec, and 11st is also expected to drive operating profit growth.

KT's third-quarter revenue is expected to decrease 2.2% year-on-year to 6.0771 trillion KRW, but operating profit is estimated to slightly increase by 1.07% to 318.5 billion KRW. Although BC Card and Estate were hit by COVID-19, the strong performance of content subsidiaries such as KTH, with increased T-commerce transaction volume, and Nasmedia, with increased game advertising, is expected to offset the sluggishness in financial and real estate subsidiaries.

LG Uplus's third-quarter revenue is projected to increase 4% to 3.374 trillion KRW, with operating profit rising 46.55% to 228.5 billion KRW. This is attributed to an increase in high-speed internet subscribers, subscriber inflow from subsidiary LG HelloVision, expansion of MVNO network operators, and ARPU growth driven by increased VOD demand, all contributing to solid performance.

Marketing Cost Reduction and Subsidiary Impact

The main reason for the telecom three companies' solid third-quarter performance is the expansion of non-face-to-face device purchases due to COVID-19 and the stabilization of the 5G market, which allowed for efficient marketing cost execution. Cost efficiency achieved through strengthening non-face-to-face channels such as unmanned stores and kiosks (unmanned terminals) has settled in during the third quarter. KB Securities researcher Kim Jun-seop said, "Telecom companies are controlling marketing costs, and the untact trend is expanding the self-sufficient device market," adding, "The number of subscribers will steadily increase due to the influence of newly released 5G devices."

According to the Ministry of Science and ICT, as of the end of August, the number of domestic 5G subscribers was 8,658,222. This is a 10.19% increase from July (7,857,205), which is higher than the previous month's growth rate (6.61%). The proportion of 5G subscribers among all mobile subscribers also slightly increased from 11% in July to 12.3%. New device releases such as the Galaxy S20 FE and iPhone 12 are scheduled this month, so the number of 5G subscribers is expected to rise even more sharply.

Increased mobile data demand and the expansion of media consumption such as IPTV have driven performance growth. The synergies from the completed mergers of 'T-Broad + SK Broadband' and 'HelloVision + LG Uplus' are also expected to be reflected in third-quarter results.

Cost Control Needed in Q4

However, in the fourth quarter, there are cost issues such as 5G infrastructure capital expenditures (CAPEX). The prolonged COVID-19 pandemic has slowed the pace of indoor 5G deployment, increasing consumer dissatisfaction. According to Rep. Byun Jae-il of the Democratic Party, as of July this year’s completion report, indoor wireless stations account for only 2.9% of all 5G wireless stations, so demands for increased infrastructure investment are expected to rise until the end of the year. Creating new revenue models is also crucial. The nationwide deployment of 28GHz band 5G is slow, and the business model for the B2B 5G sector remains unclear. Professor Shin Min-su of Hanyang University said, "Uncertainty in regulatory issues such as network slicing must be reduced for 5G to translate into telecom companies' profits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.