P2P Financial Act to Take Effect on the 27th

Reorganizing Due to Consecutive Accidents

Revamping Atmosphere with Organizational Restructuring

Appointing Compliance Officers

Strengthening Consumer Protection Efforts

[Asia Economy Reporter Kim Min-young] The Online Investment-Linked Finance Act (P2P Finance Act) will take effect on the 27th, but the peer-to-peer (P2P) industry is experiencing quiet days. Despite the recent series of financial accidents and the long-awaited possibility of entering the regulatory framework over the past four years, rather than celebrating, companies are reorganizing or appointing compliance officers to restructure. It is expected that a sorting process will soon take place within the P2P industry.

According to the industry on the 5th, leading P2P companies are actively reorganizing, viewing the law’s enforcement as an opportunity. Having grown from startups to financial companies with 40 to over 100 employees, they are determined to properly engage in ‘financial business.’ One of the top companies, Company A, has initiated organizational restructuring to refresh its atmosphere. A representative from Company A said, “Rather than promoting the company externally, we are internally reorganizing and preparing for the law’s enforcement.”

Other companies are also turning this period into a turning point. They are strengthening consumer protection by appointing compliance officers and improving disclosure systems to allow investors to easily view investment and loan statuses. They are also working hard to reduce delinquency rates, which investors are sensitive to.

Another company representative stated, “Although sensitive incidents continue to occur, we expect that those who survive will be recognized in the market,” adding, “Since registration with the Financial Services Commission must be completed within a year, we are busily preparing capital, personnel, and systems.”

Although the P2P Finance Act takes effect on the 27th, P2P companies have been given about a one-year grace period to expand their workforce and become accustomed to the system. During this period, a sorting process is expected, leaving only a few top companies while the rest disappear, according to industry insiders.

Previously, the P2P industry suffered from fraud and Ponzi schemes. ‘Nexfun,’ which attracted investors using used cars as collateral, saw its CEO Lee detained for fraud and unauthorized fundraising activities. The company caused controversy by declaring bankruptcy without returning 25 billion won in investments. ‘Popfunding,’ which mainly provided movable asset-backed loans, also saw its CEO Shin involved in a fraud case and recently sent to trial while in custody. Popfunding had been praised by Financial Services Commission Chairman Eun Sung-soo in November last year as an ‘innovative case in movable asset finance,’ making the incident even more shocking.

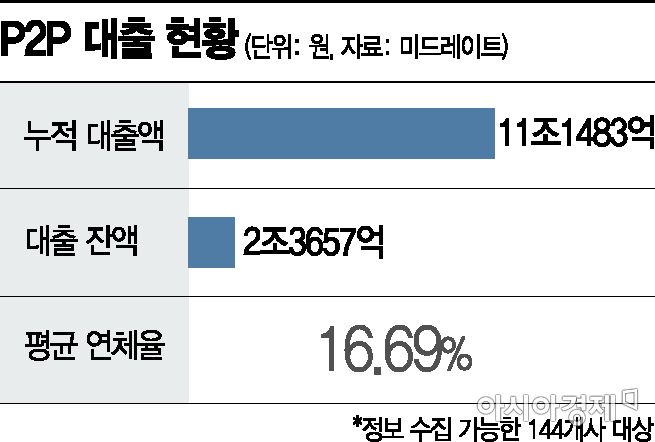

As P2P companies have been operating in Korea for nearly five years, delinquency management has become critical. According to P2P statistics firm Midrate, as of the previous day, the cumulative loan amount of 144 companies reached 11.1483 trillion won, with an average delinquency rate of 16.69%.

For this reason, financial authorities are on high alert. The Financial Services Commission has demanded that all P2P companies submit audit reports by the 26th of this month. The authorities plan to conduct registration reviews only for qualified companies, while unqualified or non-compliant companies will be subject to on-site inspections and encouraged to convert to loan businesses or close down. The industry and financial authorities estimate that about 240 companies are currently flooding the market.

A financial sector official pointed out, “While the delinquency issue can be excused by saying that companies have been diligently collecting debts themselves, fraud and Ponzi schemes are crimes, and as companies once considered trustworthy have become involved in incidents, now they have reached a point where they distrust each other.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)