Conclusion of Unsuitability for Draft Fund Support

Financial Services Commission: "Fund Purpose Not Met, Main Creditor Bank Should Decide"

Main Creditor Bank Without Shares, No Justification for KDB to Inject Funds

Just Waiting for Government Decision

[Asia Economy Reporter Kangwook Cho] Financial authorities and the main creditor bank, the Korea Development Bank (KDB), are facing difficulties over the issue of supporting Ssangyong Motor, which is engulfed in financial distress. Ssangyong Motor, already pushed to the brink by a series of adverse factors such as the parent company's withdrawal of investment, 13 consecutive quarters of losses, and a refusal of audit opinion in the first quarter, sees government support as the only solution. Some voices have raised concerns about the justification and practicality of support, leading to negative public opinion on the injection of public funds, with criticism that financial authorities and creditors are shifting the responsibility for the decision onto each other.

According to financial circles on the 29th, financial authorities have concluded that Ssangyong Motor is not suitable as a support target for the recently launched Corporate Restructuring Fund. As an automobile company, Ssangyong Motor is not part of the industries specified as eligible for support under the Enforcement Decree of the Korea Development Bank Act (such as aviation and shipping). More importantly, it does not align with the fundamental purpose of the fund, which is to help maintain employment in companies temporarily suffering due to the COVID-19 pandemic.

Financial Services Commission Chairman Eun Sung-soo, after attending the fund's launch ceremony, told reporters, "There is interest and controversy over whether the fund should support Ssangyong Motor, but this fund is not a special privilege." He added, "Even if a company is not eligible for the fund, necessary support will be provided within the framework of the livelihood and financial stability package program, tailored to the company's circumstances."

Regarding support for Ssangyong Motor from the fund, Chairman Eun expressed a cautious negative stance, saying, "We need to determine whether the problem is due to COVID-19 or a fundamental issue." However, he passed the responsibility to KDB, stating, "It is a matter for the main creditor bank to decide."

KDB is the main creditor bank of Ssangyong Motor. According to Ssangyong Motor's first-quarter report this year, as of the end of March, short-term borrowings amount to 390 billion KRW, of which KDB holds 190 billion KRW. Other creditors include Woori Bank, KB Kookmin Bank, JP Morgan, and BNP Paribas. As Chairman Eun indicated, support for Ssangyong Motor is more likely to come from KDB, the creditor bank, rather than the Corporate Restructuring Fund.

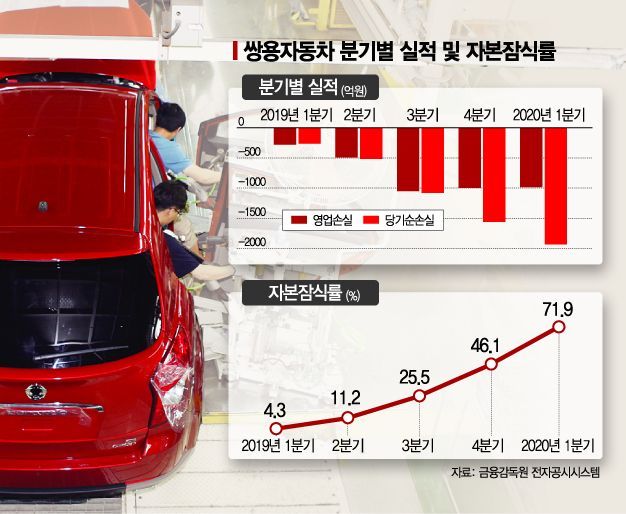

KDB is in a difficult position. Previously, in December last year, KDB extended a 20 billion KRW loan that was nearing maturity once. Until January this year, when Ssangyong Motor's major shareholder, the Indian Mahindra Group, proposed investing 230 billion KRW and 170 billion KRW (from KDB) respectively, and Ssangyong Motor planned to raise 100 billion KRW on its own, the outlook was positive. However, the situation changed drastically last month when Mahindra officially announced the withdrawal of new funding. With a 90 billion KRW loan maturing in July, if KDB does not grant an extension, Ssangyong Motor faces a high risk of default. Ssangyong Motor has recorded operating losses for 13 consecutive quarters from 2017 through the first quarter of this year. The net loss in the first quarter is the largest since the global financial crisis. The debt ratio and capital erosion rate stood at 755.6% and 71.9%, respectively, as of the first quarter. The accounting firm issued a refusal of audit opinion.

The problem is that KDB, as the main creditor bank, does not hold equity in Ssangyong Motor. Unlike Korea GM, which supported funds as the second-largest shareholder, KDB has no justification to inject funds into Ssangyong Motor. Supporting a company whose major shareholder has effectively withdrawn contradicts the basic principles of public fund injection. Moreover, KDB is already stretched thin supporting the aviation industry and Doosan Heavy Industries amid the COVID-19 crisis, making support for Ssangyong Motor difficult. However, since the company employs about 5,000 people and, including partner companies, supports tens of thousands of jobs, it is also difficult to simply abandon it. As a state-run bank, KDB can only hope the government will make a decision.

A financial industry insider said, "From the perspective of KDB, a state-run bank whose head is appointed by the government, making a unilateral decision to support a crisis company without equity could lead to future allegations of preferential treatment." He added, "Although financial authorities say the creditor bank can decide independently, it is practically impossible." He continued, "However, since financial authorities have said they will consider the matter, a countermeasure may be announced soon."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.