6 of Top 10 Loan Companies

Q1 Turns to Deficit as Feared

Corporate Loans in April Surge Over 4 Times

'Signs of Distress' Delinquency Rate Also Rises

[Asia Economy Reporters Haeyoung Kwon and Minyoung Kim] As the spread of the novel coronavirus infection (COVID-19) has caused corporate earnings to deteriorate sharply, banks are facing an emergency in managing their soundness. The delinquency rate, a sign of loan defaults, has also begun to rise. Due to the financial sector's characteristic of lagging behind the real economy, it is expected that as early as the end of the year, the impact of the COVID-19 shock will rapidly pull banks into its influence. Although proactive risk management is urgent, banks are caught in a dilemma, unable to act decisively as they are pressured by the government and public opinion demanding shared pain.

According to the financial sector on the 1st, among the top 10 companies with the largest loan asset size borrowing from Bank A, six turned to deficits in the first quarter of this year.

The president of Bank A said, "The real economy shock caused by COVID-19 is much greater than expected and the situation will be prolonged," adding, "It is necessary to manage soundness by actively supporting companies temporarily facing difficulties based on industry and corporate outlooks, and reducing exposure for those that are not." He added, "Banks need to consider a major restructuring of their loan portfolios to respond after COVID-19." In particular, this bank has many corporate loans in the manufacturing sector, and after the spread of COVID-19, the sales and profits of client companies have declined more noticeably compared to other banks. Manufacturing industries such as automobile parts, electronic components, and textile products have been directly hit by COVID-19.

In fact, the financial situation of banks is very urgent. As of the end of April, corporate loans increased by 51.7 trillion won compared to the end of January. This is more than four times the amount compared to the same period last year. During this period, loans to large corporations also increased by 21.7 trillion won. In the same period last year, loans to large corporations by banks decreased by 1 trillion won. This is due to the tightening of the corporate bond and commercial paper (CP) markets caused by the spread of COVID-19.

The funding difficulties felt by small and medium-sized enterprises (SMEs) and self-employed individuals at bank branches are also severe. The head of the sales division at Bank B said, "For a client company exporting men's clothing to Europe, sales have shrunk to a quarter of last year's," lamenting, "Export volumes have plummeted, overseas sales have been blocked, and they are not even receiving payments for previously exported goods." Except for some industries such as corrugated cardboard and mask manufacturers that have gained indirect benefits from increased demand for delivery and quarantine supplies, most are experiencing liquidity difficulties. He added, "In addition to export manufacturers, loan demand has surged among companies facing severe financial difficulties such as entertainment agencies, event planning companies, and venue rental businesses," and "Among the self-employed, demand in the food service sector has recovered, but sales have sharply declined mainly in pubs and lodging businesses that operate mostly in the evening, causing significant damage."

Banks are prioritizing soundness management to prevent the risk of the real economy shock spreading to financial insolvency. Although a slowdown in corporate earnings does not immediately lead to loan defaults, unprecedented demand cliffs and sharp profit declines are worsening corporate cash flows. The delinquency rate, considered a sign of bank distress, is also on the rise. The average delinquency rate on SME loans at four major commercial banks?KB Kookmin, Shinhan, Hana, and Woori?rose from 0.43% in March to 0.47% in April. An executive in charge of loans at Bank C sighed, "It is expected that a flood of companies will be downgraded in the internal credit evaluation conducted by the end of next month," adding, "It is difficult to even estimate how much more will increase next year."

The head of the sales division at Bank D expressed concern, saying, "Even though the impact on our client companies is relatively small, their sales this year have decreased by an average of 20% compared to last year," and "If the COVID-19 situation prolongs, many companies and self-employed individuals will go bankrupt within the next two years." According to the Supreme Court, the number of companies filing for bankruptcy in courts nationwide was 252 in the first quarter of this year, a 26% increase compared to one year ago (200 cases). This is the largest scale in the past five years.

Although the likelihood of increasing financial sector insolvencies lagging the real economy is high, additional demands for shared pain from banks continue to pour in. The government has decided to provide a special guarantee of 500 billion won to automobile parts companies immediately. Based on guarantees from the Korea Credit Guarantee Fund and the Korea Technology Finance Corporation, banks are expected to supply additional funds. Reducing existing loans is practically difficult. On the 29th of last month, Prime Minister Chung Sye-kyun hinted at additional financial support targeting not only the automobile sector but also industries facing severe management difficulties. Follow-up financial support for other industries is also expected to fall on banks. Banks cannot manage risks comfortably due to scrutiny from financial authorities and public opinion. A financial sector official pointed out, "The government is ordering banks to expand funding to companies and the self-employed even by relaxing regulations, making it difficult to strengthen soundness management," adding, "It is time to gradually raise the loan threshold to prevent bank insolvencies from spreading to the real economy."

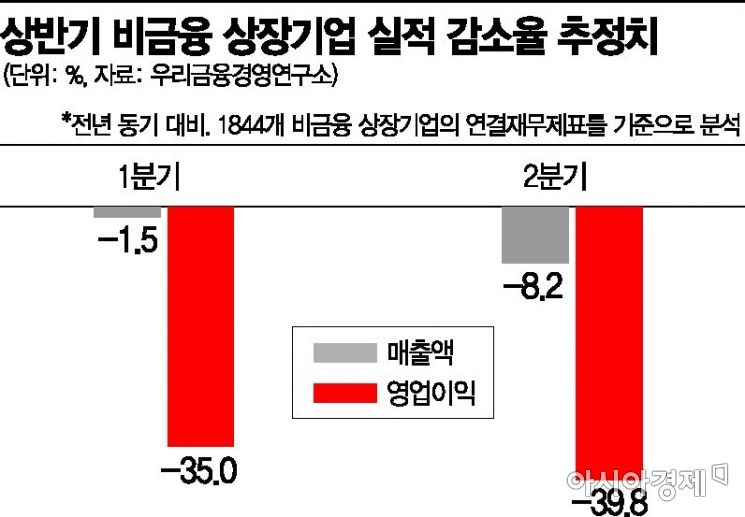

Senior researcher Sujin Kim of Woori Financial Management Research Institute expressed concern, saying, "With the cumulative deterioration of performance since 2018 weakening the fundamental strength of companies, if economic activity normalization is delayed, the poor performance of some industries is highly likely to translate into credit risk," and "Banks need to strengthen monitoring and risk management considering the differential impact of COVID-19 on industries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.