Explosive Growth in Bank Loans as Internet Banks Also See Rapid Increase in Personal Loans

KakaoBank Personal Loans Up 17% This Year

K-Bank Loans in August Jump 41% Compared to June

Financial Authorities Monitor Commercial Banks and Keep Close Watch on Internet Banks

[Asia Economy Reporter Kim Hyo-jin] As bank credit loans continue to surge daily, financial authorities have begun to closely monitor loans from internet-only banks. Although their share in the total loan volume remains low, there is a judgment that there are signs of overheating in the overall trend.

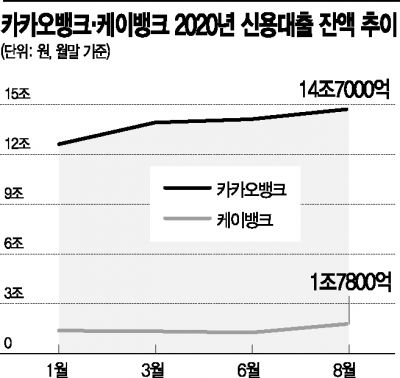

According to the banking sector on the 10th, as of the end of last month, KakaoBank's credit loan balance was about 14.7 trillion won, an increase of 400 billion won (2.79%) compared to the end of the previous month. KakaoBank's credit loan balance at the end of January this year was 12.6 trillion won. It increased by 2.1 trillion won (16.66%) from the beginning of this year to last month. This far exceeds the 13.30% increase rate of credit loans from the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?during the same period.

K Bank is also rapidly increasing its loans. After being in a state of suspended operations due to funding difficulties, it resumed lending in July and recorded a balance of 1.78 trillion won last month, just one month later. This represents a 41.26% increase compared to June, just before the resumption of lending.

The increase in loans from internet-only banks is analyzed to be related to the 'Donghak Ant Movement,' where individuals borrow money to invest in stocks. Supporting this analysis is the fact that KakaoBank's credit loans jumped by 1 trillion won in March, when individual investors began to flood the stock market.

Analysis of Large Influx of Young People Amid Debt Investment and Panic Buying Trends

Despite government regulations, the 'panic buying' by young people anxious about soaring housing prices is also interpreted as having an impact.

A banking sector official explained, "Many people take out mortgage loans from commercial banks and cover the shortfall with credit loans, but it seems that young people in their 30s and 40s particularly use internet-only banks, which allow loans through non-face-to-face mobile transactions."

A financial authority official said, "The increase in loans from internet-only banks is particularly prominent in the overall trend of the banking sector," adding, "We do not take it lightly based solely on the absolute volume of loans." Another official from the authorities stated, "We judge that there are clear signs of overheating," and "We must continuously check compliance with loan regulations related to real estate transactions going forward."

Financial Authorities: "Will Examine Whether Credit Loan Increase Is Due to Banks' Performance Competition"

On the 8th, Son Byung-doo, Vice Chairman of the Financial Services Commission, said at the Financial Risk Response Team meeting, "We will also look into whether the recent increase in credit loans is due to competition among banks for loan performance."

Vice Chairman Son added, "Although it is difficult to accurately identify the purposes of (credit loans), it is estimated that a complex influence of increased demand for living expenses and business funds, inflows of funds into asset markets such as stocks and real estate, and the active business expansion efforts of internet banks has been at play."

On the same day, Eun Sung-soo, Chairman of the Financial Services Commission, also mentioned the recent surge in loans while reflecting on his one-year tenure, stating, "We will promote the inducement of market liquidity into productive sectors and the prevention of side effects caused by all-around asset price increases under a long-term perspective."

Meanwhile, according to the Bank of Korea, as of the end of last month, the outstanding household loans at banks reached 948.2 trillion won, an increase of 11.7 trillion won from the end of the previous month, marking the largest monthly increase ever. Other loans, mostly consisting of credit loans, increased by 5.7 trillion won, also the largest monthly increase since statistics began to be compiled.

Yoon Ok-ja, head of the Market General Team at the Bank of Korea, said regarding the increase in credit loans, "The demand for housing-related funds such as apartment pre-sale deposits and recently increased jeonse (long-term deposit) prices, demand for stock investment funds for public offering subscription deposits and listed stock purchases, and increased living expenses demand as the effect of disaster relief funds disappears are estimated to be factors behind the increase in credit loans."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.