Additional Stimulus Measures and Quarterly Earnings Expectations

North America Fund Sees Highest Investment in a Month

[Asia Economy Reporter Song Hwajeong] Despite continued volatility in the U.S. stock market ahead of the U.S. presidential election, North American funds and U.S.-related exchange-traded funds (ETFs) are showing favorable returns. This is interpreted as being driven by expectations for additional U.S. stimulus measures and third-quarter corporate earnings.

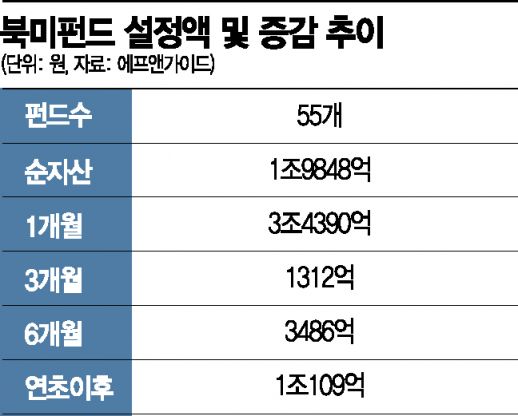

According to financial information provider FnGuide and the Korea Exchange on the 14th, North American funds saw an inflow of 131.2 billion KRW over the past month, the largest inflow among regional and country-specific funds. Since the beginning of the year, 1 trillion KRW has flowed in. The total assets under management of 55 North American funds amount to 1.9848 trillion KRW, approaching 2 trillion KRW.

Returns are also favorable. The North American funds posted a one-month return of 3.95%, second only to Emerging Asia (4.83%). Although Emerging Asia funds had the highest returns, they have been experiencing continuous outflows. Over the past month, 6.8 billion KRW was withdrawn, and since the beginning of the year, 89.5 billion KRW has flowed out.

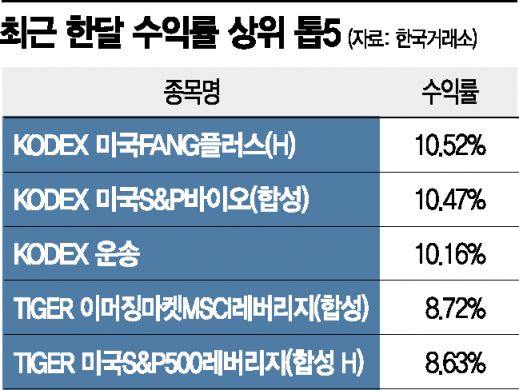

U.S.-related ETFs are also strong. The KODEX U.S. FANG Plus (H) recorded the highest one-month return among all ETFs at 10.52%. It was followed by KODEX U.S. S&P Biotech (Synthetic) at 10.47%, TIGER U.S. S&P 500 Leverage (Synthetic H) at 8.63%, and KODEX U.S. Russell 2000 (H) at 8.2%, all ranking among the top performers.

The U.S. stock market, which experienced a correction throughout September due to weakness in technology stocks, has recently resumed an upward trend. The S&P 500 index has risen 4.43% this month, while the Dow Jones Industrial Average and Nasdaq increased by 3.23% and 6.24%, respectively.

The strength in the U.S. stock market is attributed to expectations for additional stimulus measures. Although negotiations over the U.S. additional stimulus package are facing difficulties, optimism remains. Ban Inseong, a researcher at Cape Investment & Securities, said, "Although the U.S. Republican and Democratic parties are clashing over some details in the additional stimulus negotiations, the gap is narrowing over time, so the possibility of reaching an agreement remains valid."

There are also expectations for third-quarter earnings. According to Daishin Securities, the net profit growth rate of S&P 500 companies in the third quarter is expected to decline by 21% year-on-year, continuing negative growth following the second quarter. However, earnings estimates are being revised upward ahead of earnings announcements. The third-quarter S&P 500 net income consensus was raised by 5.8% compared to the end of August and by 2.4% compared to one month ago, reaching $273.1 billion. Lee Younghan, a researcher at Daishin Securities, explained, "Following better-than-expected results in the second quarter, expectations for an earnings surprise in the third quarter are increasing." Kim Jungwon, a researcher at Hyundai Motor Securities, said, "The overheating of growth stocks has been corrected, and expectations for economic recovery improvements based on abundant liquidity will resume," adding, "There is still room for further gains."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.