High Dividend Yield Yet Attractive Undervaluation 'Bursting'

Continuously Acquiring Shares of BNK, DGB, JB Financial Group

Betting on 'Lotte Tour Development' Benefiting from Foreign Tourist Return

Significantly Reducing Stake in NH Investment & Securities Amid Private Equity Redemption Issues

[Asia Economy Reporter Park Jihwan] It has been revealed that the National Pension Service (NPS) has recently acquired a large number of regional financial stocks, which are gaining attention for their undervalued stock prices. The NPS also focused its bets on stocks expected to benefit from the return of foreign tourists in the future. On the other hand, the shareholding ratios of some companies involved in the private equity fund redemption issue worth over 5 trillion won have significantly decreased.

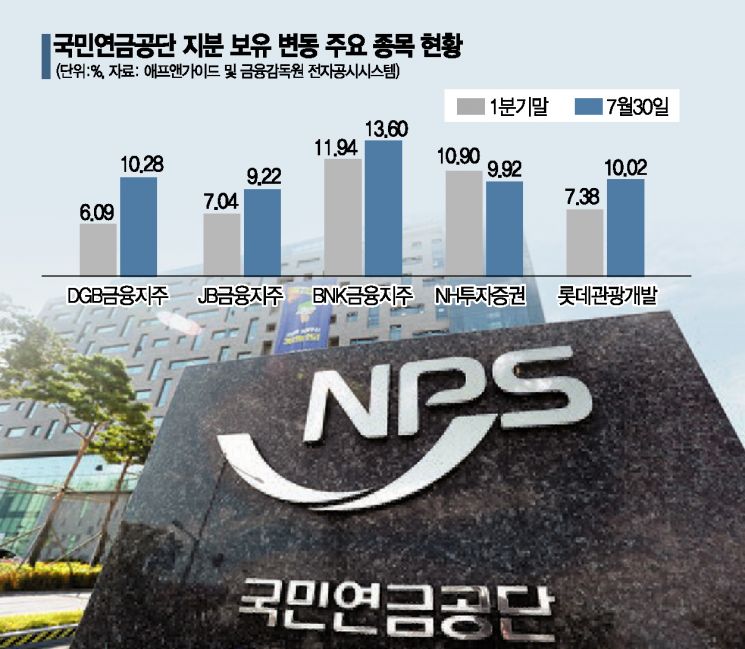

According to FnGuide and the Financial Supervisory Service's electronic disclosure system on the 30th, the NPS has recently been significantly increasing its shareholding ratios in regional financial holding companies. Through three disclosures on the 3rd, 7th, and 16th of this month, the NPS announced that it purchased a total of 12,051,198 shares of BNK Financial Group. The NPS's stake in BNK Financial increased by 1.66 percentage points from 11.94% at the end of Q1 this year to 13.60%. The NPS has been continuously acquiring shares not only in BNK Financial but also in DGB Financial Group and JB Financial Group. The shareholding ratio of DGB Financial Group, which was 6.09% at the end of Q1, recently rose by 4.19 percentage points to 10.28%. JB Financial Group also saw an increase of 2.18 percentage points during the same period.

The reason the NPS is particularly focusing on regional financial stocks among financial stocks is interpreted as the attractive undervalued buying opportunity despite their high dividend yields.

Seo Youngsoo, a researcher at Kiwoom Securities, said, "Regional financial stocks, which provide many loans to the manufacturing industry, are expected to benefit from government policy support for these industries," adding, "In particular, with dividend yields around 6% and a price-to-book ratio (PBR) of 0.20, their undervaluation appeal is significantly highlighted."

Additionally, the NPS recently increased its stake in Lotte Tour Development to over 10%. The NPS became the second-largest shareholder following Chairman Kim Kibyeong and related parties, who hold 54.3% of the shares. Lotte Tour Development's stock price has risen 26% this month amid growing expectations for the development of the Jeju Dream Tower complex resort. The Jeju Dream Tower is located 3 km from Jeju International Airport and 7 km from Jeju International Passenger Terminal. Within a 600-meter radius, there are Shilla Duty Free and Lotte Duty Free stores, which are considered advantageous for attracting foreign tourists.

Lotte Tour Development is also attracting significant interest from institutional investors other than the National Pension Service. Last month, institutional investors only net-sold Lotte Tour Development shares on four trading days. This month, except for the 28th, they have net-bought a total of 9.637 billion won worth of shares up to the previous day. This is interpreted as due to expectations that, since the Jeju Dream Tower has not yet started operations, it has not been affected by the COVID-19 pandemic and will benefit from the return of foreign tourists in the future.

The NPS has recently reduced its holdings in companies where major issues have arisen. The NPS significantly lowered its stake in NH Investment & Securities, which is at the center of the redemption suspension crisis involving Optimus Asset Management, where redemptions exceeding 5 trillion won are feared to be halted. The NPS reduced its stake in NH Investment & Securities from 10.40% at the end of last month to 9.92%, selling off 1,344,915 shares within a month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)