US Resumes Rare Earth Refining Subsidies Previously Banned for Environmental Damage

China Controls 52% of Congo Cobalt Mines, Competes for Lithium in South America

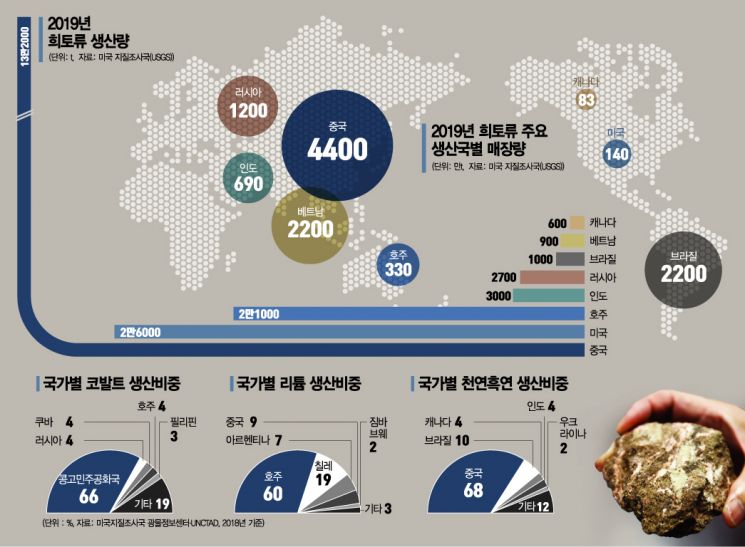

[Asia Economy Reporter Hyunwoo Lee] The recent global expansion of the rare earths war is distinct from past conflicts in that it clearly defines rare earths as strategic weapons. The Voice of America (VOA) recently cited a report from a U.S. private consulting firm stating that "China is encouraging the rare earths industry for geopolitical influence," adding that "China uses rare earths as a strategic weapon against Western countries" and "is also injecting national-level subsidies."

Horizon Advisory, a U.S. consulting firm, included more specific details in a recent report regarding this issue. It stated that China has little interest in the commercial value of rare earths. VOA reported that Nathan Picarsic, founder of Horizon, said in an interview with The Wall Street Journal (WSJ), "The Chinese government is not interested in economic profits" and "controls the rare earths industry in a way that wins without fighting." He added, "From 2015 to 2018, the Chinese government provided an average annual subsidy of $175 million (approximately 209.3 billion KRW) to rare earth-related companies, but the actual business profits averaged only about $117 million per year." Horizon pointed out that this differs from China's previous approach of presenting itself as a reliable commercial partner in the global supply chain while maintaining dominance in the rare earth mining industry as a resource-rich country.

As rare earths become increasingly weaponized, the U.S., which relies heavily on China, is also changing its securing strategy. The U.S. government has restarted domestic rare earth refining operations, which had been banned due to severe environmental destruction, even providing subsidies. In the 1990s, rare earth production and refining processes released massive amounts of radioactive materials, causing serious health hazards, leading to the disappearance of related mines and refining plants in the U.S.

According to The Diplomat and other U.S. foreign policy and security outlets on the 7th (local time), USA Rare Earth, which is jointly promoting rare earth mining projects with the Texas Mineral Resources Corporation, announced plans to build a rare earth refining plant near El Paso, Texas, by next year. The company began trial operations of a rare earth refining plant in Colorado earlier this month. The reopening of a rare earth refining plant in the U.S. is the first in over 20 years since all rare earth processing plants were shut down in 1999 due to environmental regulations. Additionally, the Mountain Pass mine in California, once the world's second-largest producer, was closed in 2002 but resumed production in 2018.

The U.S. Department of Defense is actively securing overseas rare earths. According to The New York Times (NYT), last month the U.S. government discussed rare earth supply plans with African countries such as Malawi and Burundi. In May, it submitted a proposal to Congress to remove the spending cap on rare earth resources needed for missile, precision electronic device, and hypersonic missile development. It also announced subsidies for rare earth production to Lynas Corporation in Australia and its U.S. partner, Blue Line Corporation.

Unlike in the past, the U.S. is also actively blocking Chinese overseas corporate acquisitions. To secure rare earths, the U.S. suddenly expressed interest in purchasing Greenland, a Danish territory, in September last year. According to Foreign Policy, Greenland Minerals, a rare earth mining company, reported that 10 million tons of rare earths are deposited throughout Greenland and that since 2016, it has been conducting exploration surveys of commercially viable mines together with Chinese companies. When China attempted to establish exploration bases along Greenland’s coast, U.S. opposition began. The U.S. State Department raised security concerns with the Danish government regarding China's contacts.

China had previously pursued a strategy of eliminating competitors by securing overseas mines, but after a series of recent failures in mine acquisitions, it appears to be changing its strategy. China is focusing on securing lithium and cobalt, rare earth resources that are scarce domestically, by acquiring mines in Africa and South America. According to Foreign Policy, since 2017, China has controlled 52% of cobalt mine production in the Democratic Republic of Congo, and secured 41% and 67% of lithium production in Chile and Argentina, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.