Bank of Korea Cuts Base Rate to 0.5%... Expectations for Policy Mix Effect

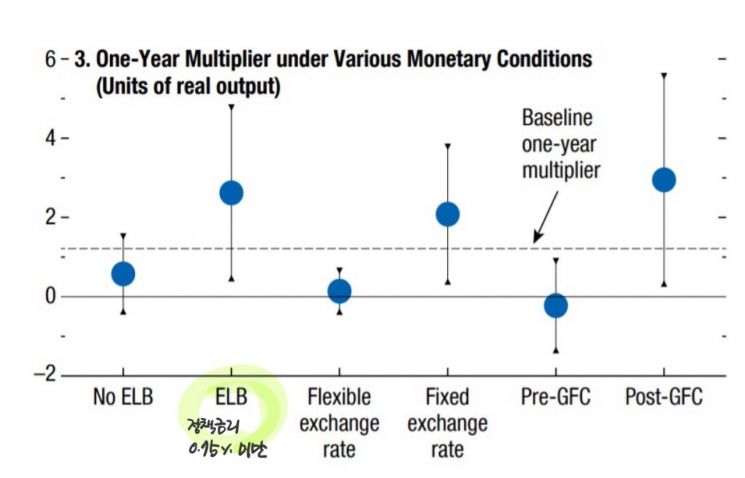

▲Point estimates of the fiscal multiplier over one year under each economic condition.

▲Point estimates of the fiscal multiplier over one year under each economic condition. *International Monetary Fund (IMF)

[Asia Economy Reporter Kim Eunbyeol] As the Bank of Korea further lowered the base interest rate to a record low of 0.50% per annum, expectations are rising that the effect of fiscal policies to respond to the novel coronavirus infection (COVID-19) could be amplified by reducing the base rate to the effective lower bound. The Effective Lower Bound (ELB) refers to the lowest limit to which a non-reserve currency country can reduce its interest rates. In Korea's case, the market estimates this level to be around 0.25% to 0.50%.

According to the "Research Results on the Fiscal Multiplier Effect" analyzed by the International Monetary Fund (IMF) on the 29th, when the base interest rate approaches the effective lower bound, the fiscal multiplier records a value of 2 or higher. The fiscal multiplier refers to the ratio by which real Gross Domestic Product (GDP) increases when fiscal stimulus measures are implemented. Considering that the IMF's global average fiscal multiplier is about 1, if the central bank lowers the base interest rate to the effective lower bound in tandem, the effect of government fiscal policy effectively doubles. This is a kind of Policymix effect, which is the policy combination between fiscal and monetary policies.

The IMF particularly explained, "In fixed exchange rate regimes or single currency systems where fiscal stimulus does not allow interest rate increases, the fiscal multiplier appears even stronger," adding, "In most advanced countries, the fiscal multiplier after the global financial crisis, when interest rates were low, was higher than before the crisis and resembled the fiscal multiplier at the effective lower bound."

Summarizing this in a local report, the Bank of Korea’s Washington representative stated, "The fiscal multiplier is larger when there is idle labor in the market and monetary policy supports fiscal stimulus," and added, "Tailored discretionary fiscal policies that fit specific situations and the nature of shocks can be the most powerful support for economic response, especially when there is strong political will for such measures."

Similar research has emerged in Korea as well. Professor Kim Soyoung of the Department of Economics at Seoul National University, speaking at a policy symposium jointly hosted by the Korean Finance Association, Korea Institute of Finance, and Bank of Korea Economic Research Institute the day before, explained, "When the nominal interest rate hits the zero lower bound (ZLB), i.e., the effective lower bound, the government spending multiplier is larger than usual because inflation expectations rise, reducing real interest rates and thereby stimulating consumption and investment." In Japan, the government spending multiplier at the effective lower bound was estimated at 1.5, more than twice the usual 0.6.

Professor Kim stated, "In Korea’s case, if the base interest rate reaches the effective lower bound, the government spending multiplier is likely to be larger than usual." However, she added, "If asked whether the effect of government spending will increase after the Bank of Korea lowered the base rate to 0.5% today, it is not yet clear," noting, "This is because the COVID-19 situation is causing comprehensive difficulties in economic activities not only due to demand-side factors but also supply factors and psychological aspects."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.