Total Financial Complaints 45,900 Cases... 15% Increase Compared to Same Period Last Year

[Asia Economy Reporter Kim Hyo-jin] Since last year, complaints related to financial investments have significantly increased in the first half of this year due to a series of private equity fund incidents. Complaints related to asset management have surged nearly 12 times.

Complaints regarding bank loans also increased significantly as economic conditions worsened due to the novel coronavirus disease (COVID-19).

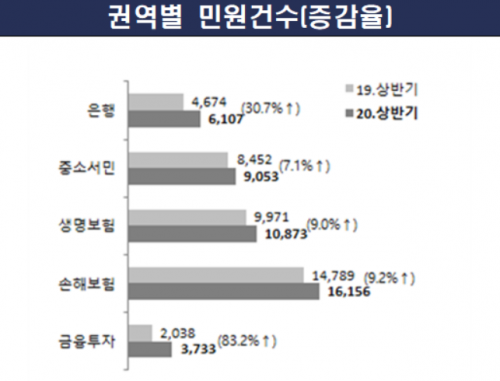

According to the Financial Supervisory Service on the 15th, financial complaints in the first half of this year totaled 45,922 cases, a 15% (5,998 cases) increase compared to 39,924 cases in the first half of last year.

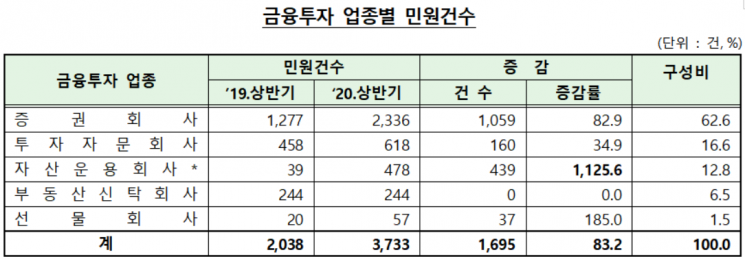

By financial sector, complaints related to financial investments increased the most, rising by 83.2% (1,695 cases) to 3,733 cases compared to 2,038 cases in the first half of last year. Among these, complaints related to asset management companies surged by 1,125.6% (439 cases), from 39 cases in the first half of last year to 478 cases. Complaints about futures companies increased by 185%, and those about securities companies rose by 82%.

The Financial Supervisory Service explained, "Complaints related to private equity funds and the West Texas Intermediate (WTI) crude oil futures exchange-traded notes (ETN) premium rate caused a significant increase in 'fund' and 'derivative' type complaints."

Bank complaints totaled 6,107 cases, increasing by 30.7% (1,433 cases) compared to the same period last year, marking the second-largest increase. Complaints related to loans rose by 55.7%, and bancassurance and fund-related complaints surged by 439%.

There were particularly many complaints related to loan transactions such as loan maturity extensions, repayment deferrals, and requests for interest rate reductions due to economic difficulties, as well as complaints about delays in private equity fund redemptions.

Complaints related to indemnity insurance and automobile insurance also increased significantly, with complaints related to non-life insurance reaching 16,156 cases in the first half, a 9.2% (1,367 cases) increase compared to the same period last year. By type, complaints about insurance claim calculation and payment were the highest at 43.3%, followed by contract establishment and cancellation at 10.2%, insurance solicitation at 7.5%, and exemption and liability determination at 6.7%.

Life insurance complaints totaled 10,873 cases, a 9% (902 cases) increase compared to the same period last year. Complaints of the 'insurance solicitation' type, which claim incomplete sales of whole life insurance, increased by 29.9% (1,315 cases) to 5,717 cases compared to 4,402 cases in the same period last year. By type, insurance solicitation accounted for the largest share at 53.7%, followed by insurance claim calculation and payment at 17.5%, and exemption and liability determination at 11.3%.

Complaints related to small and microfinance increased by 7.1% (601 cases) to 9,053 cases compared to the same period last year. Complaints related to credit card companies, loan businesses, and mutual finance increased, while complaints related to mutual savings banks and installment finance companies slightly decreased.

In the first half, 42,392 complaints were processed, a 9.3% (3,609 cases) increase compared to the same period last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)