HMR and Ramen Industry Expected to Show Strong Performance

[Asia Economy Reporter Oh Ju-yeon] As the time spent at home has increased due to the novel coronavirus infection (COVID-19), the online food and Home Meal Replacement (HMR) market has grown, drawing attention to the improving performance trend of domestic food and beverage industries.

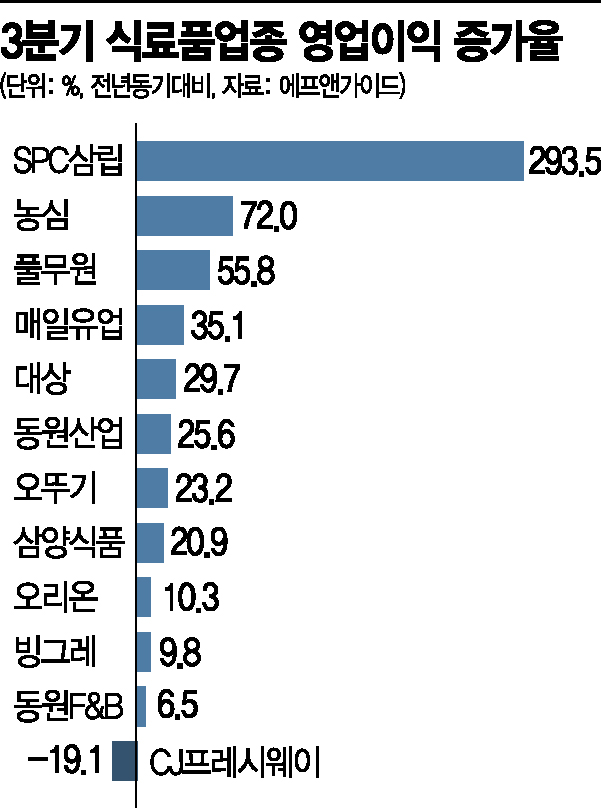

According to financial information firm FnGuide on the 17th, among 12 companies classified under the domestic food industry, 11 companies are estimated to have increased operating profits in the third quarter of this year compared to the same period last year. The operating profits of these companies, estimated by three or more securities firms, totaled 471 billion KRW, a 22.46% increase from 384.6 billion KRW in the third quarter of last year.

Among them, processed food companies are expected to benefit significantly. The demand for convenience foods surged in the first half of the year due to the prolonged COVID-19 pandemic, and this trend is expected to continue structurally. According to Samsung Securities, during the initial five years of the HMR market, the main consumers were single-person households in their 20s and 30s, but since last year, the senior demographic has emerged as the primary customer base. Researcher Cho Sang-hoon stated, "With the escalation of social distancing measures, consumers are reluctant to have contact with outsiders, minimizing dining out, and conversely, demand for convenience foods is expected to increase again." He added, "In the third quarter, gift set demand will create an additional positive factor amid this performance trend."

The company expected to benefit from the increased demand for convenience foods is CJ CheilJedang. Kiwoom Securities forecasts that CJ CheilJedang's consolidated operating profit for the third quarter will increase by 40% year-on-year, while Samsung Securities expects a 49% increase in operating profit excluding CJ Logistics compared to the same period last year.

Kiwoom Securities researcher Park Sang-jun explained, "Although CJ CheilJedang's stock price has recently undergone a correction, raising concerns about third-quarter performance, the improvement seen in the second quarter was mainly due to fundamental improvements, so it is highly likely that the strong performance trend will continue in the second half of the year."

Ottogi is also expected to benefit from the continued increase in demand for convenience foods, with the average operating profit for the third quarter estimated by three or more securities firms at 45.1 billion KRW, a 23.2% increase year-on-year.

SPC Samlip stood out in terms of operating profit growth rate. SPC Samlip's operating profit in the second quarter dropped 44% year-on-year to 9.3 billion KRW due to the direct impact of COVID-19. However, in the third quarter, growth in food, processed meat, and some bakery sectors is expected to increase operating profit by 293.5% compared to the third quarter of last year. Nevertheless, in absolute terms, the third-quarter operating profit forecast is about 9.2 billion KRW, similar to the previous quarter. DB Financial Investment expects that while the fourth quarter, the peak season, will be linked to the operating status of the steamed bun (Hoppang) division, the current operating situation suggests a possibility of improvement compared to the previous year.

Ramen companies are also expected to show strong performance in the third quarter. Nongshim's operating profit for the third quarter is forecasted at 31.9 billion KRW, a 72.0% increase year-on-year, and Samyang Foods is expected to post 25.3 billion KRW, a 20.9% increase compared to the same period last year.

Kim Hye-mi, a researcher at Cape Investment & Securities, said, "Although the performance momentum of the food and beverage industry has weakened compared to before, as we anticipate improvements in COVID-19, attention should also be paid to the 'rise in grain prices.'" She added, "There is a possibility of overall food price increases, and if the price hike trend spreads in the future, it could serve as a basis for a second rally in stock prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.