The domestic tourism industry, which had been contracted due to the spread of the novel coronavirus infection (COVID-19), is recently showing signs of recovery. With restrictions on international travel, people who cannot travel abroad are visiting domestic tourist destinations. Although it has not yet recovered to pre-COVID-19 levels, this is being seen as a signal that the worst period has passed. As the number of newlyweds going on honeymoons to Jeju Island and Namhae increases, some resorts and hotels have become so fully booked that it is difficult to make reservations even on weekdays. Expectations for improved performance of listed companies related to resorts, which had poor results in the first quarter, are also growing. Asia Economy examines the potential for performance improvement and financial status of Ananti, Yongpyong Resort, and Lotte Tour Development, which is preparing to open a complex resort in Jeju Island.

[Asia Economy Reporter Jang Hyowon] Although the number of domestic resort users has increased due to COVID-19, Ananti is not entirely smiling. This is because selling memberships is more beneficial for profits than resort operations. Going forward, the key for Ananti is the success of membership sales for its new facility, 'Village de Ananti.'

◆ Increased Room Occupancy Due to Early Heat

Ananti is a comprehensive leisure company capable of directly performing all sectors including leisure facility development, construction, operation, and sales. Currently, it operates Ananti Namhae, Ananti Penthouse Seoul, Ananti Club Cheongdam, and Ananti Cove (including Hilton Busan).

In the market, Ananti is known as a North-South cooperation stock due to its ownership of Geumgangsan Ananti. In particular, the global investor Jim Rogers was appointed as an outside director of Ananti in 2018, which influenced its stock price. However, since Geumgangsan tourism has not yet resumed, the outlook for related businesses remains uncertain.

Ananti completed Geumgangsan Ananti in May 2008, but Geumgangsan tourism was suspended in July of the same year. In 2010, North Korea froze the assets of Geumgangsan Ananti. Accordingly, Ananti reflects an annual idle depreciation expense of about 1.2 billion KRW for Geumgangsan Ananti. As of the end of the first quarter this year, the book value of Geumgangsan Ananti stands at 53.8 billion KRW.

Ananti's business segments are divided into resort operations, sales, and others. As of the end of the first quarter this year, the sales composition ratio was 87.7% for resort operations, 8.9% for sales, and 3.4% for others. Resort operation sales include fees for rooms, ancillary facilities, and golf courses. The sales segment refers to membership sales revenue. In Ananti's case, membership sales are recognized as sales revenue rather than long-term deposits because the transfer of assets to consumers is done through a registration system.

Ananti recorded consolidated sales of 20.5 billion KRW in the first quarter, down 44.1% from 36.7 billion KRW in the same period last year. Operating loss also turned to 21.5 billion KRW. The biggest cause of the large deficit was the 14.7 billion KRW in commission fees related to the 'Village de Ananti' project, which began construction last year.

Sales in the sales segment also plummeted by 87% to 1.8 billion KRW from 13.8 billion KRW in the same period last year. Ananti officials explained, "Although there are some sales volumes, we did not conduct sales in the first quarter to focus on membership sales for Village de Ananti, which will start in July."

Sales in the resort operation segment, which was hit by COVID-19, decreased by 18.9% to 18 billion KRW from 22.2 billion KRW in the same period last year. Operating loss in the resort operation segment alone was 8 billion KRW, with a loss rate of 44.4%. Due to the nature of the resort industry, depreciation expenses are large, so even excluding these, the EBITDA showed a loss of 3.3 billion KRW. EBITDA in the first quarter of last year was 680 million KRW.

Ananti officials said, "Although resort operations slightly decreased in the first quarter, sales have recovered to last year's level since June due to earlier-than-usual heat. For the second quarter, since there are no large one-time expenses like in the first quarter and occupancy rates are increasing, better results than the first quarter are expected."

◆ Continuous Decline in Profits... When Will Sales Resume?

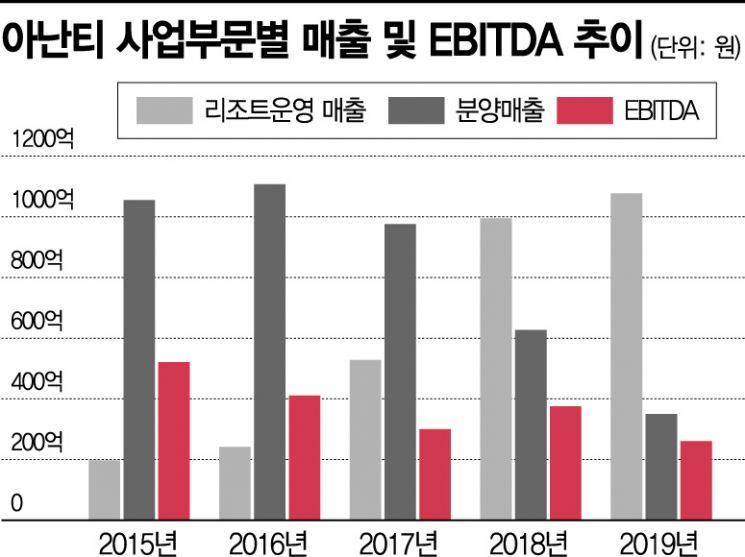

Ananti's EBITDA has been declining every year. EBITDA, which was 52.1 billion KRW in 2015, halved to 26.1 billion KRW last year. This is analyzed to be due to the gradual decrease in sales revenue, which incurs almost no costs. Sales revenue can only be generated if all memberships of existing facilities are sold and there are no new facilities.

Ananti's sales revenue decreased from 105.5 billion KRW in 2015 to 35 billion KRW last year. The reason sales revenue briefly recorded around 100 billion KRW from 2015 to 2017 is interpreted as the opening of Ananti Penthouse Seoul in 2016 and Ananti Cove in 2017.

On the other hand, resort operation sales surged from 19.7 billion KRW to 107.7 billion KRW during the same period. Since resort operations increase selling and administrative expenses such as labor costs, management fees, and commission fees as the scale grows, profitability is lower compared to sales revenue. This explains the continuous decline in EBITDA.

Ananti plans to start sales of Village de Ananti from July. Village de Ananti, which broke ground last year in Gijang, Busan, is scheduled to be completed in 2023. Village de Ananti is expected to be more than twice the size of Ananti Cove, Ananti's largest existing business site in Busan.

Ananti officials said, "We plan to sell memberships worth 800 billion KRW over three years until Village de Ananti is completed, and the timing when sales revenue is reflected in the financial statements will be after completion in 2023 according to accounting standards."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)