If Biden Wins... US and EU to Jointly Pressure China on Environmental Issues

Biden's 'Eco-Friendly Policy' Commitment Expands Beyond Environment to International Affairs

Pressure Card on China, the Largest Carbon Emitter... New Trend in US-China Conflict

China Reacts: "Targeting Emerging Countries, Trade Barrier Disguised as Environmental Protection"

[Asia Economy Reporter Kwon Jaehee] The 'carbon border taxes' imposed on goods imported from countries with high carbon emissions are showing signs of expanding from an environmental issue to an international political issue. The carbon border tax, first brought up by the European Union (EU), recently became a card to pressure China, the largest carbon emitter, after Joe Biden, the US Democratic presidential candidate, announced it as part of his campaign promises. As this new 'spark' in US-China tensions increasingly entangles Europe, warnings are emerging that it could become another flashpoint in the global trade war.

Initially, the carbon border tax was merely an environmental issue at the EU level. Ursula von der Leyen, President of the European Commission, announced shortly after taking office in December last year that the Green New Deal would be promoted as a growth strategy to achieve carbon neutrality in Europe by 2050, introducing decarbonization across the economy and implementing carbon border taxes. The carbon border tax is levied on goods produced in countries with weak greenhouse gas emission regulations, serving as a measure to protect domestic companies that are relatively disadvantaged in price competitiveness. However, opposition from the world's first and second largest economies, the US and China, kept the carbon border tax confined to a European issue. The US, after the Trump administration, withdrew from the Paris Climate Agreement and pursued policies far from eco-friendly, while China also opposed it. Wilbur Ross, then US Secretary of Commerce, stated, "This is a new trade barrier," and warned, "If implemented, retaliatory measures will be taken." China also protested, saying, "This is a measure against free trade," and "The carbon tax is a new trade weapon under the guise of environmental protection and violates the fundamental principles of the World Trade Organization (WTO)."

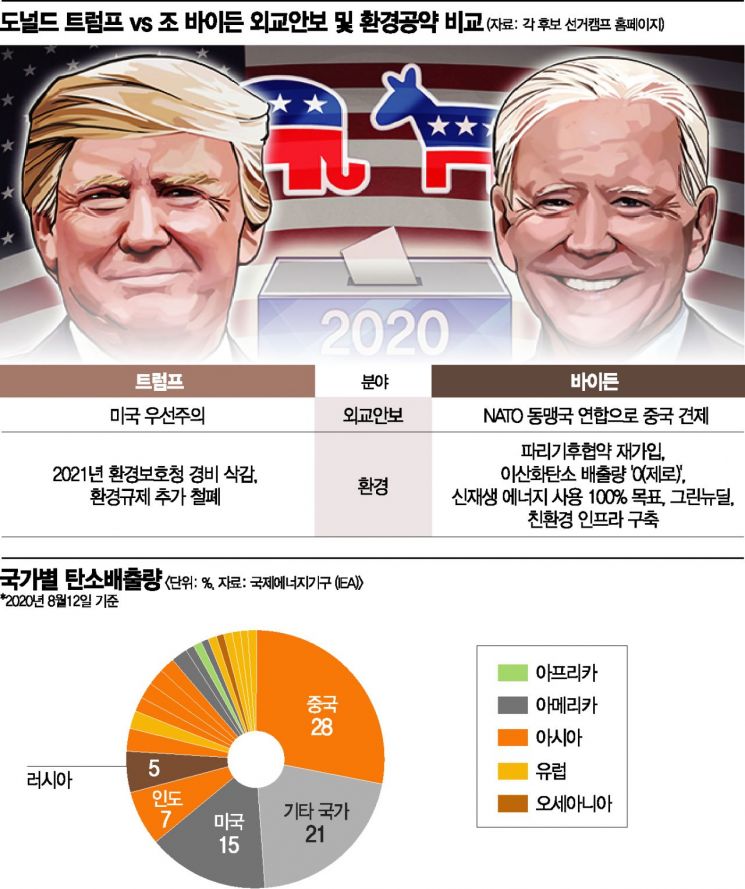

The issue became global when Biden strongly emphasized eco-friendly policies ahead of the presidential election. The Biden campaign highlighted environmental friendliness to differentiate from President Trump. Through promises represented by the '240 trillion won Green New Deal,' they began targeting voters. With goals such as creating over one million jobs through clean energy infrastructure investment, they outlined detailed plans including ▲ building a 100% clean energy economy by 2050 (achieving net zero carbon emissions) ▲ investing $2 trillion by 2035 to build a low-carbon, eco-friendly society ▲ rejoining the Paris Climate Agreement, and included a plan to introduce a carbon tax bill by 2025.

China, in particular, fell directly under the influence of the carbon border tax. If Biden implements the carbon border tax after taking office, China, the world's largest carbon emitter, will inevitably face a direct blow to its exports to the US. The carbon border tax also signifies restoring alliances with Europe, making a joint US-EU effort targeting China possible. Strengthening alliances is also Biden's diplomatic strategy to curb China's threatening technological rise. When Biden announced his pledge to introduce a carbon tax by 2025, the EU expressed its welcome. A major foreign media outlet evaluated, "Europe, which is pushing for the carbon tax, will make peace, but the risk of confrontation with China will increase."

Some criticize the carbon border tax as a new trade barrier, but others argue it will ultimately deepen globalization. It is claimed that cross-border logistics could create a new trend mediated by eco-friendliness. Ultimately, if countries do not make eco-friendly efforts, they may be excluded from this new trend, meaning the carbon border tax could contribute to global participation in environmental protection.

However, as the carbon border tax appears to target China, concerns are rising that it could become a new spark threatening the global economy, following the 'Huawei exclusion.' If Biden is elected, the US and EU are likely to form a so-called 'carbon club' to counter China.

As expected, China has reacted strongly. Following the EU, the US is also taking a stance of imposing new regulations using environmental issues as a weapon, prompting China to openly express discomfort, saying, "The carbon tax will harm the international community's efforts to take joint action on climate change." The Chinese government expressed concerns that the carbon border tax would pose significant obstacles to international trade, including complicated customs clearance, investment contraction, and disadvantages from tariff adjustments affecting trade profits. Furthermore, China sharply criticized, saying, "The US and EU rank first and second in cumulative carbon emissions," and "The carbon tax targeting emerging countries, whose manufacturing competitiveness is just beginning to rise, is a trade barrier disguised as environmental protection."

☞ Carbon Border Taxes

Taxes imposed on goods imported from countries with weak greenhouse gas emission regulations. Companies in countries with strong greenhouse gas regulations install various eco-friendly facilities to meet high environmental standards, which raises product prices, making them relatively less competitive compared to products made in countries with weaker regulations. Carbon border taxes are considered a measure to protect domestic companies within the region.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.