[Asia Economy Reporter Minyoung Kim] Viva Republica, the operator of the mobile financial service 'Toss,' announced on the 16th that Shinhan Bank has joined Toss's loan comparison service 'Find the Right Loan for Me.' This is the first time Shinhan Bank has joined a fintech company's loan comparison service.

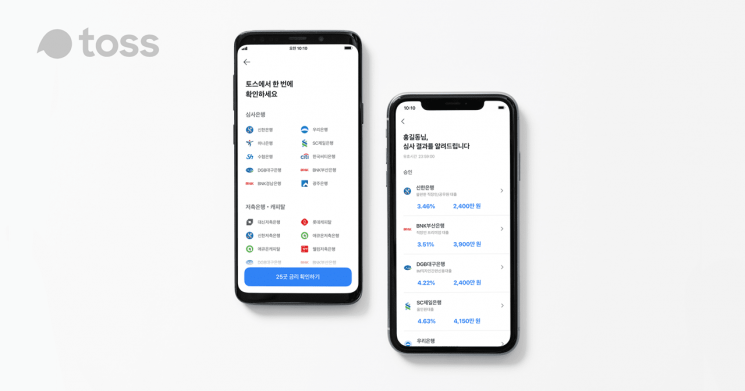

This service allows users aged 23 and older to compare interest rates and limits of unsecured loan products from 25 financial companies, including 10 banks, by simply entering basic information on the Toss application (app). It was selected as an innovative financial service by the Financial Services Commission in May last year and launched in August of the same year.

At the time of launch, users could compare unsecured loan products from four secondary financial institutions, but now 10 primary financial institutions including Hana Bank, Woori Bank, SC First Bank, and Shinhan Bank, as well as 11 secondary financial institutions, have joined. The service handles 31 products including unsecured loans and jeonse deposit loans.

The usage of the service has also increased significantly. In the first month after its launch in August last year, the cumulative number of loan applications was about 170,000, with a cumulative approval amount of 668 billion KRW and a cumulative loan execution amount of 6.5 billion KRW. As of this month, just over a year after launch, more than 23 million loan applications have been made, with cumulative approvals exceeding 193 trillion KRW and cumulative loan amounts reaching 1.2 trillion KRW.

Seunggun Lee, CEO of Toss, said, “In just over a year since its launch, it has grown into a loan comparison service covering the entire primary and secondary financial sectors” and “we plan to expand the categories to include jeonse deposit loans and refinancing loan products, which have high demand among financial consumers.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)