[Asia Economy Reporter Kim Hyo-jin] The Financial Supervisory Service (FSS) has begun inspecting banks' compliance with housing loan regulations.

According to the financial sector on the 6th, the FSS recently requested written materials from commercial banks and savings banks to verify compliance with mortgage loan regulations.

The FSS plans to focus on whether credit loans were properly reflected when calculating the Debt Service Ratio (DSR). This is related to concerns that the recent surge in credit loans is flowing into the real estate market. The DSR is the ratio of the annual principal and interest repayment amount of all household loans to annual income.

Currently, banks apply a DSR of 40% or less to those attempting to purchase homes priced over 900 million KRW in speculative or overheated speculation zones, and the FSS intends to check whether there have been any violations of this rule.

They will also inspect whether there have been any illicit loans circumventing regulations by using personal business owner or corporate loans.

In response to criticisms that funds borrowed for purposes such as facility capital are being used for real estate investment, the FSS will check whether loan funds were used appropriately according to their intended purposes.

Based on the written materials submitted by banks, the FSS plans to conduct on-site inspections if any regulatory violations or suspicious cases are found.

FSS Governor Yoon Seok-heon pointed out the phenomenon of funds flowing into the real estate market due to low interest rates and a surge in market liquidity at last month's executive meeting, ordering strengthened inspections of financial companies' compliance with loan regulations and strict measures against any violations.

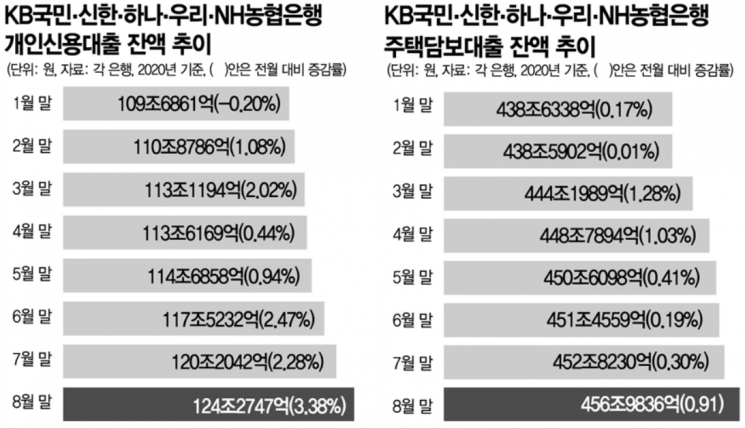

Last month, personal credit loans from the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?increased by a record high of 4.0705 trillion KRW. During the same period, mortgage loans also rose by 4.1606 trillion KRW.

This is interpreted as being influenced by trends such as "debt investment" (bit-tu), where people borrow money to invest in stocks under ultra-low interest rates, and "young-chul," where people in their 30s and 40s gather all available loans and assets to buy a home.

As loans rapidly increase, concerns about potential defaults, especially among younger generations, are also rising.

An analysis by the Nara Salim Research Institute of Korea Credit Bureau (KCB) data as of the end of July showed that both loan amounts and delinquency amounts for the 20s and 30s age groups have significantly increased. The average loan amount per person in their 30s was 37.77 million KRW, up 1.97% from the previous month, and the average delinquency amount per person was 562,000 KRW, up 3.92% from the previous month.

For those in their 20s, the average loan amount per person was 6.98 million KRW, up 4.08% from the previous month, and the delinquency amount was 108,000 KRW, up 3.5% from the previous month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.