Top 7 Domestic Purchases Yield 4.73%

Overseas Direct Purchases Yield 17.84%... 4 Times Difference

[Asia Economy Reporter Oh Ju-yeon] After the rebound following the novel coronavirus infection (COVID-19), the returns of 'direct stock buyers (individual investors who directly purchase overseas stocks)' who turned their attention to overseas stock markets significantly outperformed those of individual investors who invested in the domestic stock market.

Comparing the returns of the top 7 net purchased stocks by individuals in both domestic and overseas markets, the average return showed a nearly fourfold difference. In the domestic stock market, individuals heavily purchased exchange-traded funds (ETFs) linked to crude oil or the KOSPI index, but their contrary investment approach eroded their average returns. On the other hand, direct stock buyers targeted blue-chip companies rather than ETFs, and all the top net purchased stocks recorded positive (+) returns.

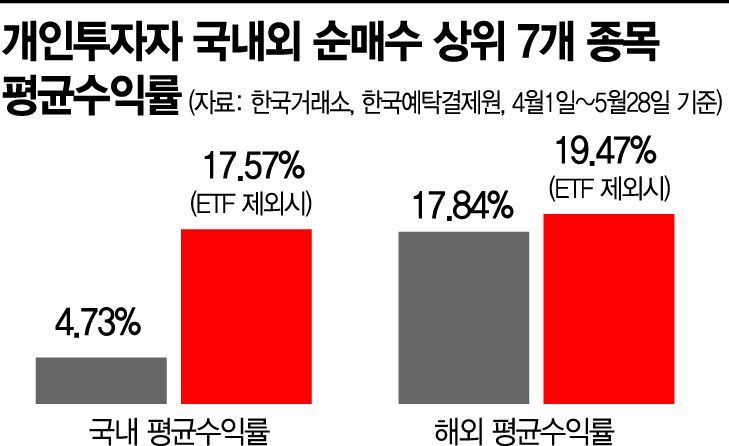

According to the Korea Securities Depository on the 29th, the average return of the top 7 stocks most purchased by individuals in the domestic securities market from last month 1st to this month 28th was 4.73%. During the same period, the average return of the top 7 net purchased overseas stocks was 17.84%, about four times higher.

In the domestic stock market, the first and third most net purchased stocks by individuals were the 'KODEX200 Futures Inverse 2X' and 'KODEX WTI Crude Oil Futures (H)' ETFs, with purchases worth 1.2757 trillion KRW and 1.0483 trillion KRW respectively. The KODEX200 Futures Inverse 2X profits when the index falls, and the KODEX WTI Crude Oil Futures (H) is linked to international oil price increases. However, the KOSPI, which continuously rose without a second drop, increased by 20.36% from 1685.46 on last month 1st to 2028.54 on this month 28th. As a result, the KODEX200 Futures Inverse 2X incurred a loss of -31.88%. Investors in KODEX WTI Crude Oil Futures (H), who bet on a rebound in international oil prices, experienced the unprecedented event of 'negative oil prices,' cutting their returns in April by half. Although slightly recovered this month, the returns for April-May were -22.85%.

Meanwhile, the second, fourth, and fifth most net purchased stocks by individuals?Samsung Electronics (1.1249 trillion KRW), SK Hynix (436.3 billion KRW), and Hyundai Motor (352.3 billion KRW)?rose by 10.04%, 7.02%, and 15.03% respectively, but these were below the KOSPI's growth rate. Naver, ranked sixth in net purchases, surged 47.55%, restoring some pride. However, its net purchase volume was 327.4 billion KRW, which was not large compared to other top net purchased stocks.

In contrast, individual investors who invested in overseas stocks made different choices. During the same period, direct stock buyers invested in blue-chip stocks such as Hasbro (477.5 billion KRW), Microsoft (231.8 billion KRW), Alphabet (195.6 billion KRW), Apple (152.0 billion KRW), Delta Air Lines (144.6 billion KRW), and Walt Disney (112.8 billion KRW). These stocks mostly belonged to IT/software and airline sectors, which have been highlighted post-COVID-19. Notably, Hasbro, ranked first in net purchases, attracted attention. Hasbro is a leading American toy company, and funds flowed in with expectations that toy demand would increase due to restrictions on outdoor activities during the COVID-19 pandemic. All these stocks recorded positive returns. Microsoft rose 19.84% from $155.26 on last month 1st to $182.29 on this month 28th, while Alphabet and Apple increased by 28.69% and 32.58% respectively. Even in the airline sector, which Warren Buffett abandoned, individuals earned returns comparable to SK Hynix. Delta Air Lines' return was 7.54%.

Even excluding inverse and crude oil ETFs, which caused large losses for individuals, domestic investment returns did not surpass overseas investment returns. When ETFs were excluded from the top net purchased stocks domestically and overseas, returns were 17.57% domestically and 19.47% overseas, showing a difference of about 2 percentage points.

Interest in overseas stocks among individuals is expected to increase further. In particular, it is analyzed that attention should be paid to the U.S. and Chinese stock markets, where many 4th industrial revolution innovative companies are listed. Kim Ji-san, head of the Kiwoom Securities Research Center, said, "The U.S. is the country with the most industry-leading companies worldwide, with the most aggressive investments and high market shares within innovative industries," adding, "Even after COVID-19, it continues to strengthen its market dominance." He further noted, "With the U.S. presidential election at the end of the year, aggressive support measures for economic recovery and protection of domestic companies are expected to continue," and "Differentiation between the U.S. and non-U.S. regions may widen, highlighting the attractiveness of the U.S. stock market."

Jung Yeon-woo, head of the Daishin Securities Research Center, said, "Although the COVID-19 shock is significant, equally strong monetary, financial, and fiscal policies are being implemented one after another, so recovery can proceed quickly," adding, "Considering the activation of untact culture and IT infrastructure construction, the pace of the 4th industrial revolution will accelerate, and companies that are already attracting global attention and leading the market will continue to be spotlighted."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.