KB Kookmin Surpasses Samsung for the First Time in 9 Years Since Spinoff

Samsung Maintains 2nd Place in Personal Credit Sales

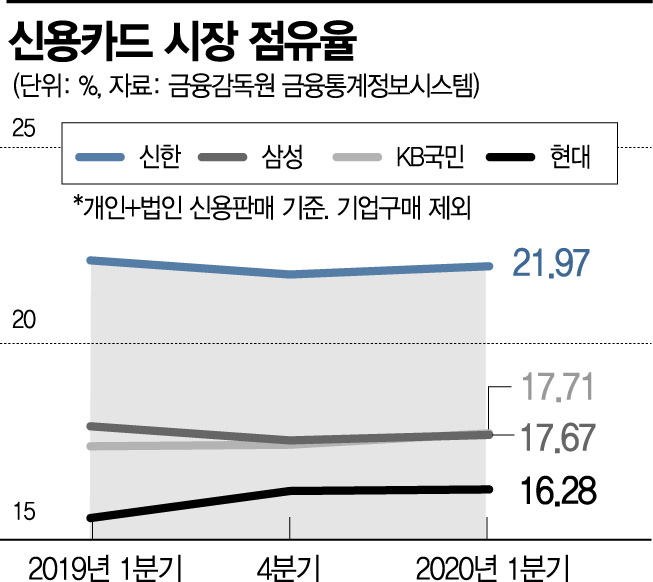

[Asia Economy Reporter Ki Ha-young] KB Kookmin Card has risen to the second place in credit card market share for the first time in nine years since its spin-off in 2011. The fierce ranking battle among Samsung, KB Kookmin, and Hyundai Card for the second place, which has continued for several years, appears to be reaching a turning point.

According to the Financial Supervisory Service's Financial Statistics Information System on the 29th, KB Kookmin Card ranked second with a market share of 17.71% in personal and corporate credit sales (excluding corporate purchases) in the first quarter of this year among the seven specialized card companies (Shinhan, Samsung, KB Kookmin, Hyundai, Lotte, Woori, and Hana Card). This is the first time in nine years since its spin-off in 2011. The difference with Samsung Card, which ranked third with 17.67%, is 0.04 percentage points. KB Kookmin Card has been narrowing the gap with Samsung Card by showing an upward trend every quarter until recently. In the fourth quarter of last year, the gap narrowed to 0.11 percentage points, closely chasing Samsung Card.

The advancement of KB Kookmin Card is attributed to efforts to expand its membership base and diversify its business. In particular, the increase in corporate customers such as companies and local governments was effective. The amount of credit sales handled for corporate clients by KB Kookmin Card increased from 11.7 trillion won in 2017 to 12.4 trillion won in 2018. Last year, it surged to 14.2 trillion won. In the first quarter of this year, it is holding steady at 3.4 trillion won despite the impact of COVID-19. A KB Kookmin Card official explained, "The market share has increased due to continuous expansion of the customer base and business diversification such as automobile installment financing." In fact, automobile installment financing assets have increased by about 1 trillion won annually, from 1 trillion won in 2017 to 1.8 trillion won in 2018, and 2.8 trillion won last year.

Samsung Card, which had held the second place, slipped to third. Its market share in the first quarter was 17.67%. However, excluding corporate card performance, its personal credit sales market share remains second at 18.24%. The third place in this market is KB Kookmin Card with a market share of 17.42%. This is interpreted as a result of differences in management strategies between Samsung Card and KB Kookmin Card. A Samsung Card official said, "Following a management policy focused on soundness and efficiency, we are promoting improvements in the profit structure by refraining from excessive marketing competition," adding, "We are reducing cashback in the automobile finance market, which is a representative bleeding competition market, and also scaling down sales in the less profitable corporate tax market."

Hyundai Card's upward trend is also noteworthy. Hyundai Card recorded a market share of 16.28% in the first quarter, ranking fourth. It has steadily increased its market share from 15.55% in the same period last year. It is analyzed that the expansion of the membership base was effective through the exclusive new partnership with the membership-based large discount store 'Costco' in May last year and strengthening of private label credit cards (PLCC).

Meanwhile, Shinhan Card maintained an overwhelming first place with a market share of 21.97%, creating a gap from the second tier. The gap in market share between small and medium-sized card companies such as Lotte, Woori, and Hana Card and large card companies is widening. Lotte Card's market share slightly increased to 9.61% in the first quarter compared to the previous year, but Woori Card and Hana Card decreased to 8.68% and 8.08%, respectively.

The battle for the second place in credit card market share is expected to continue in the second quarter as well. An industry insider said, "There are various variables such as disaster relief fund payments in the second quarter," adding, "We need to watch whether KB Kookmin Card will defend its second place or Samsung Card will reclaim the second place it lost."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)