Lowest Interest Rates on Credit Loans from 5 Major Banks

Increase of 0.11~0.19%P for Grade 1

Deposit Rates Seem to Hit Bottom

Concerns Over Damage to Self-Employed and General Households

[Asia Economy Reporter Jo Gang-wook] Loan interest rates at commercial banks are rising one after another. This is because the financial authorities have stepped in to curb the rapid increase in household loans amid the craze for 'Yeongkkeul (funds gathered to the soul)' and 'Debt Investment (borrowing to invest)'. On the other hand, deposit interest rates continue to decline endlessly. As the ultra-low interest rate policy in the 0% range continues, it has become difficult not only to grow a large sum of money but even to borrow living expenses, deepening the sighs of ordinary people.

According to the financial sector on the 14th, as the financial authorities recently expressed concern over the rapid increase in household loans including unsecured loans and ordered stronger management, commercial banks are consecutively adjusting interest rates and reducing limits. The interest rates on unsecured loans at major banks, which had been steadily falling since the Bank of Korea cut the base rate earlier this year, reversed to an upward trend last month. The lowest interest rates on representative unsecured loans at the five major banks (based on personal credit rating grade 1) have risen by 0.11 to 0.19 percentage points annually over the past month.

Hana Bank lowered the loan limit of its non-face-to-face unsecured loan product 'Hana One Q' by up to about 70 million KRW and reduced the preferential interest rate by 0.1 percentage points starting from the 8th. This means the final unsecured loan interest rate increased by 0.1 percentage points. NH Nonghyup Bank's 'Exciting Office Worker Loan' lowest interest rate was 2.09% annually as of the 22nd of last month, up 0.19 percentage points from 1.90% a month earlier. Nonghyup Bank also plans to lower the preferential interest rates of its non-face-to-face unsecured loan product 'All One Office Worker Loan' by 0.10 to 0.20 percentage points.

KB Kookmin Bank raised interest rates by 0.10 to 0.15 percentage points from the 29th of last month by reducing loan limits for professionals and office workers and cutting some preferential interest rates on unsecured loans. Woori Bank cut the maximum preferential interest rate on its main unsecured loan product 'Woori Main Office Worker Loan' by 0.5 percentage points annually. Internet-only banks KakaoBank and K Bank also raised their lowest unsecured loan interest rates by 0.15 and 0.1 percentage points, respectively.

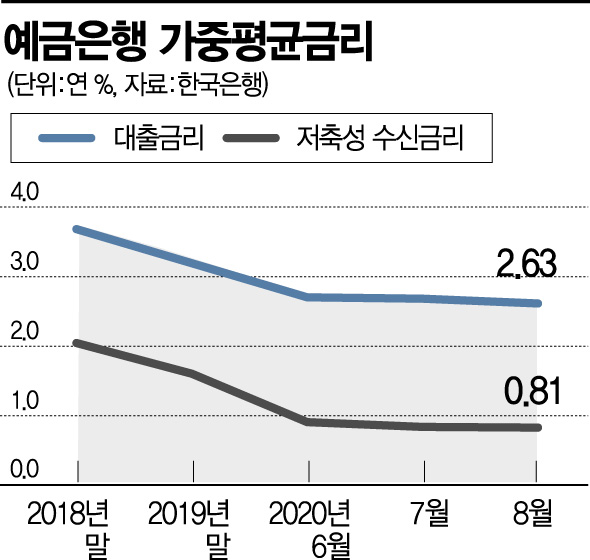

On the other hand, deposit interest rates have set new lows for three consecutive months. It has long been a thing of the past that time deposits served as a reliable means for ordinary people to increase their assets. According to the Financial Supervisory Service's integrated financial product comparison disclosure site 'One Look at Financial Products', the highest interest rate for one-year time deposit products at commercial banks (excluding preferential rates) was a pre-tax annual rate of 1.30% (K Bank's 'Code K Time Deposit'). Similarly, excluding preferential rates, the lowest interest rate was only 0.45% (Woori Bank's Won Deposit). According to the Bank of Korea, the weighted average interest rate on savings deposits at deposit banks in August (based on new contracts) was 0.81% annually, about half of the 1.60% at the end of last year.

Some voices express concern that as deposit interest decreases and loan interest rates rise, not only self-employed people who suffered from the COVID-19 pandemic but also ordinary households may be adversely affected. According to a loan behavior survey conducted by the Bank of Korea targeting 201 financial institutions, the loan attitude index for general household loans is expected to become the strictest, changing from 9 in the third quarter to -9 in the fourth quarter.

A financial sector official pointed out, "The Bank of Korea lowered the policy rate and injected a lot of money to mitigate the economic shock caused by the COVID-19 pandemic, but loan regulations are rather tightening. If the trend of strengthening loan screening under financial authorities' regulations becomes widespread, there could be a situation where even self-employed people and ordinary households are neglected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.