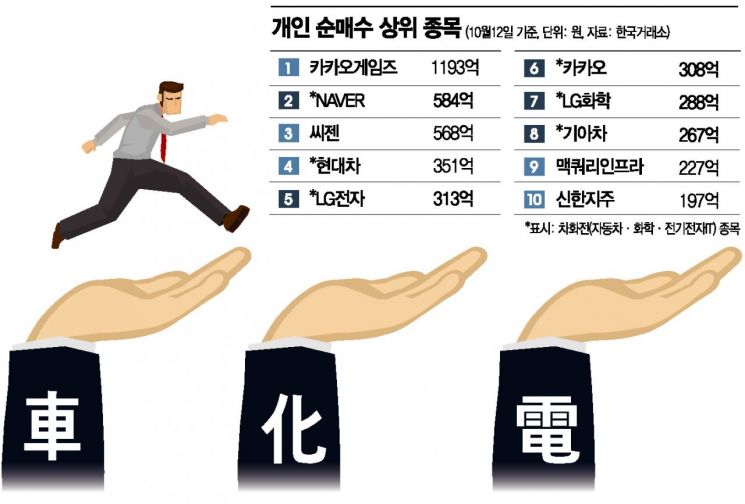

First Week After Social Distancing Easing Sees Concentrated Buying in Automobile, Chemical, and Electrical Electronics Sectors

More Conservative Judgments Than Economic Recovery Expectations

Foreigners Choose Top Performers Samsung Electronics and SK Hynix

[Asia Economy Reporter Minwoo Lee] After the easing of social distancing measures due to the novel coronavirus infection (COVID-19), individual investors focused their buying on so-called 'Chahwajeon' stocks, which include automobile, chemical, and electrical electronics IT sectors, in the first stock market session. This is interpreted as betting on existing strong stocks without hastily judging economic recovery.

According to the Korea Exchange on the 13th, the stock most net purchased by individual investors the previous day was Kakao Games, with a total purchase amount of 119.3 billion KRW. This is believed to be due to the release of shares allocated to institutional investors during the public offering process after the lock-up period ended following its listing last month. The second most net purchased stock was NAVER, a representative IT sector company, with a total net purchase of 58.4 billion KRW. Other stocks in the top net purchases included Hyundai Motor (4th place, 35.1 billion KRW), LG Electronics (5th place, 31.3 billion KRW), Kakao (6th place, 30.8 billion KRW), and LG Chem (7th place, 28.8 billion KRW). Samsung SDI and Lotte Chemical, categorized under the electric vehicle battery theme and traditional chemical materials companies respectively, ranked 11th and 12th. Except for Kakao Games, the focus was on existing strong stocks known as 'Chahwajeon.'

It is analyzed that individual investors chose earnings and stability even on the first day after Prime Minister Chung Sye-kyun chaired the Central Disaster and Safety Countermeasures Headquarters meeting on the 11th and announced the easing of social distancing to level 1. Rather than a recovery in consumer sentiment due to the easing of social distancing, they chose existing earnings stocks. In particular, LG Chem, Kakao, and Lotte Chemical had continued net selling until before the government announcement this month but switched to net buying after the announcement.

Concerns that the domestic stock market may enter a correction phase due to various uncertainties until the U.S. presidential election scheduled for the 3rd of next month also supported this choice. Kiwoom Securities researcher Seo Sang-young explained, "International oil prices fell 3% due to supply increase issues, offshore yuan weakened 0.8% against the dollar, COVID-19 trends in Europe and the U.S. continue to spread, and uncertainties surrounding the U.S. presidential election are still expected to weigh on the domestic stock market." Shin Young Securities researcher Lim Min-ho forecasted, "As President Trump's various statements continue before the election, the market is likely to gradually reflect the election result uncertainties that are not currently priced in."

The expectation of strong earnings also seemed to have a positive effect. According to financial information provider FnGuide, the estimated operating profit for the third quarter for the IT sector and consumer discretionary sectors including automobile and chemical industries are 13.2075 trillion KRW and 4.1767 trillion KRW, respectively. The IT sector's figure represents a 22.32% increase from the previous quarter and a 43.79% increase from the same period last year. The consumer discretionary sector also increased by 189.42% from the previous quarter and 1.30% from the same period last year. The third-quarter earnings momentum is expected to surpass the level before the COVID-19 outbreak. Kakao Pay Securities researcher Lee Sang-min said, "IT hardware, utilities, capital goods, and automobile sectors led the KOSPI's earnings growth in the third quarter of 2020," adding, "Since the market is no longer in a phase where 'growth is scarce,' attention should be paid to large-cap value stocks."

Meanwhile, foreign investors mainly bought leading stocks with strong earnings. The most net purchased stock was Samsung Electronics, with purchases amounting to 193 billion KRW on the 12th alone. They continued net buying for five consecutive trading days, accumulating 530.8 billion KRW. SK Hynix, ranked second, also net purchased 121.1 billion KRW. Samsung Electronics recorded an 'earnings surprise' with a third-quarter operating profit of 12.3 trillion KRW, and SK Hynix is expected to achieve an operating profit of 1.3017 trillion KRW, a 175.4% increase from the same period last year. Along with these, consumer-sensitive stocks such as Hotel Shilla (19.5 billion KRW), Shinsegae (10.8 billion KRW), and Amorepacific (10.4 billion KRW) were also bought. This is interpreted as buying with the possibility of economic recovery in mind following the easing of social distancing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.