Acquisition of Pledis and Source Music to Expand Lineup

IPO Price Range 105,000~135,000 KRW

PER Equivalent at 70x... Market Reacts with Doubt

[Asia Economy Reporter Jang Hyowon] Global boy group ‘Bangtan Sonyeondan (BTS)’’s agency Big Hit Entertainment is challenging a KOSPI listing. Riding on BTS’s domination of the Billboard charts, Big Hit Entertainment plans to raise about 1 trillion KRW through its public offering. While the market highly values Big Hit Entertainment’s growth potential, there is some skepticism about the somewhat high expected offering price.

◆Maximum Market Cap of 5 Trillion KRW... Surpassing the Combined Total of the Three Major Entertainment Companies

According to the Financial Supervisory Service’s electronic disclosure, Big Hit Entertainment submitted a securities registration statement to the Financial Services Commission on the 2nd for its KOSPI listing. Through this listing, Big Hit Entertainment plans to newly issue 7.13 million shares and raise up to 960 billion KRW. The market capitalization is expected to reach up to about 4.8 trillion KRW.

In this case, it will surpass the combined market capitalization of the three major entertainment agencies. As of the 5th, the total market capitalization of JYP Entertainment (1.4 trillion KRW), YG Entertainment (950 billion KRW), and SM Entertainment (910 billion KRW) was about 3.26 trillion KRW.

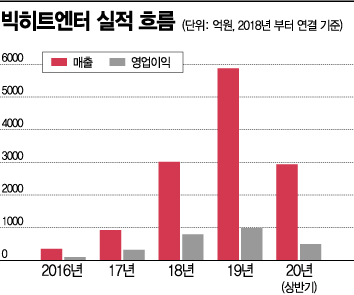

In fact, Big Hit Entertainment’s operating profit is also greater than the combined total of the three major agencies. As of the end of the first half of this year on a consolidated basis, Big Hit Entertainment recorded sales of 293.9 billion KRW and operating profit of 49.7 billion KRW. Despite difficulties such as concert cancellations due to the COVID-19 pandemic, it defended its performance with only about a 4% decrease compared to the same period last year, recording high operating profit. During the same period, the combined operating profit of JYP (22.5 billion KRW), SM Entertainment (14.8 billion KRW), and YG Entertainment (-300 million KRW) was 37 billion KRW.

Big Hit Entertainment is an entertainment content company founded in 2005 by Chairman Bang Si-hyuk and is the agency of BTS, who rose to global stardom by dominating the Billboard charts. BTS ranked 5th in global concert revenue last year, surpassing Bon Jovi, Muse, and Ariana Grande.

As BTS’s popularity grew, Big Hit Entertainment also experienced rapid growth. Big Hit Entertainment’s sales, which were 35.2 billion KRW in 2016, surged to 92.4 billion KRW in 2017, 301.3 billion KRW in 2018, and 587.2 billion KRW last year. Operating profit also increased about tenfold over four years, from 10.3 billion KRW to 98.7 billion KRW.

Thanks to BTS, performance increased significantly, but conversely, dependence on BTS also increased. As of the end of the first half of this year, BTS accounted for 87.7% of Big Hit Entertainment’s sales.

To overcome this sales concentration, Big Hit Entertainment expanded its artist lineup through mergers and acquisitions (M&A) of other agencies. Last year, Big Hit Entertainment acquired Source Music, the agency of the girl group ‘GFriend,’ and this year acquired an 85% stake in Pledis Entertainment, the agency of boy groups Seventeen and NU’EST, for 200 billion KRW.

◆Naver and Kakao as Competitors?... Questions on Offering Price Calculation

However, opinions differ on Big Hit Entertainment’s method of calculating the offering price. Big Hit Entertainment proposed a desired offering price range of 105,000 to 135,000 KRW per share. This was calculated by applying the average EV/EBITDA (Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization) multiples of comparable companies to Big Hit Entertainment’s EBITDA.

The lead underwriters selected five comparable companies: JYP Entertainment, YG Entertainment, YG Plus, Naver, and Kakao. They divided Big Hit Entertainment’s business scope into the entertainment sector, which creates music IP and produces content, and the platform sector such as ‘Weverse,’ selecting three entertainment companies and two platform companies as comparables.

The average EV/EBITDA of these companies is 42.36 times. Applying this to Big Hit Entertainment’s annualized EBITDA results in a per-share value of 160,092 KRW. A discount rate of 15.67% to 34.41% was then applied to calculate the desired offering price. When converted to price-to-earnings ratio (PER), Big Hit Entertainment’s offering price is about 70 times, significantly exceeding the average PER of 30 to 35 times for entertainment companies. Among the three entertainment companies, JYP Entertainment, which generates the highest profit, has a PER of about 38 times.

An official from the financial investment industry said, “The EV/EBITDA method of calculating the offering price is mainly used to evaluate manufacturing companies with large capital expenditures and depreciation, and this is the first time this method has been applied in the entertainment industry,” adding, “It is also hard to readily accept that Naver, with a market cap of 54 trillion KRW, and Kakao, with 35 trillion KRW, were selected as comparable companies because Big Hit Entertainment owns its own platform.”

However, there is also an opinion that this offering price calculation method properly evaluates Big Hit Entertainment’s potential. Lee Kyung-jun, CEO of Innovation Investment Advisory, said, “Big Hit Entertainment is more than a simple entertainment agency; it has a significant portion of IP-related content and infrastructure investments, so it is judged that the EV/EBITDA method was used,” and predicted, “Unless the stock market plunges, the enthusiasm for IPOs that started from SK Biopharm to Kakao Games will extend to Big Hit Entertainment.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)