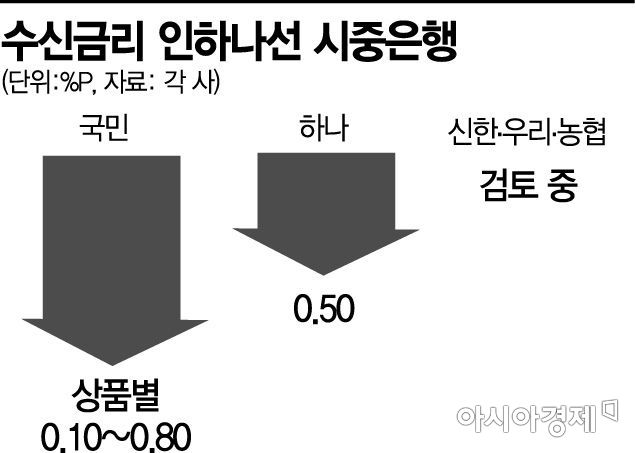

KB Kookmin Installment & Marketable Savings Deposits

Over 50 Products Simultaneously Lowered

Hana, Hope Keyum, etc. Reduced by 0.5%P

Shinhan, Woori, Nonghyup Also Considering

[Asia Economy Reporter Kim Min-young] Commercial banks are undertaking comprehensive deposit interest rate cuts. Following the Bank of Korea's base rate cut last week, adjustments have been made not only to regular time deposits and installment savings but also to products with relatively long subscription periods, preferential products for specific occupational groups, and government policy financial product interest rates.

According to the banking sector on the 3rd, KB Kookmin Bank lowered the base interest rate of its representative lump-sum deposit product, 'Kookmin Super Time Deposit,' by 0.3 percentage points starting yesterday. Accordingly, the base interest rate of this product, which was 0.6% to 1.05% annually depending on the subscription period, has been adjusted to 0.3% to 0.75%. From the 5th, the interest rate on general time deposit products will also be lowered by 0.25 percentage points from 0.80% to 0.55%.

In addition, Kookmin Bank is simultaneously lowering interest rates on deposit products that customers tend to keep for a long time once subscribed. This includes 15 types of lump-sum and marketable deposits such as 'KB Young Youth Gift Deposit' and 'KB Golden Life Pension Preferential Deposit,' as well as 34 types of installment savings including 'KB Teacher's Reliable Installment Savings.'

Furthermore, from the 8th, the interest rates on demand deposit savings accounts (MMDA) such as 'KB Preferential Savings Account' and 'KB Preferential Corporate Account' will be reduced by 0.05 to 0.20 percentage points. Kookmin Bank stated, "We reflected the Bank of Korea's base rate cut in deposit interest rates." Previously, on the 28th of last month, the Bank of Korea lowered the base rate from 0.75% to a historic low of 0.5%. This is the second cut this year. On March 17th, a 'big cut' was implemented, lowering the base rate by 0.5 percentage points at once.

Interest rates on financial products for socially disadvantaged groups have also been lowered. Hana Bank reduced the interest rates of the Hope Savings Account (for recipients) and Tomorrow Savings Account (for low-income impoverished groups), which are part of the low-income asset formation support project, from 2.5% to 2.0% for a 36-month term starting from the 1st. Eligible subscribers for the Hope Savings Account include households receiving livelihood or medical benefits, households receiving housing or education benefits with income recognized as 50% or less of the median income, or near-poverty groups, while the Tomorrow Savings Account targets participants in self-support work programs. If workers save between 50,000 and 200,000 KRW, the government matches the amount with earned income tax credits or savings incentives.

A Hana Bank official explained, "We lowered the base interest rate in consultation with the Ministry of Health and Welfare," adding, "However, the preferential interest rate was raised from 0.8 percentage points to 1.3 percentage points, so the maximum interest rate customers receive remains the same at 3.3%."

NH Nonghyup Bank will suspend new subscriptions to the NH Hope Filling Account from the 1st of next month. This product is available for one account per person and targets basic livelihood security recipients, near-poverty groups, persons with disabilities, multicultural families, North Korean defectors (Saeteomin), low-income elderly aged 65 or older, child-headed households, earned income tax credit recipients, single-parent family support beneficiaries, and homeless individuals. The installment product was popular because if subscribed for more than three years, the interest rate reached 4.45%. About 30,000 people subscribed combining both demand and installment products. An NH Nonghyup Bank official said, "We plan to re-launch the same product (NH Hope Filling Account 2) with some interest rate adjustments."

Kookmin Bank also lowered the interest rate of a similar product, 'KB Kookmin Happiness Installment Savings,' by 0.80 percentage points from 3.65% to 2.85% for a one-year term.

Other commercial banks such as Shinhan and Woori are also reviewing the extent and timing of deposit interest rate cuts. A representative from a commercial bank said, "The responsible department is discussing deposit interest rate cuts," adding, "The timing has not been decided yet."

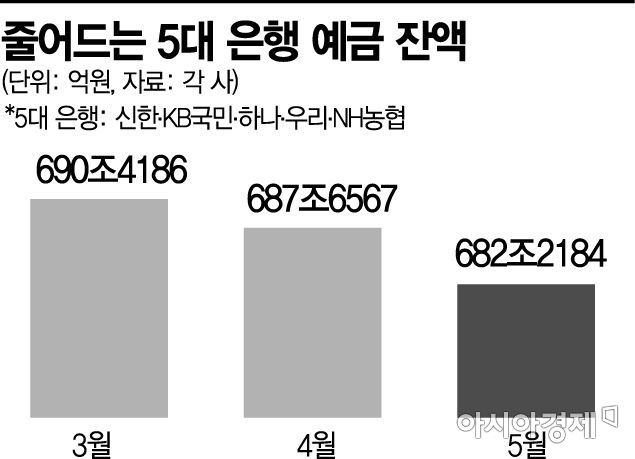

Financial consumers disappointed by interest rates in the 0% range are withdrawing money from banks. According to the financial sector, as of the end of last month, the balance of deposits and installment savings at the five major commercial banks (Shinhan, Kookmin, Hana, Woori, Nonghyup) was 682.2184 trillion KRW, down by 5.4383 trillion KRW (0.8%) compared to 687.6567 trillion KRW at the end of April. Compared to the end of March, 8.2002 trillion KRW has been withdrawn.

A representative from a commercial bank said, "Bank deposits and installment savings have been considered the easiest saving method, so balances tended to increase," adding, "Young people are withdrawing money from banks to invest in real estate and stocks, while elderly people who used bank interest to cover living expenses are moving their money to savings banks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.