Emergency Management Stabilization Fund

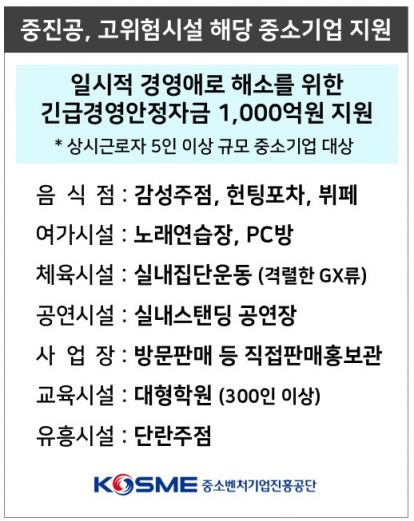

[Asia Economy Reporter Kim Daeseop] The Small and Medium Business Corporation announced on the 21st that it is providing 100 billion KRW in emergency management stabilization funds through the 4th supplementary budget to small and medium enterprises (SMEs) in high-risk facilities experiencing business difficulties due to measures such as gathering bans or restrictions caused by the novel coronavirus infection (COVID-19).

The support targets are the 10 industries among the 12 high-risk facilities excluding entertainment bars and colatecs. These include emotional bars, hunting pochas, buffets, karaoke rooms, PC rooms, indoor group exercise (intense GX types), indoor standing concert halls, direct sales promotion centers such as door-to-door sales, large academies (with 300 or more people), and danran bars, all SMEs with five or more regular employees.

The loan period is a 2-year grace period followed by 3 years of installment repayment. The loan limit per company is up to 1 billion KRW (up to 1.5 billion KRW over 3 years), the same as existing SMEs. The Small and Medium Business Corporation applies a fixed interest rate of 1.5% to reduce the financial burden on SMEs in high-risk facilities and has relaxed application requirements to allow loan applications even if the business difficulty conditions are not met.

Additionally, it operates a simplified evaluation system including non-face-to-face (untact) screening and Hi-Pass/Fast Track assessments to reduce the evaluation burden on companies and provide funds quickly.

Kim Hakdo, Director of the Small and Medium Business Corporation, said, "The Small and Medium Business Corporation will do its best to resolve the business difficulties of SMEs in high-risk facilities, which have been severely affected by recent gathering ban measures, by relaxing policy fund application requirements and simplifying evaluation procedures to provide prompt financial support."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)