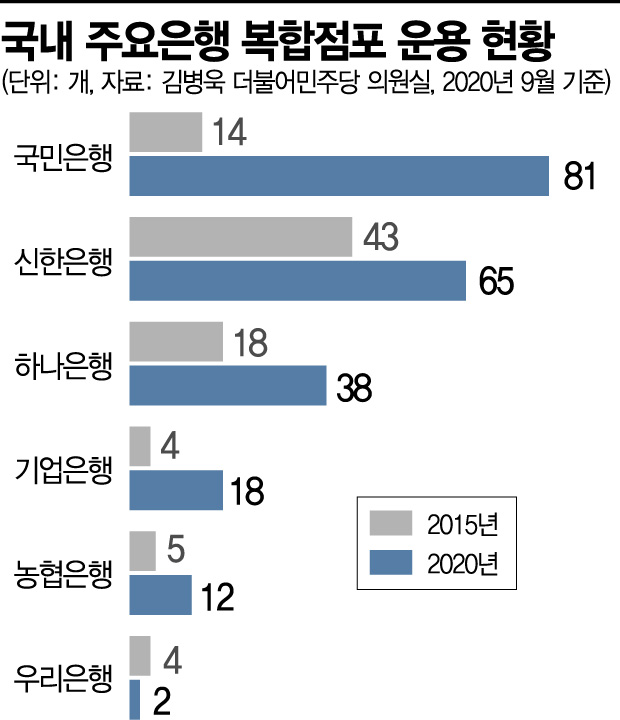

6 Banks' Complex Branches Increased from 88 in 2015 to 216 This Year

Expanding Complex Branches and Recruiting Experts in Real Estate, Tax, and Other Fields

[Asia Economy Reporter Park Sun-mi] Banks struggling to secure profitability are actively attempting to break down traditional business boundaries. They are expanding hybrid branches that combine 'banking + securities' and simultaneously targeting customer acquisition and improved asset management efficiency through collaboration with real estate and tax experts.

According to data submitted by the Financial Supervisory Service to the office of Kim Byung-wook, a member of the National Assembly's Political Affairs Committee from the Democratic Party of Korea, the number of hybrid branches operated by six banks?Kookmin, Shinhan, Hana, Woori, Nonghyup, and Industrial Bank of Korea?has more than doubled from 88 in 2015 to 216 as of September this year. During this period, Kookmin Bank's hybrid branches increased nearly sixfold, while Hana Bank and Industrial Bank of Korea also saw increases of more than twofold and fourfold, respectively.

Why Expand Hybrid Branches?

Banks are actively increasing hybrid branches because providing integrated asset management services allows them to manage affiliated company customers at the group level, thereby retaining them. This also strengthens face-to-face channel competitiveness for high-net-worth individuals and enhances efficiency and customer satisfaction. While banks are reducing the number of branches due to the activation of non-face-to-face services, they are aggressively establishing hybrid branches where banking and securities services can be handled simultaneously.

KB Financial Group, which owns a total of 12 affiliates including banking, securities, life insurance, non-life insurance, card, and capital, is aggressively promoting collaboration among affiliates through the expansion of hybrid branches. As of October, KB Financial has a total of 83 hybrid branches, including 74 asset management (WM) hybrid branches and 9 corporate investment banking (CIB) hybrid branches, and plans to add 5 more WM hybrid branches by the end of this year.

A KB Financial Group official explained, "To strengthen the collaboration system within the group, we have reorganized the existing 'Synergy Promotion Department' into the 'One-firm Strategy Department' since last year." He added, "We solicit ideas in various areas such as package products, affiliate-linked processes, and group joint marketing within the group and commercialize them."

Hana Financial Group has also established a strategy to provide financial affiliate services such as banking, securities, and insurance in one place.

The goal is to satisfy customers' financial needs by offering various banking and securities services through collaboration within the group. To this end, they are expanding their collaboration strategy nationwide by regionalizing local hubs centered on major cities and broadening the scope of hybrid branches. This year, the Gwangjang-dong Branch, Nowon Branch, Dogok Branch, Incheon Branch, Family Branch, and Pohang Branch opened as hybrid branches, and as part of regional hub development, the first hybrid branch in a local metropolitan city, the Daejeon Dunsan WM Center, also opened.

Active Collaboration with Real Estate, Tax, and Legal Experts

Competitive Formation of Dedicated Land Compensation Consultation Teams

In addition to expanding hybrid branches, banks are increasingly recruiting real estate, tax, and legal experts to support comprehensive asset management consultations. Especially as the third phase of new town land compensation is set to accelerate in the second half of this year, with expectations that land compensation funds amounting to 50 trillion won will be released by next year, banks have competitively formed dedicated land compensation consultation teams as part of their collaborative work systems.

NH Nonghyup Bank launched a 'Land Compensation Supporters' team last month, consisting of 20 real estate and tax experts, providing ▲ appropriate land value assessment and alternative investment real estate acquisition strategies ▲ capital gains tax-saving strategies and customized gift and inheritance consulting ▲ optimal asset portfolio design and financial planning consultations. Woori Bank has also organized a 'Land Compensation Support Team' within its Private Banking (PB) customer department since last month, while Shinhan Bank is providing tax, legal, and land appraisal consultations through collaboration with real estate and tax experts.

However, there are concerns that competitive collaboration for performance in the banking sector may create loopholes for evading responsibility and incomplete sales of financial products when accidents occur, highlighting the need for countermeasures. There are also calls for the Financial Supervisory Service to intensively monitor and supervise the appropriateness of customer handover processes at hybrid branches, as customers visiting banks are often introduced to high-risk securities financial products.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.