Conflict Over Deposit Increase Before Enforcement

Landlords and Tenants Both Anxious

Concerns About Fairness Depending on Contract Timing Even in Same Complex and Area

Supply Expected to Plummet Due to 'Residence Obligation'

"Regulatory Easing for Redevelopment Projects Must Accompany"

[Asia Economy Reporters Yuri Kim and Mune Won] The government's and ruling party's 'Three Lease Laws' are causing widespread turmoil in the rental market. With legislative efforts underway to significantly strengthen tenants' rights?including the mandatory lease reporting system, the right to request contract renewal, and the rent ceiling system?conflicts between landlords and tenants over deposit adjustments are intensifying, along with issues such as dual pricing and worsening shortages of available properties. In particular, the sharp rise in jeonse (long-term lease) prices is exacerbating housing insecurity among tenants.

◆ "Let's raise it in advance"... Growing conflicts over deposit resets = Mr. A, who owns a newly built apartment in the Gangnam area of Seoul, is considering a 'deposit reset' about two months before his tenant's lease contract expires. The current market price is around 900 million to 1 billion KRW, nearly double what it was two years ago. However, with the rent ceiling system limiting rent increases to 5%, there is concern that he may not be able to raise the deposit to match market prices. Mr. A is reviewing options to gather as much capital as possible, evict the tenant, and then 'reset' the deposit.

Landlords are seeking ways to raise rents or evict existing tenants before the law is amended. Such movements are already being detected in newly built apartment complexes in the metropolitan area. For example, in Helio City, Garak-dong, Songpa-gu, Seoul, the jeonse price for an 84㎡ (exclusive area) apartment was only 600 to 700 million KRW when residents first moved in in 2018, but it has now jumped to 900 million to 1 billion KRW. Landlords who initially offered low deposits at move-in but intended to raise deposits upon renewal are now anxious.

◆ Concerns over wildly varying jeonse prices for the same unit = There are also concerns that jeonse deposits for the same unit size within a complex could vary drastically depending on the timing of the lease contract. In newly built complexes where prices were initially low at move-in but have sharply increased after two years, price differences could reach hundreds of millions of KRW. On landlord online communities, complaints arise such as, "Many landlords say that deposits reset when tenants move out, allowing them to raise prices freely for new contracts, but many people cannot move in due to financial, job, or education reasons." Especially for those who are not wealthy, it is difficult to return tens or hundreds of millions of KRW in deposits and vacate the apartment just to raise the deposit.

◆ Tenants pushed into a corner... Dilemma amid shortage of listings = Tenants are also suffering due to landlords' aggressive attempts to raise deposits ahead of the 'Three Lease Laws.' Mr. B, who lives in Gangbuk-gu, Seoul, has agreed with his landlord to raise the deposit by 30 million KRW after renewing his lease in November, but recently received a request from the landlord to increase the deposit immediately next month. He said, "I think this is an unreasonable demand because of the Three Lease Laws. Since the contract is not yet expired, I am not obligated to accept it, but it is a difficult situation."

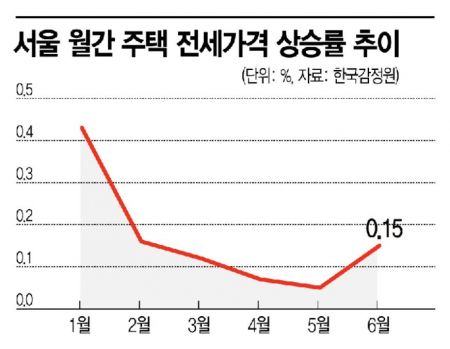

Looking for a new jeonse home is not easy either. Jeonse prices in Seoul have been rising sharply recently, and available listings are rapidly decreasing. Moreover, due to constraints such as education and commuting, tenants have limited options. According to KB Real Estate Live On, as of June, Seoul's jeonse supply-demand index was 173.5, continuing an upward trend since surpassing 150 in November last year. A value above the baseline of 100 indicates a severe supply shortage.

◆ Seoul's housing supply to be halved next year = Supply conditions are also unfavorable. The number of new housing units in Seoul is expected to be halved next year, and as more landlords seek to fulfill residency requirements to avoid various tax regulations, the jeonse supply is expected to fall short of expectations. According to Real Estate 114, the number of scheduled new housing units in Seoul next year is 21,739, about half of this year's planned 42,012 units.

Government measures such as the June 17th policy impose a six-month residency requirement for mortgage loans in regulated areas (one-home owners must dispose of existing homes within six months) and allow reconstruction project sales only to those who have lived in the area for over two years in the Seoul metropolitan speculative overheating zones, further destabilizing the rental market. Mr. A, a real estate agent near Eunma Apartment in Daechi-dong, Seoul, said, "Many landlords are evicting tenants due to reconstruction rights issues and moving back in. Demand for jeonse remains steady, but there are no listings."

Professor Kwon Dae-jung of Myongji University Graduate School of Real Estate said, "Jeonse prices will continue to surge ahead of the autumn moving season. Effective supply measures, including easing reconstruction and redevelopment regulations, must accompany these changes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.