Woori Financial Research Institute Presents UBS's Leading Digital WM Case

Digital Capability Enhancement Needed in Asset Management Sector in Untact Era

[Asia Economy Reporter Kim Hyo-jin] Swiss investment bank UBS is the world's number one in the wealth management (WM) market, managing WM assets worth $2.6 trillion as of June. While competitors struggled with declining profits amid the economic crisis triggered by the COVID-19 pandemic in the first half of this year, UBS reported excellent performance centered on its WM business.

Unlike Morgan Stanley (-30.1%) and Bank of America (-45.2%), whose net profits sharply declined in the first quarter, UBS's net profit surged 40.3% year-on-year to $1.6 billion. This improvement in UBS's performance was due to its dedicated division for ultra-high-net-worth individuals, the GWM (Global Wealth Management) business unit, achieving its highest quarterly revenue since the financial crisis, with operating profit increasing 41.1% year-on-year. UBS classifies WM clients into ultra-high-net-worth individuals with assets over $100 million, high-net-worth individuals with assets over $5 million, and affluent clients with assets over $100,000.

In the second quarter, while Morgan Stanley WM (-8.1%) and Bank of America Global Wealth and Investment Management (GWIM, -42.0%) saw declines in operating profit, UBS GWM maintained positive growth (0.7%). GWM, UBS's core business, accounts for 50% of the group's operating profit. Since the 2008-2009 financial crisis, UBS has reduced its global investment banking (IB) division and focused on its traditionally strong WM business. UBS's GWM leads the world in assets under management, surpassing Morgan Stanley WM ($1.2 trillion) and Bank of America GWIM ($1.2 trillion), ranked second and third respectively.

UBS has also been selected as the world's best bank for five consecutive years in Euromoney's private banking survey, which annually surveys over 2,000 financial professionals worldwide, evaluating services by region and client segment.

The reason UBS could stably expand profits in WM

On the 20th, Senior Researcher Kim Su-jeong of Woori Financial Research Institute cited UBS's expansion of its digital strategy as the reason UBS could stably increase profits in the WM sector despite COVID-19.

Traditionally strong in face-to-face WM services, UBS's increase in digital strategy to maintain its leading market position was effective.

According to Woori Financial Research Institute, UBS has invested about $3.5 billion annually in digitalization since 2017 and plans to continue investing over 10% of its annual revenue until 2022. UBS introduced an agile approach at its Swiss Digital Factory, established in 2017, characterized by smooth collaboration between business units, immediate decision-making, and rapid problem-solving, and plans to expand this globally.

With Ralph Hamers, who led innovative digital transformation at ING, appointed as the next CEO scheduled to take office this November, the industry expects UBS to accelerate its digitalization efforts further.

Researcher Kim viewed UBS's digital strategy as characterized by ▲ aggressive expansion of customer segments centered on digital services ▲ enhancement of face-to-face service quality using digital tools ▲ securing technological capabilities through long-term partnerships with fintech companies.

Domestic financial companies must also hasten WM digital transformation

He explained, "Based on internal analysis, UBS expanded the upper asset limit of affluent clients who will primarily receive platform-based services from $2 million to $5 million starting this year. Compared to Bank of America and JP Morgan, which classify high-net-worth individuals as those with assets over $250,000, UBS aggressively expanded the affluent segment and the scope of digital services."

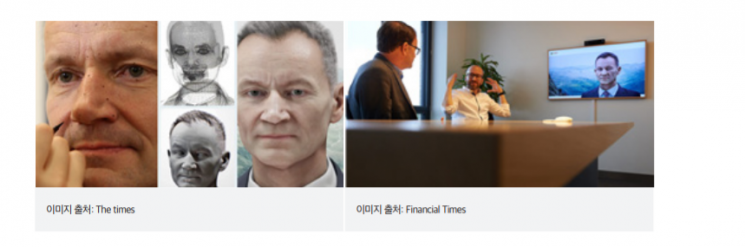

Additionally, UBS made another attempt to integrate digital into face-to-face services by developing the industry's first digital human, which was piloted in WM. In June 2018, UBS launched a digital human modeled after Daniel Kalt, the chief economist at its Swiss headquarters, to provide economic and market analysis to some high-net-worth clients, supporting asset management. The digital human assists personal advisors (PAs) and offers clients an experience similar to receiving asset management services directly from top experts.

Researcher Kim emphasized that domestic financial companies should also accelerate the digital transformation of WM, as demonstrated by UBS's success.

He said, "Amid the growing importance of non-face-to-face WM services due to the COVID-19 impact, it is time to strengthen non-face-to-face sales channels through proactive digital transformation and improve customer convenience. Companies should pursue differentiated digital strategies tailored to clients' asset sizes and service usage characteristics to meet diverse needs by customer segment."

He added that for ultra-high-net-worth individuals, it is necessary to strengthen face-to-face services based on digital solutions for personal advisors, while for affluent clients, who are relatively easier to apply digital services to, platform-centered services should be refined.

Researcher Kim also suggested, "It is worth considering developing digital solutions that actively reflect the company's needs while securing excellent technological capabilities through long-term partnerships with fintech firms."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)