$100 Billion Outflow from Emerging Markets by April... Four Times the Global Financial Crisis

Exchange Rate Plunge, Trade Decline, Foreign Currency Debt Triple Burden... US 'Lineup' Also a Burden

[Asia Economy reporters Youngshin Cho and Hyunwoo Lee] As tensions deepen between the United States and China, emerging market economies, already struggling due to the novel coronavirus disease (COVID-19) crisis, are facing even greater difficulties. If the trade dispute between the two countries resumes, exports will decline due to reduced trade volume, and continuous capital outflows will make it difficult to defend exchange rates, raising concerns about a chain of debt defaults among emerging markets.

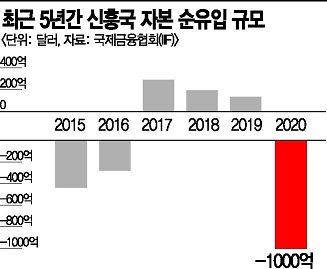

On the 28th, The New York Times (NYT) reported that the amount of capital outflow from emerging markets this year through last month is much larger than during the 2008 global financial crisis. According to the Institute of International Finance (IIF), since the global spread of COVID-19 began on January 20, capital outflows from emerging markets reached approximately $100.07 billion by the end of last month. This amount is more than four times the $23.6 billion outflow during the 2008 global financial crisis, withdrawn in a short period. In March alone, over $80 billion left emerging markets due to the COVID-19 crisis, and with the added US-China conflict over the Hong Kong security law, exchange rates are becoming unstable.

On the previous day, the offshore Hong Kong market saw the yuan exchange rate against the dollar surge to 7.1964 yuan, marking the highest level since the offshore market's establishment in 2010. As the yuan's value plummeted, exchange rates of major emerging countries also fluctuated significantly. The Brazilian real has depreciated by more than 40% against the dollar since the beginning of the year, and the Russian ruble has fallen over 30% compared to early this year. Global investment bank JP Morgan estimates that emerging markets have spent more than $124 billion defending their currencies since February.

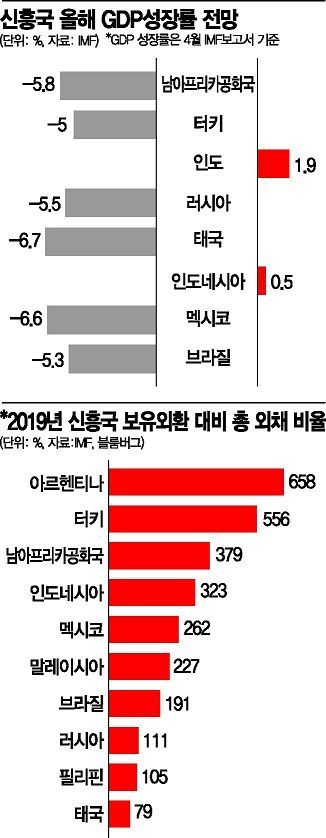

Emerging markets are facing a double burden of sharp currency depreciation and increased foreign currency debt. According to Bloomberg News, foreign currency debt of emerging markets, as compiled by the World Bank (WB), amounts to $8.4 trillion (approximately 1,422 trillion KRW), which is about 30% of their total gross domestic product (GDP). This figure has nearly doubled from $4.7 trillion in 2009. Argentina, already suffering from severe fiscal deterioration, entered its ninth default on the 22nd. Countries with high external debt ratios such as Turkey and Brazil are also experiencing worsening fiscal conditions, increasing default concerns. The three major international credit rating agencies?Standard & Poor's (S&P), Moody's, and Fitch?have downgraded the credit ratings and outlooks of 76 countries as of last month.

Declining trade volume is also tightening the noose around emerging markets. The World Trade Organization (WTO) forecasted that international trade volume decreased by 0.1% last year amid the intensifying US-China trade dispute, and this year, due to the COVID-19 crisis, international trade could plummet by up to 31.9% compared to the previous year. To make matters worse, the sharp drop in international oil prices caused by the COVID-19 crisis has worsened the fiscal conditions of Middle Eastern oil-producing countries, putting most emerging economies in distress. International oil prices, which maintained around $60 at the beginning of the year, have now plunged to about $30.

The overt 'line-up' strategy led by the US targeting its allies is also a concern for emerging markets. At the end of last month, US Secretary of State Mike Pompeo announced plans to form an Economic Prosperity Network (EPN) with allies including Australia, India, Japan, New Zealand, South Korea, and Vietnam, making the line-up a reality. The EPN is a China-centered anti-China bloc economic system that the US is planning to establish with its allies to break away from the China-centered global supply chain and create a new supply chain. If the US imposes additional economic sanctions or trade disputes against China, emerging markets with high dependence on exports to China and significant Chinese investment inflows are expected to face even greater difficulties.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.