Gap Rate Falls Below 30% in Two Months

Single-Price Trading of 4 Leveraged Stocks

Oil Prices Poised to Rise to $40

Retail Investors Increase Buying Pressure Again

Inverse Leverage Faces Massive Crash

Full Loss Risk if Price Exceeds 20,000 Won

[Asia Economy Reporter Minji Lee] Leveraged crude oil exchange-traded notes (ETNs) based on West Texas Intermediate (WTI) crude oil in the U.S. have emerged from a two-month trading suspension. This is because the gap between the market price and the indicative value (iv) narrowed as oil prices, which had fallen into negative territory, rose to $30 per barrel. Accordingly, four types of leveraged ETNs were traded on the 29th through single-price trading without any suspension.

According to the Korea Exchange, as of 10 a.m. that day, all four leveraged WTI crude oil ETNs?Shinhan Leverage WTI Crude Oil ETN, Samsung Leverage WTI Crude Oil ETN, QV Leverage WTI Crude Oil ETN, and Mirae Asset Leverage Crude Oil Futures Mixed?showed gains compared to the previous session. QV Leverage Crude Oil ETN traded at 270 won, up 10% from the previous day, while Shinhan Leverage Crude Oil ETN (6%), Samsung Leverage Crude Oil ETN (8%), and Mirae Asset Leverage ETN (3%) also recorded increases.

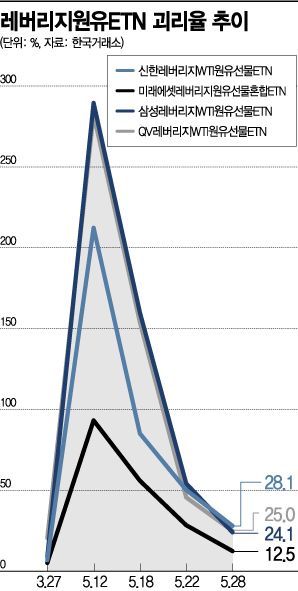

The leveraged crude oil ETNs, which resumed trading the previous day, saw their premium rates fall below 30% for the first time in two months. Mirae Asset Leverage ETN, which had been trading through single-price trading, saw its premium rate drop below 30% on the 22nd and then fall further to the 10% range. Since the end of March, the premium rate of leveraged crude oil ETNs had soared to 1000% due to continuous bullish bets by individual investors, resulting in securities being sold at abnormal prices. However, with the rise in oil prices and the financial authorities' trading suspension measures, the premium rate is narrowing to a normal range (6% for domestic indices, 12% for overseas indices).

Currently, the premium rate compared to the real-time indicative value (iiv) is around 20%. As of the previous day, Shinhan Leverage Crude Oil ETN showed 26.3%, and Samsung Leverage Crude Oil ETN was at 25%. If the premium rate for all four ETNs falls below 12% for three consecutive trading days, single-price trading will be converted to continuous trading.

The significant drop in the price premium of crude oil ETNs to double digits is due to the recent sharp rise in international oil prices to $30. The four leveraged crude oil ETNs currently track the crude oil futures index calculated by the S&P 500, which is based on the August delivery WTI futures price. The August delivery WTI price is fluctuating between $33 and $34, while the July delivery is around $32 to $33. Kim Kwang-rae, a researcher at Samsung Futures, said, "With the resumption of economic activities in major countries in the U.S. and Europe, demand is expected to revive, and production cuts by major countries are creating upward pressure. The rebound in refinery operating rates is likely to lead to a sharp decline in inventories, which could push prices to break through $40."

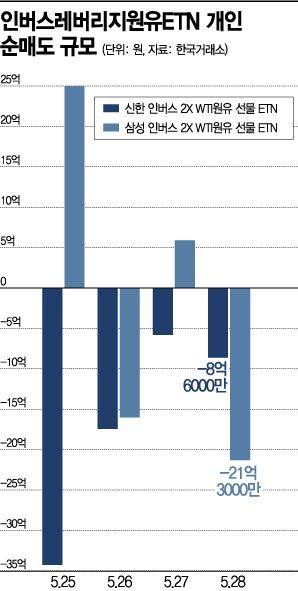

Individual investors are increasing their buying momentum in the market again. Although they are effectively buying securities at prices about 20% higher than the indicative value, it is interpreted that individuals expect oil prices to rise even further. On the previous day, individuals purchased 15.1 billion won worth of leveraged crude oil ETNs in the market, with 8 billion won in Samsung Leverage ETN and 5.9 billion won in Shinhan Leverage ETN.

On the other hand, losses for inverse investors are snowballing. As oil prices, which had fallen into negative territory, surged, other individual investors bought inverse leveraged products betting on a decline. For example, Samsung Inverse Leverage WTI Crude Oil Futures ETN recorded 21,685 won as of the 22nd of last month but is currently trading at around 3,600 won, down about 83%. Since the product aims for twice the returns, losses also double, raising concerns of total loss if the average purchase price exceeds 20,000 won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.