[Asia Economy Reporter Lee Chun-hee] In order to secure the objectivity and reliability of publicly announced real estate prices, there was a call in the National Assembly to base them on market prices and separate them from tax policies.

On the 17th, the National Assembly Legislative Research Office published an 'Issue and Discussion' report on 'Policy Tasks Related to the Criteria for Calculating Publicly Announced Real Estate Prices' containing such content.

The report pointed out that the currently calculated appropriate prices for public announcement are detached from market prices. Since the appropriate price is defined under the current 'Act on Public Announcement of Real Estate Prices' as 'the price most likely to be established when normal transactions occur in an ordinary market,' it is generally understood as the 'normal market price,' but in reality, there is a significant difference from market prices.

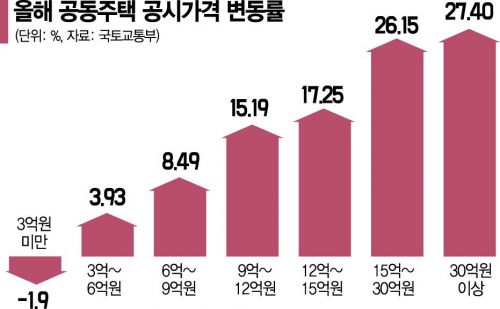

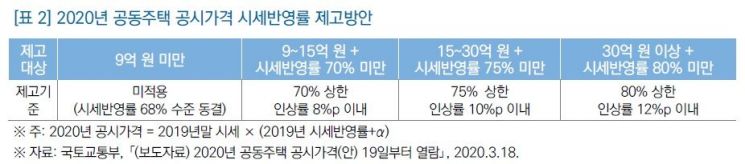

In fact, the Ministry of Land, Infrastructure and Transport also revealed in 2020 that the rate of reflecting market prices in publicly announced prices for apartment complexes was only about 68-80% depending on the price range, effectively acknowledging that the current 'appropriate price' is lower than the market price, the report pointed out.

The report also criticized that although the government announced various measures to improve problems related to publicly announced prices, the focus was only on increasing the rate of reflecting market prices rather than objectively calculating the appropriate real estate prices. In December last year, the Ministry of Land, Infrastructure and Transport announced through the '2020 Real Estate Price Public Announcement and Public Price Reliability Enhancement Plan' that it would reform the public price system to increase the rate of reflecting market prices for high-priced real estate. The report noted that such improvement plans might rather deepen the gap in the rate of reflecting market prices by price range.

In fact, major countries such as the United States, the Netherlands, and Japan, investigated through the report, mostly use market prices as the criteria for calculating publicly announced prices. New York State in the U.S. uses the 'market value,' which is the usual transaction price, while the Netherlands uses 'Marktwaarde,' meaning the transaction price under free and careful judgment. The report also mentioned that Japan calculates publicly announced prices based on 'normal price,' which means market price. The report added that these countries do not set separate rates of reflecting market prices since market price is the standard.

To solve these problems, the report suggested that efforts should be made to calculate appropriate publicly announced prices that reflect actual market prices regardless of the type and price range of real estate. It further pointed out that setting different rates of reflecting market prices by real estate type and price range, as in the current system, may not comply with the principle of tax equality. The report viewed that if tax policy aims at 'realization of tax justice based on the principle of tax equality,' the real estate price public announcement system should aim at 'objectivity and accuracy,' meaning the two systems pursue different goals. Accordingly, the report advised that separation between the real estate price public announcement system and tax policy is necessary.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)